Region:Europe

Author(s):Rebecca

Product Code:KRAB4761

Pages:97

Published On:October 2025

By Type:The market is segmented into various types of educational offerings, including Executive MBAs, Professional Development Courses, Certificate Programs, Short Courses, Online Workshops, Micro-Credentials, Custom Corporate Training, and Others. Among these,Professional Development Coursesare particularly popular as they provide SMEs with targeted skills and knowledge that can be immediately applied in their operations. The flexibility and relevance of these courses make them a preferred choice for many businesses looking to enhance their workforce's capabilities.

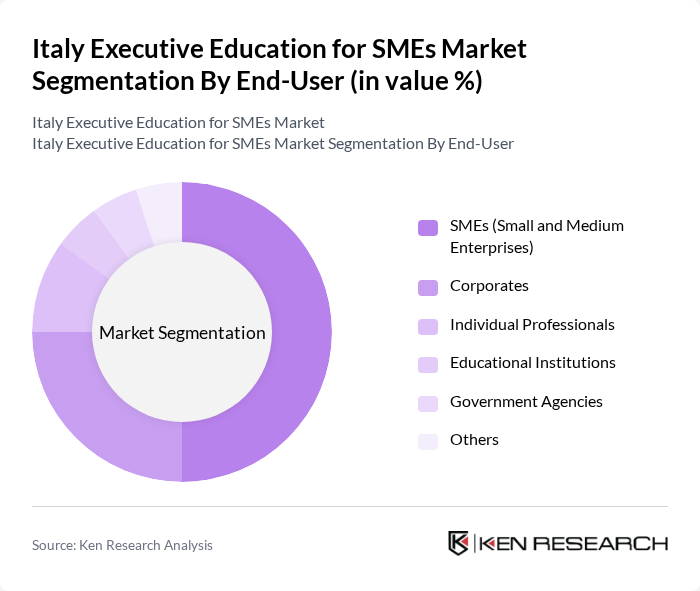

By End-User:The end-user segmentation includes SMEs, Corporates, Individual Professionals, Educational Institutions, Government Agencies, and Others.Corporatesrepresent the largest segment in the broader executive education market, driven by their need for continuous learning and adaptation to market changes. However, SMEs remain a significant and growing segment, particularly as government and EU initiatives increasingly target SME upskilling and digital transformation. The focus on practical skills and immediate applicability of knowledge makes executive education a vital resource for SMEs aiming to enhance their competitiveness and operational efficiency.

The Italy Executive Education for SMEs Market is characterized by a dynamic mix of regional and international players. Leading participants such as SDA Bocconi School of Management, MIP Politecnico di Milano Graduate School of Business, LUISS Business School, Università Cattolica del Sacro Cuore, University of Rome Tor Vergata, Università degli Studi di Napoli Federico II, Università degli Studi di Milano, Università degli Studi di Torino, Università degli Studi di Bologna, ESCP Business School (Italy Campus), Rome Business School, Bologna Business School, Fondazione CUOA, Cegos Italia, Talent Garden Innovation School contribute to innovation, geographic expansion, and service delivery in this space.

The future of executive education for SMEs in Italy appears promising, driven by the increasing integration of technology in learning environments and a growing emphasis on soft skills. As SMEs adapt to the digital economy, hybrid learning models combining online and in-person training are likely to gain traction. Furthermore, the focus on sustainability in business practices will encourage educational programs that align with these values, fostering a new generation of leaders equipped to navigate complex challenges in the marketplace.

| Segment | Sub-Segments |

|---|---|

| By Type | Executive MBAs Professional Development Courses Certificate Programs Short Courses Online Workshops Micro-Credentials Custom Corporate Training Others |

| By End-User | SMEs (Small and Medium Enterprises) Corporates Individual Professionals Educational Institutions Government Agencies Others |

| By Delivery Mode | Fully Online (Asynchronous) Blended Learning (Online + In-Person) Live Virtual Classes (Synchronous) Mobile Learning Others |

| By Duration | Short-Term (Less than 1 month) Medium-Term (1 month to 1 year) Long-Term (More than 1 year) Certification Programs Others |

| By Certification Type | Accredited Programs Non-Accredited Programs Industry-Specific Certifications Others |

| By Geographic Focus | National Programs Regional Programs Local Programs International Programs Others |

| By Price Range | Budget Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| SME Executives in Manufacturing | 60 | CEOs, Operations Managers |

| SME Executives in Services | 50 | Founders, Business Development Managers |

| Education Program Directors | 40 | Deans, Program Coordinators |

| Industry Experts and Consultants | 45 | Business Advisors, Economic Analysts |

| Participants of Executive Education Programs | 55 | Alumni, Current Students |

The Italy Executive Education for SMEs market is valued at approximately USD 2.0 billion, reflecting a significant demand for skill enhancement among small and medium enterprises to remain competitive in a rapidly evolving business landscape.