Region:Europe

Author(s):Shubham

Product Code:KRAA4730

Pages:85

Published On:September 2025

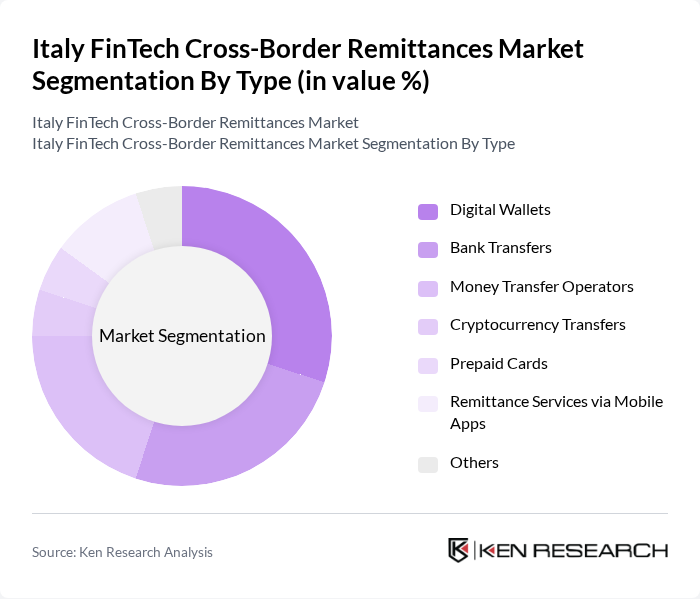

By Type:The market is segmented into various types, including Digital Wallets, Bank Transfers, Money Transfer Operators, Cryptocurrency Transfers, Prepaid Cards, Remittance Services via Mobile Apps, and Others. Each of these segments caters to different consumer needs and preferences, with digital wallets and money transfer operators currently leading the market due to their convenience and user-friendly interfaces.

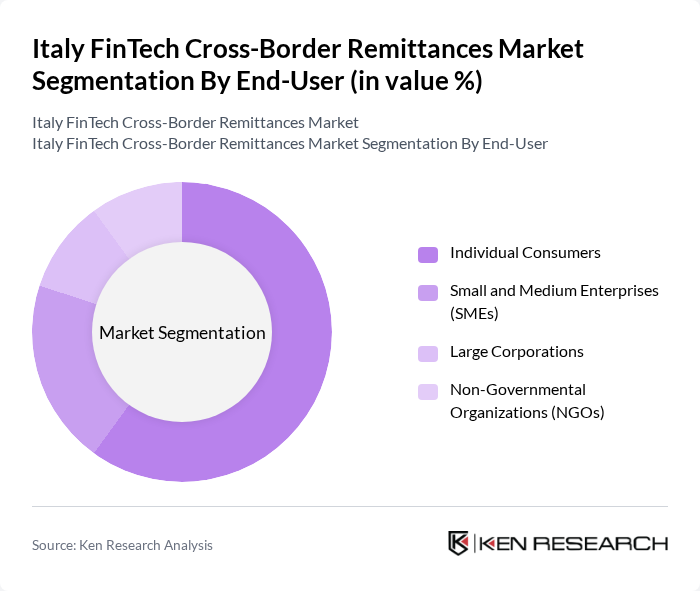

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Non-Governmental Organizations (NGOs). Individual consumers dominate the market, driven by the need for personal remittances, while SMEs and NGOs also contribute significantly due to their operational requirements for cross-border transactions.

The Italy FinTech Cross-Border Remittances Market is characterized by a dynamic mix of regional and international players. Leading participants such as TransferWise, Western Union, PayPal, MoneyGram, Revolut, Remitly, WorldRemit, Azimo, Skrill, Xoom, N26, Wise, Cash App, Venmo, Curve contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Italy FinTech cross-border remittances market appears promising, driven by technological advancements and increasing digital adoption. As more users embrace mobile wallets and digital platforms, the market is expected to see a significant shift towards cashless transactions. Additionally, the integration of AI for fraud detection will enhance security, fostering consumer trust. These trends indicate a robust growth trajectory, positioning Italy as a key player in the evolving global remittance landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Digital Wallets Bank Transfers Money Transfer Operators Cryptocurrency Transfers Prepaid Cards Remittance Services via Mobile Apps Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Non-Governmental Organizations (NGOs) |

| By Payment Method | Credit/Debit Cards Bank Transfers Cash Payments Mobile Payments |

| By Transaction Size | Small Transactions Medium Transactions Large Transactions |

| By Frequency of Transactions | Daily Transactions Weekly Transactions Monthly Transactions |

| By Geographic Focus | Europe Asia Americas Africa |

| By Customer Segment | Expatriates Students Migrant Workers Tourists |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Remittance Service Users | 150 | Migrants, International Students |

| FinTech Service Providers | 100 | Product Managers, Business Development Executives |

| Regulatory Bodies | 50 | Policy Makers, Compliance Officers |

| Financial Institutions | 80 | Banking Executives, Risk Management Professionals |

| Consumer Advocacy Groups | 40 | Consumer Rights Advocates, Financial Educators |

The Italy FinTech Cross-Border Remittances Market is valued at approximately USD 8.5 billion, reflecting significant growth driven by the increasing number of expatriates and the rise of digital payment solutions that enhance transaction efficiency and reduce costs.