Region:Central and South America

Author(s):Dev

Product Code:KRAA1633

Pages:85

Published On:August 2025

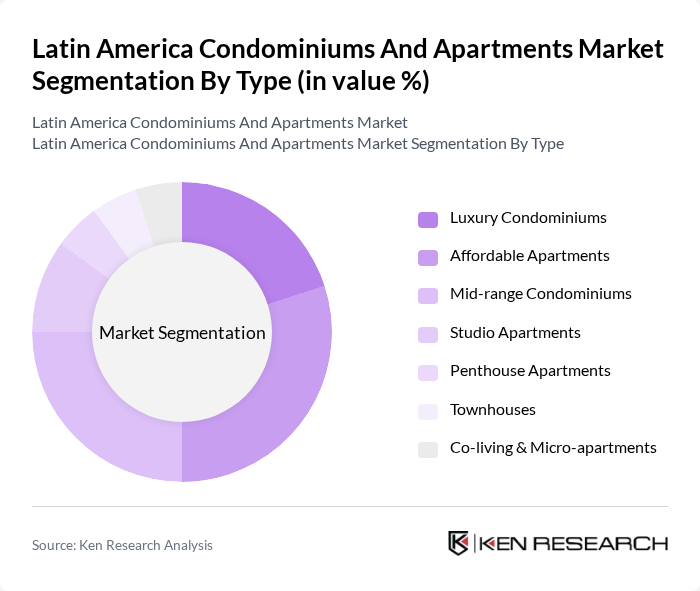

By Type:The market is segmented into various types of residential properties, including luxury condominiums, affordable apartments, mid-range condominiums, studio apartments, penthouse apartments, townhouses, and co-living & micro-apartments. Each type caters to different consumer preferences and financial capabilities, reflecting the diverse needs of the population.

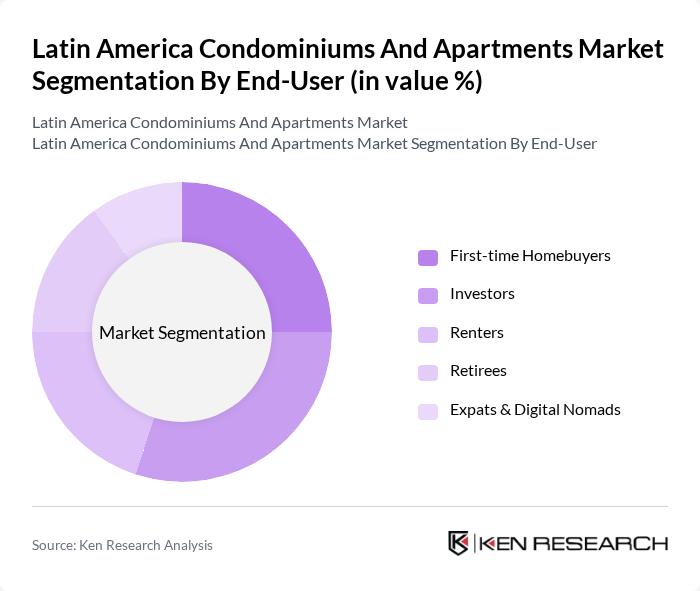

By End-User:The end-user segmentation includes first-time homebuyers, investors, renters, retirees, and expats & digital nomads. Each group has distinct motivations and requirements, influencing their choice of residential properties in the market.

The Latin America Condominiums And Apartments Market is characterized by a dynamic mix of regional and international players. Leading participants such as MRV Engenharia e Participações S.A., Cyrela Brazil Realty S.A., Direcional Engenharia S.A., Construtora Tenda S.A., Even Construtora e Incorporadora S.A., Helbor Empreendimentos S.A., JHSF Participações S.A., Tecnisa S.A., Gafisa S.A., RNI Negócios Imobiliários S.A., Viver Incorporadora e Construtora S.A., Grupo Sadasi (Mexico), Grupo Prodesa (Colombia), Inmobiliaria Aconcagua (Chile), Inmobiliaria Desco (Peru) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Latin America condominiums and apartments market appears promising, driven by ongoing urbanization and a growing middle class. As cities expand, the demand for affordable housing solutions will likely increase, prompting developers to innovate. Additionally, the integration of smart technologies and sustainable practices in construction will become more prevalent, aligning with consumer preferences for eco-friendly living. These trends indicate a dynamic market landscape that is responsive to both economic conditions and consumer needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Luxury Condominiums Affordable Apartments Mid-range Condominiums Studio Apartments Penthouse Apartments Townhouses Co-living & Micro-apartments |

| By End-User | First-time Homebuyers Investors Renters Retirees Expats & Digital Nomads |

| By Price Range | Below $100,000 $100,000 - $300,000 $300,000 - $500,000 Above $500,000 |

| By Location | Urban Core (CBD & central districts) Suburban Areas Secondary Cities Resort & Coastal Markets |

| By Construction Type | New Developments Renovations Mixed-Use Developments Built-to-Rent (BTR) Projects |

| By Financing Type | Mortgages Cash Purchases Government Subsidies Developer Financing & Presales |

| By Ownership Type | Freehold Leasehold Shared Ownership Renter-Occupied |

| By Country | Brazil Mexico Colombia Rest of Latin America |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Condominium Buyers | 140 | First-time homebuyers, Investors |

| Apartment Renters | 120 | Young professionals, Families |

| Real Estate Developers | 60 | Project Managers, Business Development Heads |

| Property Management Firms | 60 | Property Managers, Operations Directors |

| Local Government Officials | 50 | Urban Planners, Housing Policy Makers |

The Latin America Condominiums and Apartments Market is valued at approximately USD 240260 billion, reflecting its significant share within the broader residential real estate sector in the region, driven by urbanization and rising disposable incomes.