United Arab Emirates Kitchen Furniture Market Overview

- The United Arab Emirates Kitchen Furniture Market is valued at USD 1.2 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for modern and functional kitchen designs, coupled with a rise in disposable income among consumers. The market has seen a significant shift towards modular and custom kitchen solutions, reflecting changing consumer preferences for aesthetics and utility. Urbanization, a robust real estate sector, and a high GDP per capita further support this trend, with consumers investing more in home upgrades and kitchen renovations .

- Key cities dominating this market includeDubai and Abu Dhabi, which are known for their rapid urbanization and high standard of living. The concentration of affluent consumers and a thriving real estate sector in these cities contribute to the robust demand for kitchen furniture. Additionally, the presence of numerous international and local brands enhances competition and innovation in the market .

- In 2023, the UAE government implemented regulations aimed at promoting sustainable building practices, which include guidelines for eco-friendly materials in kitchen furniture. TheUAE Fire and Life Safety Code of Practice 2018(issued by the UAE Civil Defense) and theEstidama Pearl Rating System(issued by the Abu Dhabi Urban Planning Council) require the use of sustainable, low-emission, and recyclable materials in building interiors, including kitchen furniture. These initiatives encourage manufacturers to adopt sustainable practices, thereby enhancing the overall quality and environmental impact of kitchen furniture products in the market .

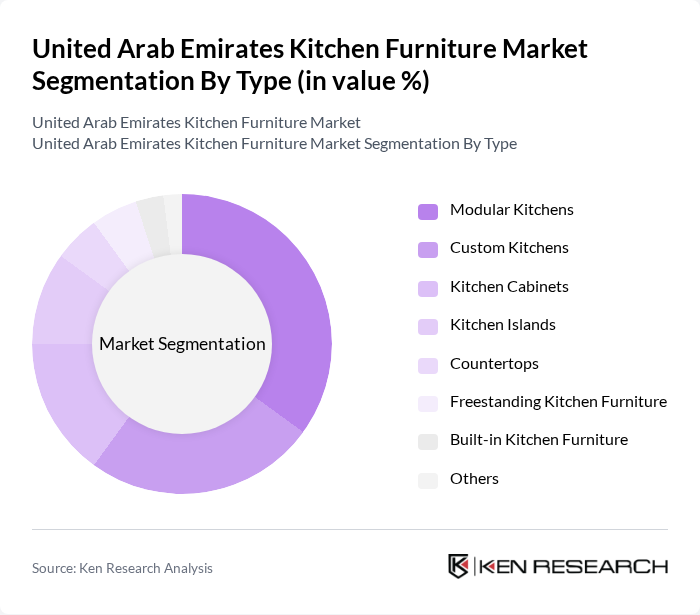

United Arab Emirates Kitchen Furniture Market Segmentation

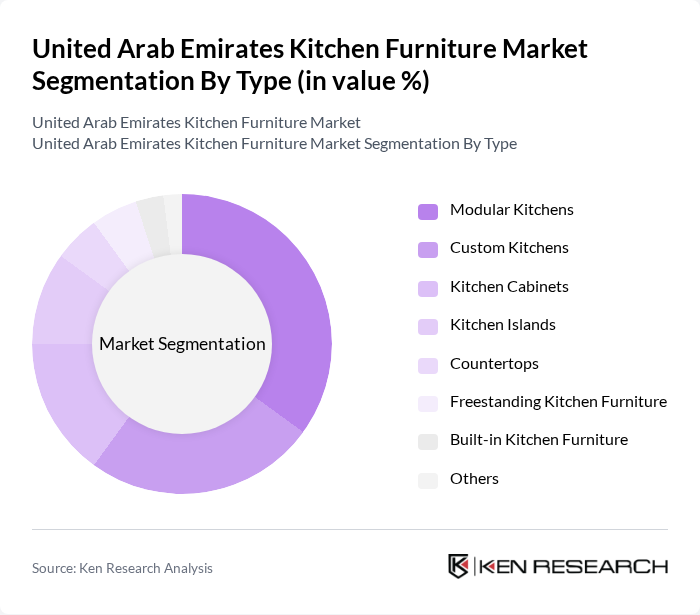

By Type:The kitchen furniture market can be segmented into various types, including Modular Kitchens, Custom Kitchens, Kitchen Cabinets, Kitchen Islands, Countertops, Freestanding Kitchen Furniture, Built-in Kitchen Furniture, and Others. Among these,Modular Kitchensare gaining significant traction due to their flexibility and space-saving designs, appealing to urban consumers with limited kitchen space.Custom Kitchensalso hold a substantial share as they cater to specific consumer preferences and styles. The market also reflects growing demand for eco-friendly and technologically integrated kitchen solutions, such as smart storage and energy-efficient materials .

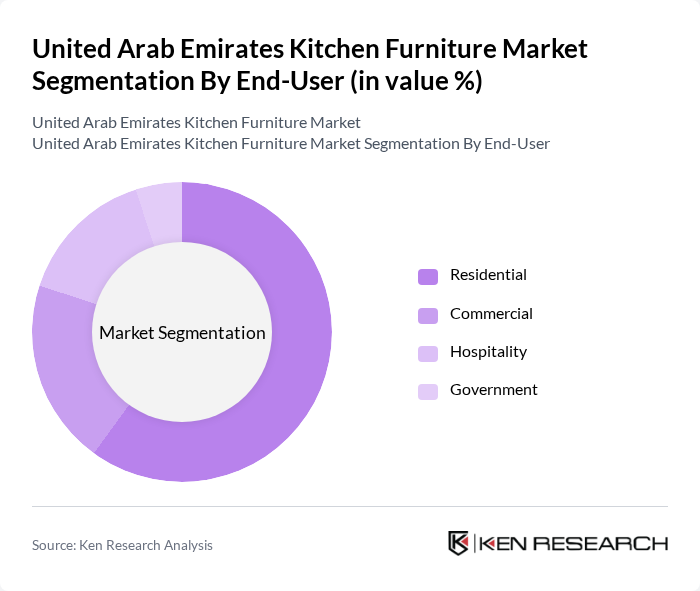

By End-User:The end-user segmentation includes Residential, Commercial, Hospitality, and Government sectors. TheResidentialsegment dominates the market, driven by the growing trend of home renovations and the increasing number of new housing projects. The Commercial and Hospitality sectors also contribute significantly, as businesses seek to create appealing environments for customers and employees. The Hospitality segment, in particular, benefits from the UAE's status as a global tourism hub, which drives demand for high-quality, durable kitchen furniture in hotels and serviced apartments .

United Arab Emirates Kitchen Furniture Market Competitive Landscape

The United Arab Emirates Kitchen Furniture Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA, Home Centre, Pan Emirates, Danube Home, Al-Futtaim ACE, Royal Furniture, Interiors, The One, Midas Furniture, Landmark Group, Al Huzaifa Furniture, United Furniture, Marina Home Interiors, Al-Jazira Furniture, BoConcept contribute to innovation, geographic expansion, and service delivery in this space.

United Arab Emirates Kitchen Furniture Market Industry Analysis

Growth Drivers

- Increasing Urbanization:The urban population in the UAE is projected to reach approximately 8.8 million in future, according to the World Bank. This rapid urbanization drives demand for modern kitchen furniture as more people move into urban areas, necessitating efficient and stylish kitchen solutions. Urban dwellers often seek contemporary designs that maximize space, leading to a surge in modular kitchen installations, which are favored for their adaptability and aesthetic appeal.

- Rising Disposable Income:The UAE's GDP per capita is estimated at around USD 47,663 in future, reflecting a growing middle class with increased purchasing power. As disposable incomes rise, consumers are more willing to invest in high-quality kitchen furniture that enhances their living spaces. This trend is evident in the growing demand for premium materials and custom designs, as households prioritize aesthetics and functionality in their kitchen environments.

- Demand for Modular Kitchen Solutions:The modular kitchen segment is anticipated to grow significantly, with an estimated market value of AED 1.2 billion in future. This growth is driven by consumer preferences for customizable and space-efficient solutions that cater to modern lifestyles. Modular kitchens offer flexibility in design and functionality, appealing to both homeowners and renters who seek to optimize their kitchen spaces without extensive renovations.

Market Challenges

- High Competition:The UAE kitchen furniture market is characterized by intense competition, with over 200 local and international brands vying for market share. This saturation leads to price wars and reduced profit margins, making it challenging for new entrants to establish themselves. Established brands must continuously innovate and differentiate their offerings to maintain their competitive edge, which can strain resources and impact overall market growth.

- Fluctuating Raw Material Prices:The kitchen furniture industry is heavily reliant on raw materials such as wood, metal, and glass, which have seen price volatility due to global supply chain disruptions. For instance, the price of plywood has increased by 15 percent in the past year due to supply shortages. These fluctuations can significantly impact production costs, forcing manufacturers to either absorb the costs or pass them on to consumers, potentially affecting sales.

United Arab Emirates Kitchen Furniture Market Future Outlook

The future of the UAE kitchen furniture market appears promising, driven by technological advancements and evolving consumer preferences. As smart kitchen technologies gain traction, manufacturers are likely to integrate IoT devices into their products, enhancing convenience and efficiency. Additionally, the trend towards minimalist designs and multifunctional furniture will continue to shape product offerings, catering to the needs of urban dwellers seeking both style and practicality in their kitchen spaces.

Market Opportunities

- Expansion of E-commerce Platforms:The rise of e-commerce in the UAE presents a significant opportunity for kitchen furniture brands. With online sales projected to reach AED 20 billion in future, companies can leverage digital platforms to reach a broader audience, offering convenience and competitive pricing. This shift allows for innovative marketing strategies and enhanced customer engagement through personalized shopping experiences.

- Sustainable and Eco-friendly Products:Growing environmental awareness among consumers is driving demand for sustainable kitchen furniture. The market for eco-friendly products is expected to grow by 25 percent annually, as consumers increasingly prioritize sustainability in their purchasing decisions. Brands that adopt sustainable practices and materials can differentiate themselves, appealing to environmentally conscious buyers and enhancing their market position.