Region:Europe

Author(s):Dev

Product Code:KRAB3631

Pages:92

Published On:October 2025

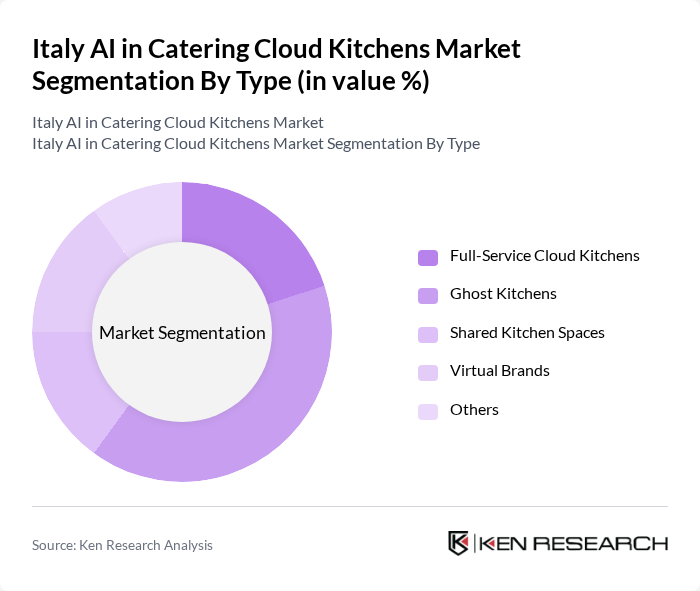

By Type:The market is segmented into various types, including Full-Service Cloud Kitchens, Ghost Kitchens, Shared Kitchen Spaces, Virtual Brands, and Others. Among these, Ghost Kitchens are gaining significant traction due to their cost-effectiveness and ability to cater to the growing demand for food delivery without the overhead of traditional restaurants. The trend towards online food ordering has made Ghost Kitchens a preferred choice for many entrepreneurs looking to enter the food service industry.

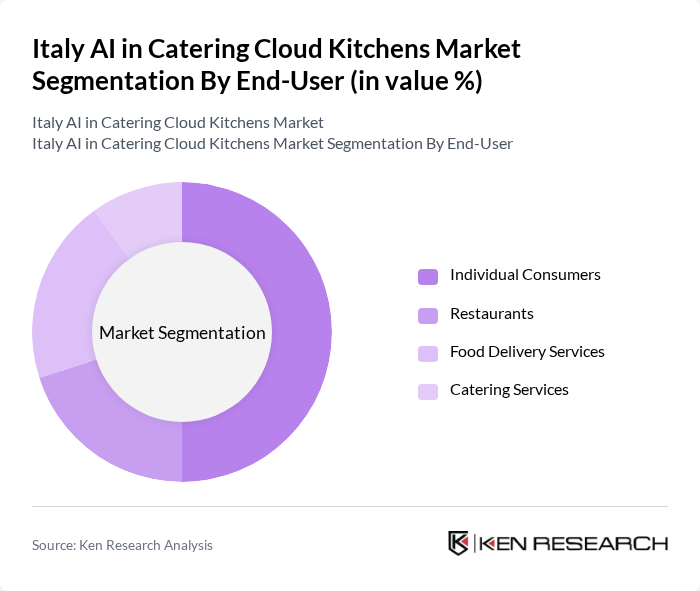

By End-User:The end-user segmentation includes Individual Consumers, Restaurants, Food Delivery Services, and Catering Services. Individual Consumers are the leading segment, driven by the increasing trend of online food ordering and the convenience of home delivery. The rise in consumer preference for diverse food options and the growing number of food delivery apps have significantly contributed to this segment's dominance.

The Italy AI in Catering Cloud Kitchens Market is characterized by a dynamic mix of regional and international players. Leading participants such as Deliveroo, Just Eat, Uber Eats, Glovo, Kitchen United, Rebel Foods, CloudKitchens, Keatz, Taster, Foodpanda, Zomato, DoorDash, EatStreet, Chowly, Kitopi contribute to innovation, geographic expansion, and service delivery in this space.

The future of the AI in catering cloud kitchens market in Italy appears promising, driven by technological advancements and evolving consumer preferences. As online food ordering continues to rise, cloud kitchens are expected to leverage AI for enhanced customer experiences and operational efficiencies. Furthermore, the integration of sustainable practices and innovative menu offerings will likely attract a broader customer base, positioning cloud kitchens as a vital component of the Italian food service industry in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Full-Service Cloud Kitchens Ghost Kitchens Shared Kitchen Spaces Virtual Brands Others |

| By End-User | Individual Consumers Restaurants Food Delivery Services Catering Services |

| By Application | Meal Preparation Food Delivery Catering Events Meal Kits |

| By Distribution Channel | Online Platforms Direct Sales Third-Party Delivery Services |

| By Pricing Model | Subscription-Based Pay-Per-Order Bundled Offers |

| By Customer Segment | Millennials Families Corporate Clients |

| By Policy Support | Government Subsidies Tax Incentives Grants for Technology Adoption |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cloud Kitchen Operators | 100 | Operations Managers, Business Development Heads |

| AI Technology Providers | 75 | Product Managers, Technical Directors |

| Consumer Preferences in Food Delivery | 150 | Regular Online Food Orderers, Food Enthusiasts |

| Regulatory Impact on Cloud Kitchens | 50 | Policy Makers, Industry Regulators |

| Market Trends in Catering Services | 80 | Market Analysts, Industry Consultants |

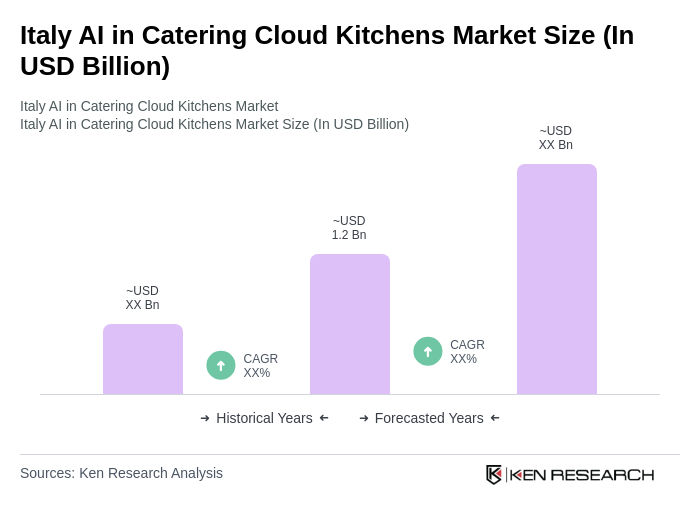

The Italy AI in Catering Cloud Kitchens Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by the increasing demand for food delivery services and the integration of artificial intelligence in operational processes.