Region:Europe

Author(s):Dev

Product Code:KRAB0952

Pages:85

Published On:October 2025

By Type:The digital advertising market can be segmented into various types, including Display Advertising, Search Engine Marketing, Social Media Advertising, Video Advertising, Native Advertising, Programmatic Advertising, Influencer Marketing, Affiliate Marketing, Digital Out-of-Home (DOOH) Advertising, and Others. Each of these segments plays a crucial role in shaping the overall market dynamics. Social media and search engine advertising are leading segments, supported by rapid growth in mobile and video advertising formats driven by increased smartphone adoption and AI-powered targeting .

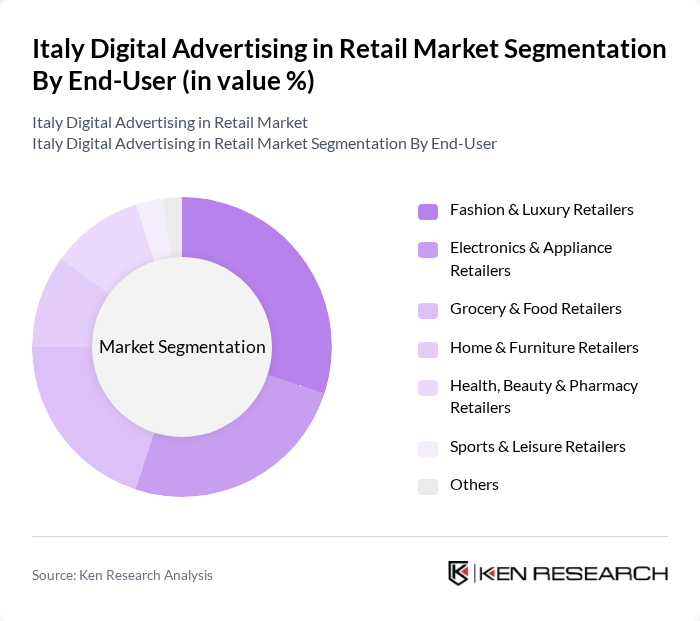

By End-User:The end-user segmentation includes Fashion & Luxury Retailers, Electronics & Appliance Retailers, Grocery & Food Retailers, Home & Furniture Retailers, Health, Beauty & Pharmacy Retailers, Sports & Leisure Retailers, and Others. Each segment has unique advertising needs and strategies that cater to their specific consumer demographics. Fashion, electronics, and grocery retailers are the most active in digital advertising, leveraging omnichannel strategies and data-driven campaigns to reach targeted audiences .

The Italy Digital Advertising in Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Google LLC, Meta Platforms, Inc. (Facebook & Instagram), Amazon Advertising, Adform A/S, Criteo S.A., The Trade Desk, Inc., Adobe Inc., Verizon Media (now Yahoo Inc.), Taboola.com Ltd., Outbrain Inc., MediaMath, Inc., Sizmek by Amazon, Xandr (Microsoft Advertising), Quantcast Corporation, Italiaonline S.p.A., WebAds S.p.A., Dentsu Italia S.p.A., H-FARM S.p.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of digital advertising in Italy's retail sector is poised for transformative growth, driven by technological advancements and evolving consumer behaviors. As retailers increasingly adopt data-driven strategies, the integration of artificial intelligence and machine learning will enhance ad targeting and personalization. Additionally, the rise of immersive technologies, such as augmented reality, will create new avenues for engaging consumers. These trends indicate a dynamic landscape where innovation and adaptability will be crucial for success in the competitive digital advertising market.

| Segment | Sub-Segments |

|---|---|

| By Type | Display Advertising Search Engine Marketing Social Media Advertising Video Advertising Native Advertising Programmatic Advertising Influencer Marketing Affiliate Marketing Digital Out-of-Home (DOOH) Advertising Others |

| By End-User | Fashion & Luxury Retailers Electronics & Appliance Retailers Grocery & Food Retailers Home & Furniture Retailers Health, Beauty & Pharmacy Retailers Sports & Leisure Retailers Others |

| By Sales Channel | E-commerce Platforms Brick-and-Mortar Retailers Mobile Commerce (m-commerce) Social Commerce Omnichannel Retailers Others |

| By Consumer Demographics | Age Group Gender Income Level Geographic Location Others |

| By Advertising Format | Banner Ads Sponsored Content Pop-up Ads Interstitial Ads Video Ads Audio/Podcast Ads Shoppable Ads Others |

| By Campaign Objective | Brand Awareness Lead Generation Customer Retention Sales Conversion Store Traffic (Drive-to-Store) Others |

| By Budget Size | Small Budgets Medium Budgets Large Budgets Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fashion Retail Digital Advertising | 100 | Marketing Directors, Brand Managers |

| Electronics Retail Campaigns | 80 | Digital Marketing Specialists, E-commerce Managers |

| Grocery Sector Online Promotions | 60 | Category Managers, Advertising Managers |

| Consumer Electronics Ad Effectiveness | 50 | Product Marketing Managers, Data Analysts |

| Home Goods Digital Strategies | 70 | Brand Strategists, Digital Media Planners |

The Italy Digital Advertising in Retail Market is valued at approximately USD 4.5 billion, reflecting significant growth driven by increased internet penetration, the rise of e-commerce, and the adoption of advanced digital marketing strategies among retailers.