Region:Europe

Author(s):Dev

Product Code:KRAB0341

Pages:82

Published On:August 2025

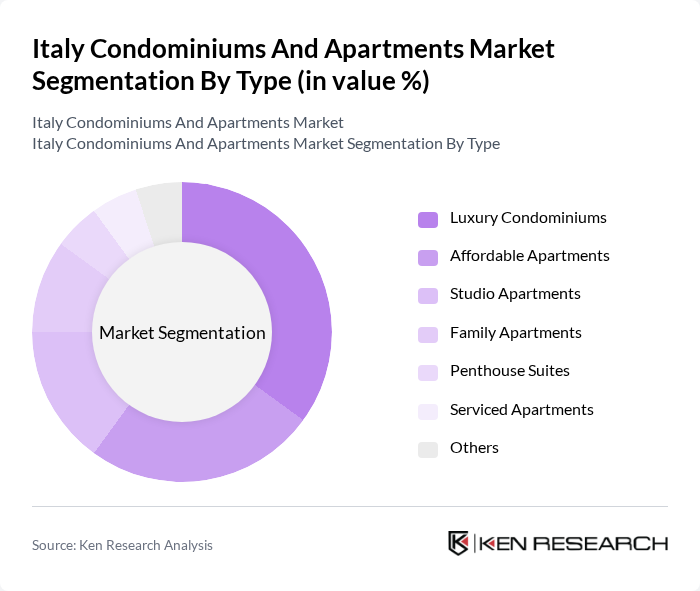

By Type:The market is segmented into luxury condominiums, affordable apartments, studio apartments, family apartments, penthouse suites, serviced apartments, and others. Luxury condominiums continue to lead the market, driven by demand from affluent buyers seeking premium amenities and prestigious locations. Urbanization, the appeal of exclusive living spaces, and a growing preference for energy-efficient, tech-integrated homes are further propelling the demand for luxury and modern condominiums.

By End-User:The end-user segmentation includes first-time homebuyers, investors, renters, and retirees. Investors are the dominant segment, attracted by the potential for rental income, capital appreciation, and the stability of the Italian real estate market. The increasing popularity of real estate as an investment class, favorable mortgage conditions, and the growth of short-term rental demand in major cities have significantly boosted investor activity in condominiums and apartments.

The Italy Condominiums And Apartments Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gabetti Property Solutions S.p.A., Tecnocasa S.p.A., Engel & Völkers Italia S.r.l., RE/MAX Italia S.r.l., Gruppo Toscano S.p.A., Coldwell Banker Italy, BNP Paribas Real Estate Italy, Savills Italy S.r.l., JLL Italy S.p.A., Cushman & Wakefield Italy S.r.l., Abitare Co. S.p.A., Immobiliare.it S.p.A., Casa.it S.p.A., Idealista S.p.A., Dils S.p.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Italy condominiums and apartments market appears promising, driven by ongoing urbanization and a shift towards sustainable living. As more individuals prioritize eco-friendly housing options, developers are likely to focus on green building practices. Additionally, the integration of smart home technologies is expected to enhance property appeal, attracting tech-savvy buyers. With government incentives continuing to support homeownership, the market is poised for gradual recovery and growth, despite existing economic challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Luxury Condominiums Affordable Apartments Studio Apartments Family Apartments Penthouse Suites Serviced Apartments Others |

| By End-User | First-Time Homebuyers Investors Renters Retirees |

| By Price Range | Below €100,000 €100,000 - €300,000 €300,000 - €500,000 Above €500,000 |

| By Location | Rome Milan Venice Florence Other Cities |

| By Construction Type | New Constructions Renovated Properties Historical Buildings |

| By Ownership Type | Freehold Leasehold |

| By Amenities Offered | Swimming Pools Gyms Parking Facilities Security Services |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Condominium Buyers | 100 | First-time Home Buyers, Young Professionals |

| Luxury Apartment Market | 60 | High Net-Worth Individuals, Real Estate Investors |

| Rental Market Insights | 70 | Property Managers, Tenants |

| Construction and Development Trends | 40 | Real Estate Developers, Architects |

| Market Trends in Suburban Areas | 50 | Families, Retirees |

The Italy Condominiums and Apartments Market is valued at approximately EUR 55 billion, driven by urbanization, rising demand for residential properties, and increased foreign investments, particularly in luxury and energy-efficient housing.