Region:Europe

Author(s):Geetanshi

Product Code:KRAB5755

Pages:94

Published On:October 2025

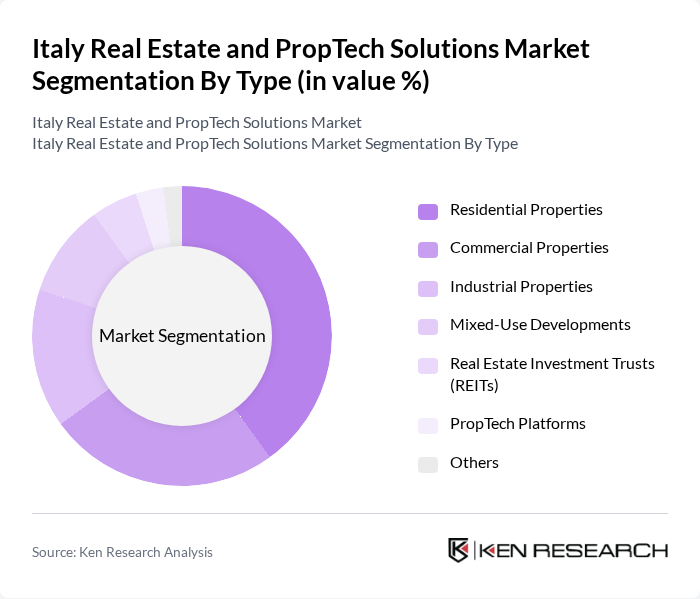

By Type:The market can be segmented into various types, including Residential Properties, Commercial Properties, Industrial Properties, Mixed-Use Developments, Real Estate Investment Trusts (REITs), PropTech Platforms, and Others. Among these, Residential Properties are currently leading the market due to the increasing demand for housing driven by urban migration, changing demographics, and improved financing conditions. Commercial Properties also hold a significant share, supported by the growth of businesses, the need for office spaces, and strong retail and hospitality investment—hospitality alone attracted EUR 1.5 billion in H1 2025, up 77% year-on-year. Industrial and logistics assets are gaining attention, while Mixed-Use Developments are emerging in urban centers to meet diverse lifestyle needs. REITs and PropTech Platforms, though smaller in share, are growing as investors seek diversified exposure and tech-driven efficiencies.

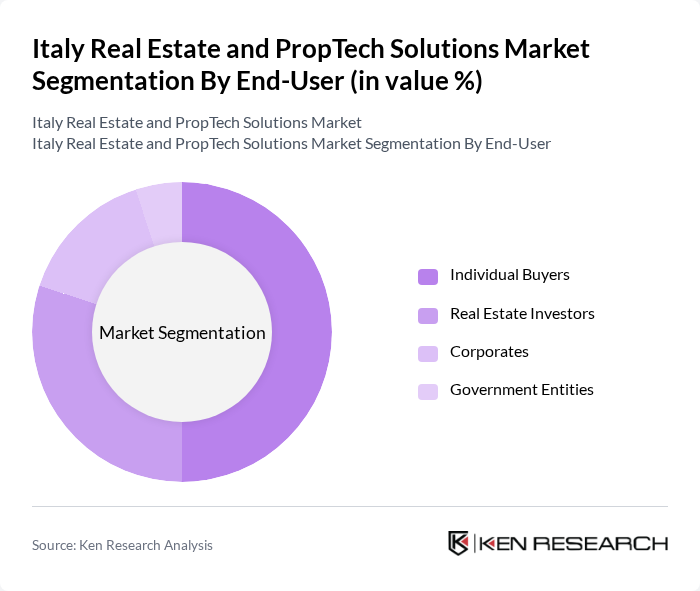

By End-User:The end-user segmentation includes Individual Buyers, Real Estate Investors, Corporates, and Government Entities. Individual Buyers dominate the market, driven by the increasing trend of homeownership and investment in residential properties, supported by favorable mortgage rates and a strong sales market. Real Estate Investors follow closely, capitalizing on the growing demand for rental properties—especially in student and short-term segments—and commercial spaces, with southern cities offering rental yields above 8%. Corporates and Government Entities contribute to the market through large-scale projects, infrastructure development, and public-private partnerships, particularly in urban renewal and sustainable development initiatives.

The Italy Real Estate and PropTech Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as RE/MAX Italy, Gabetti Property Solutions, Tecnocasa, Engel & Völkers Italy, Casa.it, Idealista, Immobiliare.it, Housers, Casavo, Bnp Paribas Real Estate, Cbre Italy, Jll Italy, Colliers International Italy, Sigest, Scenari Immobiliari contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Italy real estate and PropTech solutions market appears promising, driven by ongoing urbanization and technological integration. As cities expand, the demand for innovative housing solutions will likely increase. Additionally, the focus on sustainability and energy efficiency will shape new developments. The rise of remote work is expected to influence property design and location preferences, creating opportunities for flexible living and working spaces that cater to evolving consumer needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Properties Commercial Properties Industrial Properties Mixed-Use Developments Real Estate Investment Trusts (REITs) PropTech Platforms Others |

| By End-User | Individual Buyers Real Estate Investors Corporates Government Entities |

| By Application | Property Management Real Estate Brokerage Investment Analysis Market Research Data Analytics and AI Integration |

| By Sales Channel | Direct Sales Online Platforms Real Estate Agents |

| By Distribution Mode | Offline Distribution Online Distribution |

| By Price Range | Low-End Properties Mid-Range Properties High-End Properties |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Government Schemes |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Real Estate Developers | 90 | Project Managers, Business Development Managers |

| Commercial Property Managers | 70 | Operations Managers, Asset Managers |

| PropTech Startups | 50 | Founders, Product Managers |

| Real Estate Investors | 65 | Investment Analysts, Portfolio Managers |

| Urban Planning Authorities | 40 | Urban Planners, Policy Makers |

The Italy Real Estate and PropTech Solutions Market is valued at approximately USD 44 billion, reflecting significant growth driven by urbanization, demand for properties, and technological integration in real estate transactions.