Region:Europe

Author(s):Rebecca

Product Code:KRAB0261

Pages:89

Published On:August 2025

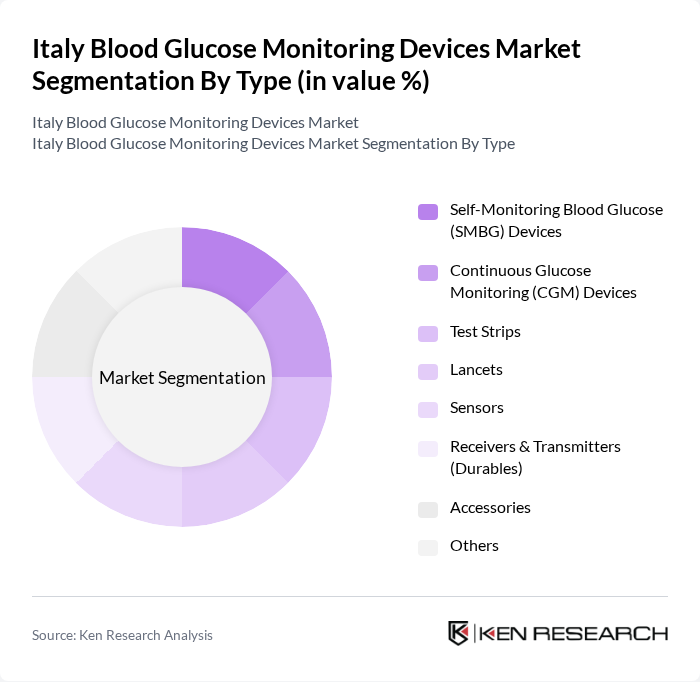

By Type:The market can be segmented into various types of blood glucose monitoring devices, including Self-Monitoring Blood Glucose (SMBG) Devices, Continuous Glucose Monitoring (CGM) Devices, Test Strips, Lancets, Sensors, Receivers & Transmitters (Durables), Accessories, and Others. Among these, Self-Monitoring Blood Glucose (SMBG) Devices remain the most widely used, attributed to their affordability, ease of use, and established presence in home-based diabetes management. Continuous Glucose Monitoring (CGM) Devices are rapidly gaining share due to their ability to provide real-time data and integration with digital health platforms.

By Modality:The market is also segmented by modality into Wearable Devices and Non-Wearable Devices. Wearable devices are experiencing strong growth due to their convenience, ability to provide continuous monitoring, and integration with digital health and fitness platforms. The increasing adoption of wearable CGM systems is driven by patient demand for real-time data and improved glycemic control.

The Italy Blood Glucose Monitoring Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abbott Laboratories, Roche Diagnostics, Johnson & Johnson (LifeScan, Inc.), Medtronic plc, Ascensia Diabetes Care, Dexcom, Inc., B. Braun Melsungen AG, Sanofi S.A., Bayer AG, Ypsomed AG, Nova Biomedical, Arkray, Inc., Omron Healthcare, Inc., F. Hoffmann-La Roche AG, Menarini Diagnostics S.r.l. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the blood glucose monitoring devices market in Italy appears promising, driven by technological innovations and increasing health awareness. The integration of digital health solutions and artificial intelligence in monitoring devices is expected to enhance user experience and accuracy. Additionally, the expansion of telehealth services will facilitate remote monitoring, making diabetes management more accessible. As these trends continue to evolve, the market is likely to witness significant growth, benefiting both consumers and healthcare providers.

| Segment | Sub-Segments |

|---|---|

| By Type | Self-Monitoring Blood Glucose (SMBG) Devices Continuous Glucose Monitoring (CGM) Devices Test Strips Lancets Sensors Receivers & Transmitters (Durables) Accessories Others |

| By Modality | Wearable Devices Non-Wearable Devices |

| By Patient Type | Type 1 Diabetes Type 2 Diabetes |

| By End-User | Hospitals Homecare Settings Diagnostic Laboratories Clinics Others |

| By Distribution Channel | Online Retail Pharmacies Hospitals Direct Sales Others |

| By Region | Northern Italy Central Italy Southern Italy Islands Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Endocrinologists and Diabetes Specialists | 60 | Healthcare Professionals, Clinical Researchers |

| Patients Using Blood Glucose Monitors | 100 | Diabetes Patients, Caregivers |

| Pharmacy and Retail Distributors | 40 | Pharmacy Managers, Supply Chain Coordinators |

| Healthcare Providers and Clinics | 50 | Clinic Administrators, Nurse Practitioners |

| Health Insurance Representatives | 40 | Policy Analysts, Claims Managers |

The Italy Blood Glucose Monitoring Devices Market is valued at approximately USD 645 million, reflecting a significant growth driven by the increasing prevalence of diabetes, advancements in technology, and rising health awareness among the population.