Region:Middle East

Author(s):Dev

Product Code:KRAA4685

Pages:99

Published On:September 2025

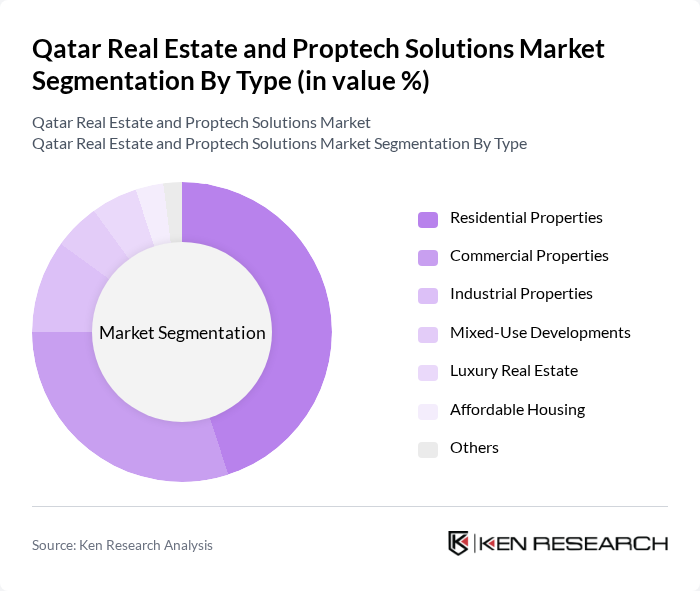

By Type:The market is segmented into various types, including Residential Properties, Commercial Properties, Industrial Properties, Mixed-Use Developments, Luxury Real Estate, Affordable Housing, and Others. Among these, Residential Properties dominate the market due to the growing population and increasing demand for housing solutions. The trend towards urban living and the rise of smart homes are also contributing factors. Commercial Properties follow closely, driven by the expansion of businesses and the need for office spaces.

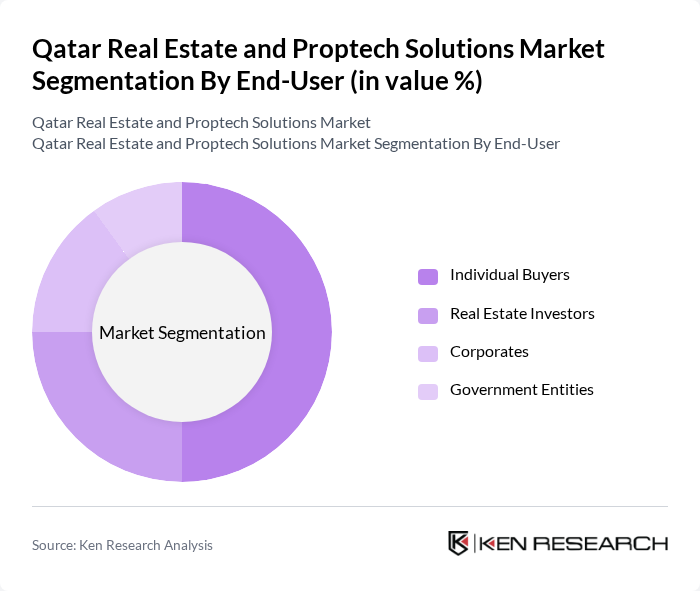

By End-User:The end-user segmentation includes Individual Buyers, Real Estate Investors, Corporates, and Government Entities. Individual Buyers represent the largest segment, driven by the increasing number of expatriates and local citizens seeking home ownership. Real Estate Investors are also significant, capitalizing on the growing market opportunities. Corporates and Government Entities play a crucial role in large-scale developments and infrastructure projects, further driving market growth.

The Qatar Real Estate and Proptech Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatari Diar, Barwa Real Estate, Ezdan Holding Group, United Development Company, Al Asmakh Real Estate Development, Doha Bank, Al Jazeera Real Estate, Qatar Real Estate Investment Company, Qatari Investors Group, Al Habtoor Group, Colliers International, JLL (Jones Lang LaSalle), CBRE Group, Knight Frank, Property Finder contribute to innovation, geographic expansion, and service delivery in this space.

The future of Qatar's real estate and proptech market appears promising, driven by ongoing urbanization and government initiatives. As the population continues to grow, demand for innovative housing solutions will rise. The integration of technology, particularly in proptech, is expected to enhance operational efficiencies and customer experiences. Furthermore, sustainability will play a crucial role in shaping development strategies, aligning with global trends towards eco-friendly practices and smart city initiatives, ensuring long-term market viability.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Properties Commercial Properties Industrial Properties Mixed-Use Developments Luxury Real Estate Affordable Housing Others |

| By End-User | Individual Buyers Real Estate Investors Corporates Government Entities |

| By Sales Channel | Direct Sales Real Estate Agents Online Platforms Auctions |

| By Property Management Type | Full-Service Management Tenant-Only Management Maintenance Services |

| By Investment Type | Residential Investment Commercial Investment REITs Joint Ventures |

| By Financing Source | Bank Loans Private Equity Crowdfunding Government Grants |

| By Market Segment | Luxury Segment Mid-Range Segment Budget Segment Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Real Estate Developers | 100 | Project Managers, Business Development Heads |

| Commercial Property Managers | 80 | Operations Managers, Asset Managers |

| Proptech Solution Providers | 70 | Product Managers, Technology Officers |

| Real Estate Investors | 60 | Investment Analysts, Portfolio Managers |

| End-users of Proptech Solutions | 90 | Real Estate Agents, Property Buyers |

The Qatar Real Estate and Proptech Solutions Market is valued at approximately USD 20 billion, driven by urbanization, infrastructure development, and a growing demand for innovative property technology solutions.