Region:Europe

Author(s):Rebecca

Product Code:KRAA4836

Pages:92

Published On:September 2025

By Type:The furniture e-commerce market is segmented into Living Room Furniture, Bedroom Furniture, Dining Room Furniture, Kitchen Furniture, Office Furniture, Outdoor Furniture, Storage Solutions, Home Decor, and Others. Living Room and Bedroom Furniture remain the largest segments, reflecting Italian consumers’ focus on comfort and style in primary living spaces. Dining and Kitchen Furniture are also significant, driven by a culture of home entertaining and culinary tradition. Office Furniture sales have grown due to remote work trends, while Outdoor Furniture and Storage Solutions are expanding as consumers seek multifunctional and space-saving products. Home Decor, including decorative accessories, lighting, and textiles, is increasingly purchased online, reflecting evolving tastes and seasonal trends .

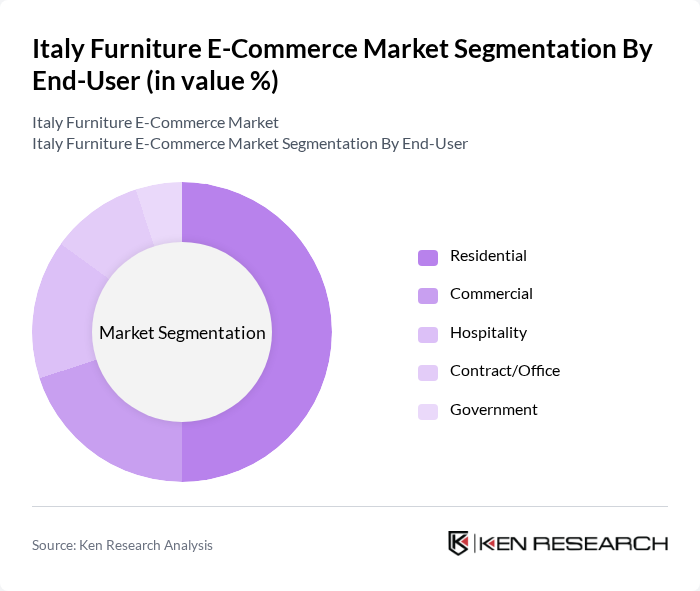

By End-User:The market is segmented by end-users into Residential, Commercial, Hospitality, Contract/Office, and Government. The Residential segment leads, driven by home renovation and interior design trends. Commercial and Hospitality segments are expanding as businesses and hotels invest in modern, sustainable furnishings to enhance guest experiences and brand image. Contract/Office furniture demand is fueled by flexible workspaces and remote work adoption, while Government procurement focuses on durability and compliance with sustainability standards .

The Italy Furniture E-Commerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA Italia, Mondo Convenienza, Leroy Merlin Italia, Maisons du Monde Italia, Conforama Italia, Scavolini, Poltronesofà, Calligaris, Arredissima, JYSK Italia, Bonaldo, Cattelan Italia, Gervasoni, Sangiacomo, Ricci Casa contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Italian furniture e-commerce market appears promising, driven by technological advancements and evolving consumer preferences. As more consumers embrace online shopping, retailers are expected to enhance their digital platforms, integrating features like augmented reality for virtual product trials. Additionally, the focus on sustainability will likely shape product offerings, with eco-friendly materials gaining traction. Companies that adapt to these trends and invest in innovative solutions will be well-positioned to capture market share and drive growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Living Room Furniture Bedroom Furniture Dining Room Furniture Kitchen Furniture Office Furniture Outdoor Furniture Storage Solutions Home Decor Others |

| By End-User | Residential Commercial Hospitality Contract/Office Government |

| By Sales Channel | Direct-to-Consumer (Brand.com) Online Marketplaces (e.g., Amazon, eBay, ManoMano) Multibrand Online Retailers Retail Partnerships (Omnichannel) Social Media Sales |

| By Price Range | Budget Mid-Range Premium/Luxury |

| By Material | Wood Metal Plastic Fabric/Upholstery Other Materials |

| By Design Style | Modern Traditional Contemporary Rustic Industrial |

| By Distribution Mode | Home Delivery Click and Collect Third-Party Logistics Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Furniture Retailers | 100 | eCommerce Managers, Marketing Directors |

| Consumer Purchase Behavior | 150 | Recent Online Furniture Buyers, Homeowners |

| Interior Design Trends | 100 | Interior Designers, Home Decor Influencers |

| Logistics and Supply Chain | 80 | Supply Chain Managers, Warehouse Supervisors |

| Market Trends and Insights | 120 | Industry Analysts, Market Researchers |

The Italy Furniture E-Commerce Market is valued at approximately USD 3.6 billion, reflecting significant growth driven by increased online shopping, smartphone adoption, and rising disposable incomes among consumers, particularly during and after the pandemic.