Region:North America

Author(s):Dev

Product Code:KRAB6024

Pages:87

Published On:October 2025

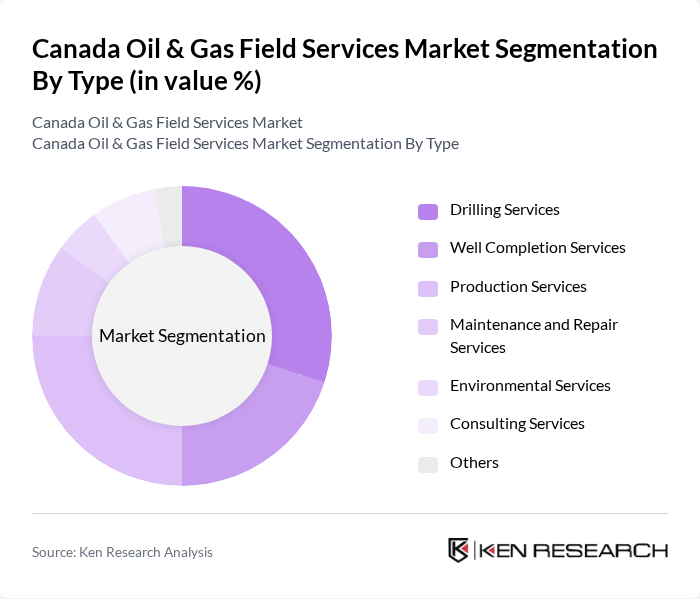

By Type:The market is segmented into various types of services that cater to the diverse needs of the oil and gas industry. The primary segments include drilling services, well completion services, production services, maintenance and repair services, environmental services, consulting services, and others. Each of these segments plays a crucial role in the overall efficiency and effectiveness of oil and gas operations.

The drilling services segment is currently dominating the market due to the high demand for new oil and gas wells, driven by the need for energy security and the exploration of untapped reserves. This segment benefits from advancements in drilling technologies, which enhance efficiency and reduce costs. Additionally, the increasing complexity of oil and gas extraction processes necessitates specialized drilling services, further solidifying its leadership position in the market.

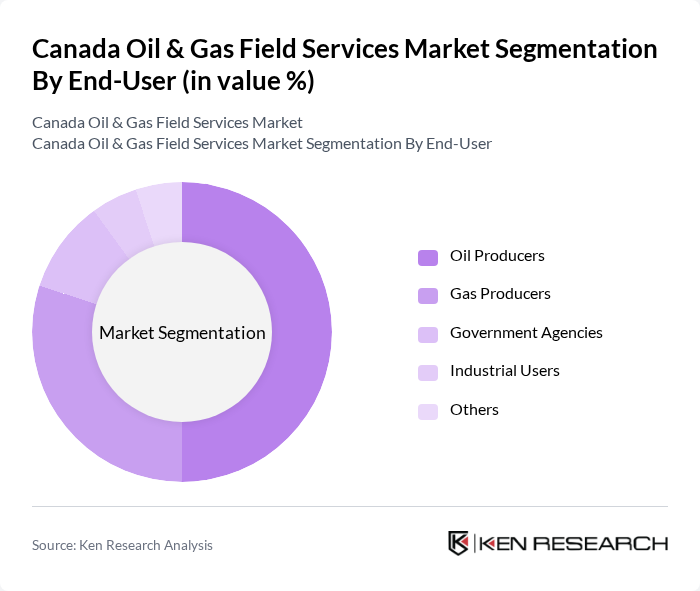

By End-User:The market is segmented based on end-users, which include oil producers, gas producers, government agencies, industrial users, and others. Each end-user category has distinct requirements and influences the demand for various field services in the oil and gas sector.

The oil producers segment is the largest end-user in the market, driven by the continuous need for oil extraction and production. This segment's growth is fueled by rising global oil demand and the need for enhanced recovery techniques. Oil producers are increasingly investing in advanced technologies and services to optimize production and reduce operational costs, further solidifying their dominance in the market.

The Canada Oil & Gas Field Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Halliburton Company, Schlumberger Limited, Baker Hughes Company, Precision Drilling Corporation, Ensign Energy Services Inc., Trican Well Service Ltd., Calfrac Well Services Ltd., Secure Energy Services Inc., Key Energy Services Inc., CWC Energy Services Corp., Total Energy Services Inc., Horizon North Logistics Inc., Savanna Energy Services Corp., Superior Energy Services Inc., Red Deer Energy Services Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Canada Oil & Gas Field Services market appears promising, driven by a combination of technological innovation and government support. As the industry increasingly focuses on sustainability, service providers are likely to adopt greener practices and technologies. Additionally, the integration of automation and AI will enhance operational efficiency, allowing companies to respond more effectively to market demands. This evolving landscape presents opportunities for growth and adaptation in a competitive environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Drilling Services Well Completion Services Production Services Maintenance and Repair Services Environmental Services Consulting Services Others |

| By End-User | Oil Producers Gas Producers Government Agencies Industrial Users Others |

| By Service Type | Exploration Services Production Services Decommissioning Services Others |

| By Region | Western Canada Eastern Canada Northern Canada Central Canada |

| By Client Type | Private Sector Public Sector Joint Ventures Others |

| By Project Size | Small Scale Projects Medium Scale Projects Large Scale Projects |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Grants |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Drilling Services | 100 | Drilling Engineers, Operations Managers |

| Completion Services | 80 | Completion Engineers, Project Managers |

| Maintenance and Repair Services | 70 | Maintenance Supervisors, Field Technicians |

| Environmental Services | 60 | Environmental Compliance Officers, Safety Managers |

| Logistics and Supply Chain Services | 90 | Logistics Coordinators, Supply Chain Analysts |

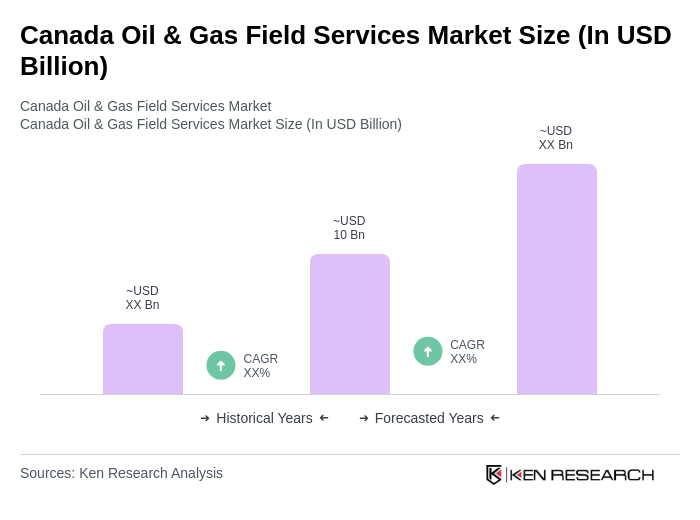

The Canada Oil & Gas Field Services Market is valued at approximately USD 10 billion, driven by increasing energy demand, technological advancements, and a focus on sustainable practices. This valuation reflects a five-year historical analysis of the market's growth and dynamics.