Region:Global

Author(s):Shubham

Product Code:KRAD2020

Pages:93

Published On:December 2025

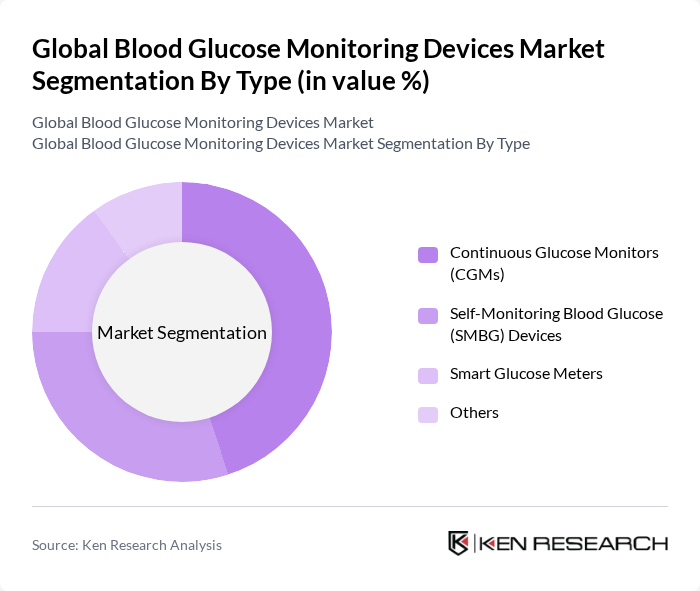

By Type:The market is segmented into Continuous Glucose Monitors (CGMs), Self-Monitoring Blood Glucose (SMBG) Devices, Smart Glucose Meters, and Others. Continuous Glucose Monitors (CGMs) are currently the leading sub-segment due to their ability to provide real-time glucose readings, which significantly enhances diabetes management. The increasing adoption of CGMs is driven by their convenience and the growing awareness of diabetes care among patients.

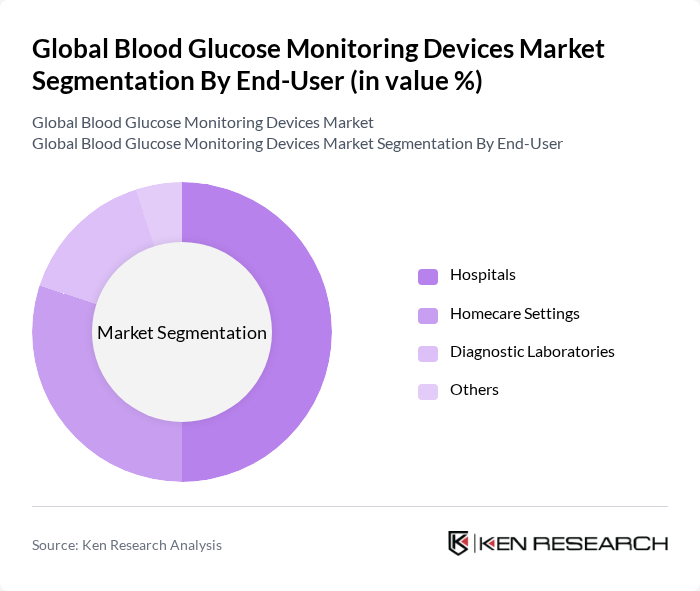

By End-User:The market is segmented into Hospitals, Homecare Settings, Diagnostic Laboratories, and Others. Hospitals are the dominant end-user segment, primarily due to the high volume of diabetes patients requiring regular monitoring and the availability of advanced monitoring technologies in clinical settings. The increasing focus on patient-centered care and the integration of technology in hospitals further drive this segment's growth.

The Global Blood Glucose Monitoring Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abbott Laboratories, Dexcom, Inc., Medtronic plc, Roche Diabetes Care, Ascensia Diabetes Care, Johnson & Johnson, B. Braun Melsungen AG, Sanofi S.A., Nova Biomedical, Ypsomed AG, Senseonics Holdings, Inc., GlySens, Inc., Arkray, Inc., F. Hoffmann-La Roche AG, Insulet Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the blood glucose monitoring devices market appears promising, driven by technological advancements and increasing consumer awareness. The emergence of over-the-counter (OTC) devices, such as Abbott's Libre Rio, targets a broader audience, including non-insulin users, potentially unlocking over USD 1 billion in annual sales. Additionally, the integration of digital health solutions and connectivity in devices is expected to enhance user engagement and support telehealth services, further propelling market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Continuous Glucose Monitors (CGMs) Self-Monitoring Blood Glucose (SMBG) Devices Smart Glucose Meters Others |

| By End-User | Hospitals Homecare Settings Diagnostic Laboratories Others |

| By Region | North America Europe Asia-Pacific Latin America |

| By Technology | Enzymatic Technology Non-Enzymatic Technology Optical Technology Others |

| By Application | Diabetes Management Clinical Research Health Monitoring Others |

| By Investment Source | Private Investments Public Funding Venture Capital Others |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Endocrinologist Insights | 100 | Endocrinologists, Diabetes Care Specialists |

| Patient User Experience | 150 | Diabetes Patients, Caregivers |

| Manufacturer Perspectives | 80 | Product Managers, R&D Heads |

| Healthcare Provider Feedback | 120 | Nurses, Diabetes Educators |

| Market Distribution Insights | 90 | Distributors, Retail Managers |

The Global Blood Glucose Monitoring Devices Market is valued at approximately USD 20 billion, driven by the rising prevalence of diabetes and technological advancements in monitoring solutions, such as continuous glucose monitoring systems and smartphone integration.