Region:Europe

Author(s):Shubham

Product Code:KRAB1138

Pages:100

Published On:October 2025

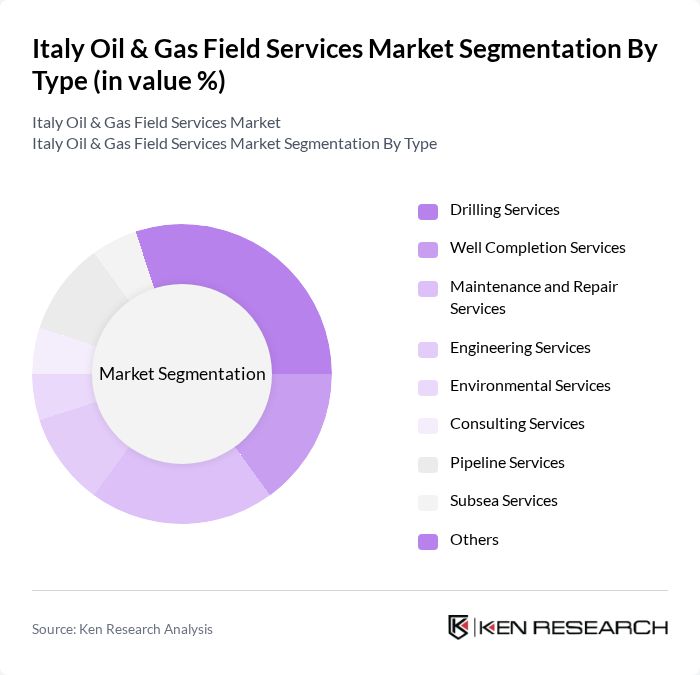

By Type:The market is segmented into a range of services essential for oil and gas operations. Key subsegments include Drilling Services, Well Completion Services, Maintenance and Repair Services, Engineering Services, Environmental Services, Consulting Services, Pipeline Services, Subsea Services, and Others. Each service segment addresses specific operational needs, from exploration and production to regulatory compliance and environmental stewardship .

The Drilling Services subsegment is the leading segment in the market, supported by the ongoing need for exploration and production of oil and gas. This segment benefits from recent advancements in drilling and well intervention technologies, which improve efficiency and reduce operational costs. The continued expansion of offshore and onshore drilling projects, along with the integration of digital solutions for real-time monitoring, further reinforces the segment’s dominance .

By End-User:The market is segmented by end-users, including Oil Companies, Gas Companies, Government Agencies, Industrial Users, and Utilities. Each end-user group has distinct operational requirements, regulatory obligations, and service needs, collectively shaping the demand for specialized field services .

Oil Companies constitute the largest end-user segment, reflecting their extensive involvement in exploration, production, and refining activities. The demand for field services among oil companies is driven by the need for operational efficiency, compliance with environmental standards, and the management of increasingly complex projects. The sector’s focus on digital transformation and cost optimization has further increased reliance on specialized field services .

The Italy Oil & Gas Field Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Eni S.p.A., Saipem S.p.A., Edison S.p.A., SGS Italia S.p.A., RINA S.p.A., TechnipFMC plc, Schlumberger Limited, Halliburton Company, Baker Hughes Company, Weatherford International plc, Petrofac Limited, Wood Group PLC, Aker Solutions ASA, Subsea 7 S.A., CGG S.A., DNV AS, Engie SA, BP plc contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Italy oil and gas field services market appears promising, driven by a combination of technological innovation and government support. As the sector increasingly embraces digital transformation, operational efficiencies are expected to improve significantly. Additionally, the integration of renewable energy sources into traditional oil and gas operations will likely create new avenues for growth. Companies that adapt to these changes will be better positioned to thrive in a competitive landscape, ensuring sustainability and profitability in the long term.

| Segment | Sub-Segments |

|---|---|

| By Type | Drilling Services Well Completion Services Maintenance and Repair Services Engineering Services Environmental Services Consulting Services Pipeline Services Subsea Services Others |

| By End-User | Oil Companies Gas Companies Government Agencies Industrial Users Utilities |

| By Application | Onshore Operations Offshore Operations Exploration Production Transportation & Storage |

| By Service Model | Contractual Services Project-Based Services Turnkey Solutions |

| By Region | Northern Italy Central Italy Southern Italy Islands |

| By Investment Source | Domestic Investments Foreign Direct Investments Public-Private Partnerships |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Drilling Services | 50 | Drilling Engineers, Operations Managers |

| Maintenance and Repair Services | 40 | Maintenance Supervisors, Technical Directors |

| Logistics and Supply Chain Services | 40 | Logistics Coordinators, Supply Chain Managers |

| Environmental and Safety Services | 40 | Safety Officers, Environmental Compliance Managers |

| Consulting and Advisory Services | 40 | Industry Analysts, Business Development Managers |

The Italy Oil & Gas Field Services Market is valued at approximately USD 1.2 billion, reflecting a five-year historical analysis. This growth is driven by increasing energy demand, investments in midstream infrastructure, and the adoption of advanced technologies in extraction and processing.