Region:Europe

Author(s):Shubham

Product Code:KRAB5076

Pages:97

Published On:October 2025

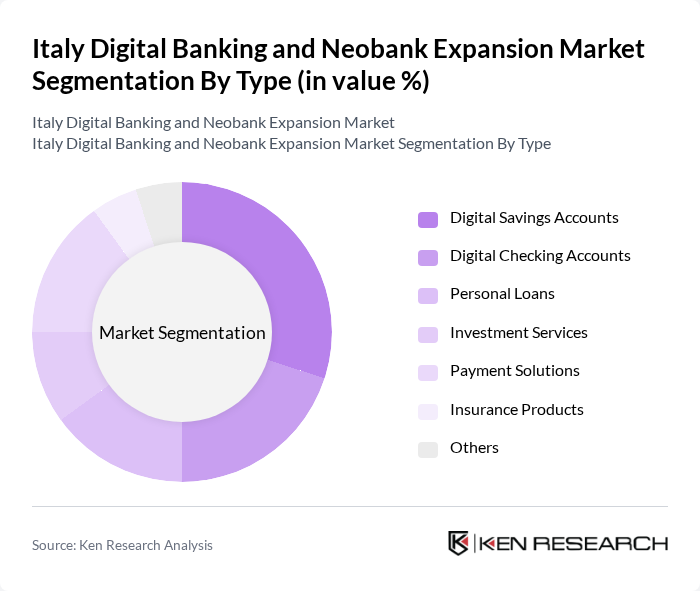

By Type:The market is segmented into various types, including Digital Savings Accounts, Digital Checking Accounts, Personal Loans, Investment Services, Payment Solutions, Insurance Products, and Others. Among these, Digital Savings Accounts and Payment Solutions are particularly prominent due to their high demand among consumers seeking convenience and better interest rates.

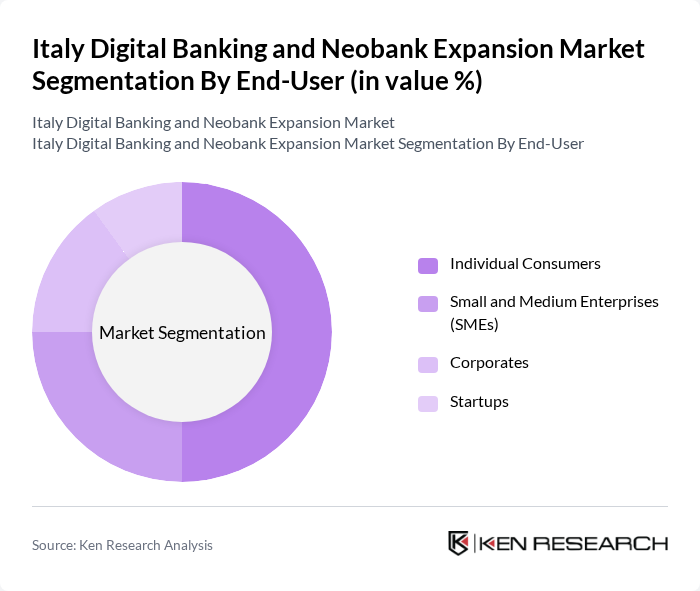

By End-User:The market is segmented by end-user into Individual Consumers, Small and Medium Enterprises (SMEs), Corporates, and Startups. Individual Consumers dominate the market, driven by the increasing preference for digital banking solutions that offer convenience and lower fees.

The Italy Digital Banking and Neobank Expansion Market is characterized by a dynamic mix of regional and international players. Leading participants such as N26, Revolut, Hype, Buddybank, Tinaba, Sella, Fineco, Banca Sella, Monese, YAP, Banca Ifis, Credimi, Oval Money, Revolut Bank, Qonto contribute to innovation, geographic expansion, and service delivery in this space.

The future of Italy's digital banking and neobank sector appears promising, driven by technological advancements and evolving consumer preferences. As more Italians embrace digital banking, the demand for innovative financial solutions will continue to rise. Neobanks are expected to enhance their service offerings through AI and machine learning, improving customer engagement and operational efficiency. Additionally, partnerships with traditional banks may facilitate broader market access, enabling neobanks to capture a larger share of the growing digital finance landscape in Italy.

| Segment | Sub-Segments |

|---|---|

| By Type | Digital Savings Accounts Digital Checking Accounts Personal Loans Investment Services Payment Solutions Insurance Products Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Corporates Startups |

| By Customer Segment | Millennials Gen Z Professionals Retirees |

| By Service Model | Direct Banking Banking-as-a-Service (BaaS) Neobank Platforms |

| By Distribution Channel | Mobile Applications Web Platforms Third-party Integrations |

| By Pricing Model | Subscription-based Transaction-based Freemium |

| By Regulatory Compliance | Fully Compliant Partially Compliant Non-compliant |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Banking Customers | 150 | Individuals aged 18-65, using digital banking services |

| Small Business Owners | 100 | Owners of SMEs utilizing neobank services |

| Fintech Industry Experts | 50 | Consultants, analysts, and thought leaders in digital finance |

| Regulatory Authorities | 30 | Officials from financial regulatory bodies in Italy |

| Banking Executives | 70 | Senior management from traditional banks and neobanks |

The Italy Digital Banking and Neobank Expansion Market is valued at approximately USD 10 billion, reflecting significant growth driven by the increasing adoption of digital financial services and consumer preferences for online banking solutions.