Region:Asia

Author(s):Rebecca

Product Code:KRAB3555

Pages:80

Published On:October 2025

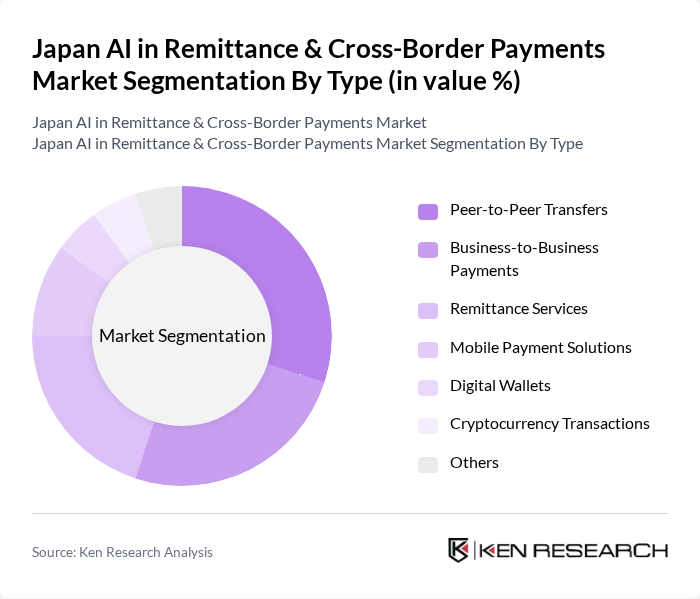

By Type:The market is segmented into various types, including Peer-to-Peer Transfers, Business-to-Business Payments, Remittance Services, Mobile Payment Solutions, Digital Wallets, Cryptocurrency Transactions, and Others. Among these, Peer-to-Peer Transfers are gaining significant traction due to the increasing number of individuals seeking quick and cost-effective ways to send money across borders. The convenience and speed offered by these services are driving their popularity, especially among younger consumers who prefer digital solutions.

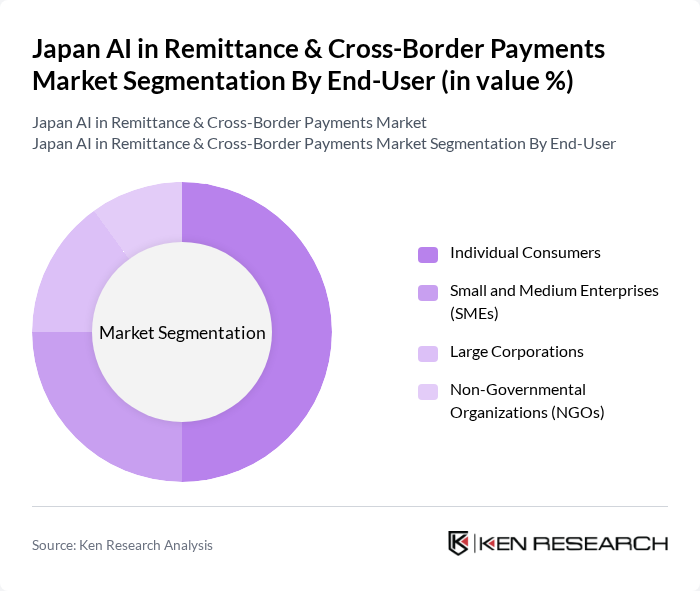

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Non-Governmental Organizations (NGOs). Individual Consumers dominate this segment, driven by the increasing need for personal remittances and the convenience of digital payment platforms. The rise in international migration and the need for families to support relatives abroad have significantly contributed to the growth of this segment.

The Japan AI in Remittance & Cross-Border Payments Market is characterized by a dynamic mix of regional and international players. Leading participants such as MoneyGram International, Inc., Western Union Company, PayPal Holdings, Inc., TransferWise Ltd., Remitly, Inc., WorldRemit Ltd., Revolut Ltd., N26 GmbH, Alipay (Ant Group), WeChat Pay (Tencent), SBI Remit Co., Ltd., Rakuten Wallet, Inc., JCB Co., Ltd., LINE Pay Corporation, PayPay Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan AI in remittance and cross-border payments market appears promising, driven by technological advancements and evolving consumer preferences. As AI technologies continue to enhance transaction efficiency and security, the market is likely to witness increased adoption among both consumers and businesses. Additionally, the integration of blockchain technology is expected to further streamline processes, reduce costs, and improve transparency, positioning Japan as a leader in innovative payment solutions in the Asia-Pacific region.

| Segment | Sub-Segments |

|---|---|

| By Type | Peer-to-Peer Transfers Business-to-Business Payments Remittance Services Mobile Payment Solutions Digital Wallets Cryptocurrency Transactions Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Non-Governmental Organizations (NGOs) |

| By Sales Channel | Online Platforms Mobile Applications Physical Outlets Agent Networks |

| By Payment Method | Bank Transfers Credit/Debit Cards E-wallets Cash Payments |

| By Currency Type | Yen US Dollar Euro Others |

| By Transaction Size | Small Transactions Medium Transactions Large Transactions |

| By Customer Segment | Retail Customers Corporate Clients Government Entities Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Remittance Service Providers | 100 | CEOs, Product Managers |

| Financial Institutions | 80 | Compliance Officers, Risk Managers |

| End-Users of Remittance Services | 150 | Consumers, Small Business Owners |

| Regulatory Bodies | 50 | Policy Makers, Financial Analysts |

| Fintech Innovators | 70 | Founders, Technology Officers |

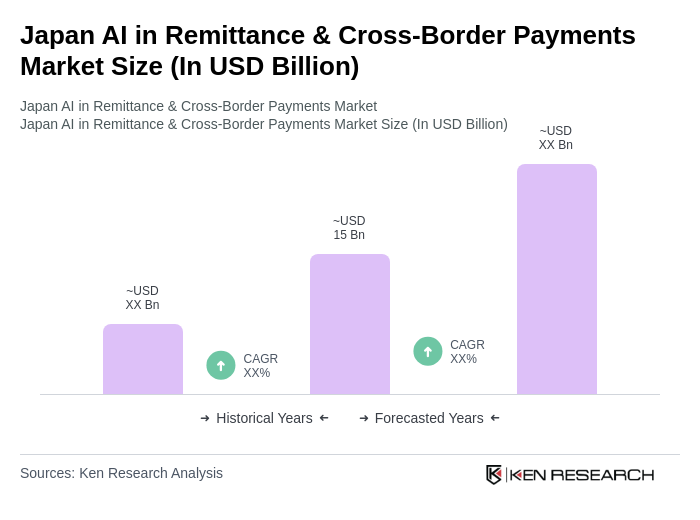

The Japan AI in Remittance & Cross-Border Payments Market is valued at approximately USD 15 billion, reflecting significant growth driven by the increasing adoption of digital payment solutions and the demand for faster, more secure remittance services.