Region:Middle East

Author(s):Rebecca

Product Code:KRAC1087

Pages:85

Published On:October 2025

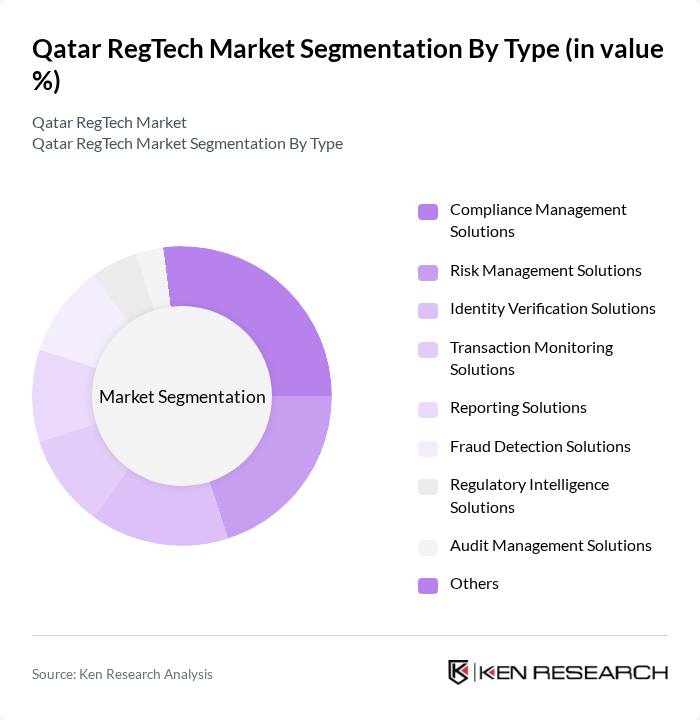

By Type:The market is segmented into various types of solutions that address the specific needs of regulatory compliance and risk management. The key subsegments include Compliance Management Solutions, Risk Management Solutions, Identity Verification Solutions, Transaction Monitoring Solutions, Reporting Solutions, Fraud Detection Solutions, Regulatory Intelligence Solutions, Audit Management Solutions, and Others. Each of these subsegments plays a crucial role in helping organizations automate compliance processes, monitor transactions in real time, detect and prevent fraud, and manage regulatory changes efficiently.

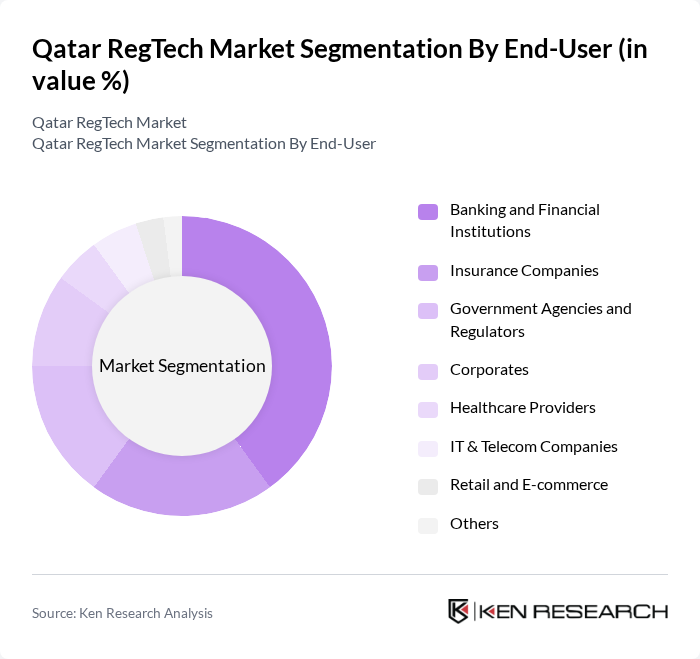

By End-User:The end-user segmentation includes various sectors that utilize RegTech solutions to enhance compliance and risk management. Key subsegments are Banking and Financial Institutions, Insurance Companies, Government Agencies and Regulators, Corporates, Healthcare Providers, IT & Telecom Companies, Retail and E-commerce, and Others. Each sector faces unique regulatory requirements, driving the demand for tailored RegTech solutions to address challenges such as anti-money laundering, fraud detection, identity verification, and regulatory reporting.

The Qatar RegTech Market is characterized by a dynamic mix of regional and international players. Leading participants such as QPay, Doha Bank, Qatar National Bank (QNB), Ooredoo, Vodafone Qatar, Diligent, Fenergo, ComplyAdvantage, LexisNexis Risk Solutions, Amlify, RiskScreen, ACTICO, SAS Institute, Oracle, IBM, Fintech Hive Qatar, QNB Group, Qatar Islamic Bank (QIB), Refinitiv (an LSEG business), Temenos contribute to innovation, geographic expansion, and service delivery in this space.

The Qatar RegTech market is poised for significant evolution as regulatory frameworks become more stringent and the financial landscape continues to digitize. In future, the integration of advanced technologies such as artificial intelligence and blockchain is expected to reshape compliance processes, making them more efficient and transparent. As financial institutions increasingly prioritize real-time compliance monitoring, the demand for innovative RegTech solutions will likely surge, driving growth and collaboration within the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Compliance Management Solutions Risk Management Solutions Identity Verification Solutions Transaction Monitoring Solutions Reporting Solutions Fraud Detection Solutions Regulatory Intelligence Solutions Audit Management Solutions Others |

| By End-User | Banking and Financial Institutions Insurance Companies Government Agencies and Regulators Corporates Healthcare Providers IT & Telecom Companies Retail and E-commerce Others |

| By Application | Anti-Money Laundering (AML) Know Your Customer (KYC) Regulatory Reporting Risk Assessment & Management Fraud Detection & Prevention Transaction Monitoring Data Protection & Privacy Compliance Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Region | Doha Al Rayyan Umm Salal Al Wakrah Others |

| By Company Size | Large Enterprises Medium Enterprises Small Enterprises |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector Compliance Technology | 120 | Compliance Officers, Risk Managers |

| Insurance Regulatory Solutions | 100 | Regulatory Affairs Managers, IT Directors |

| Investment Firms' KYC Processes | 80 | Operations Managers, Compliance Analysts |

| Fintech Startups' Regulatory Challenges | 60 | Founders, CTOs |

| Data Protection and Privacy Solutions | 90 | Data Protection Officers, Legal Advisors |

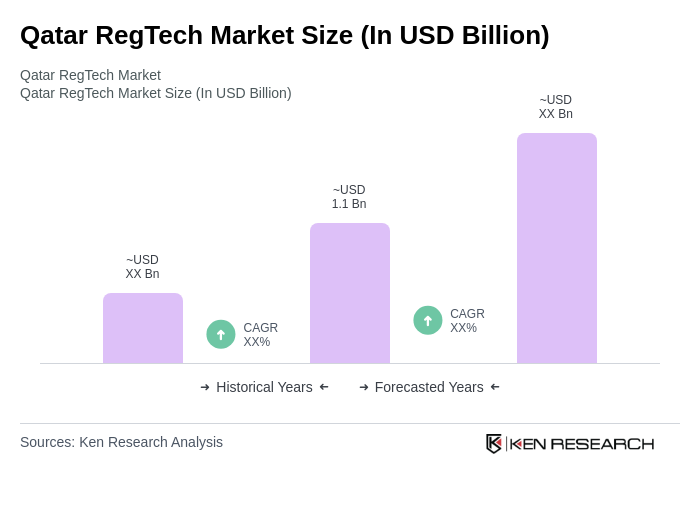

The Qatar RegTech Market is valued at approximately USD 1.1 billion, driven by increasing regulatory requirements, digital transformation in financial services, and the need for enhanced compliance and risk management processes among financial institutions.