Region:Asia

Author(s):Dev

Product Code:KRAC0456

Pages:96

Published On:August 2025

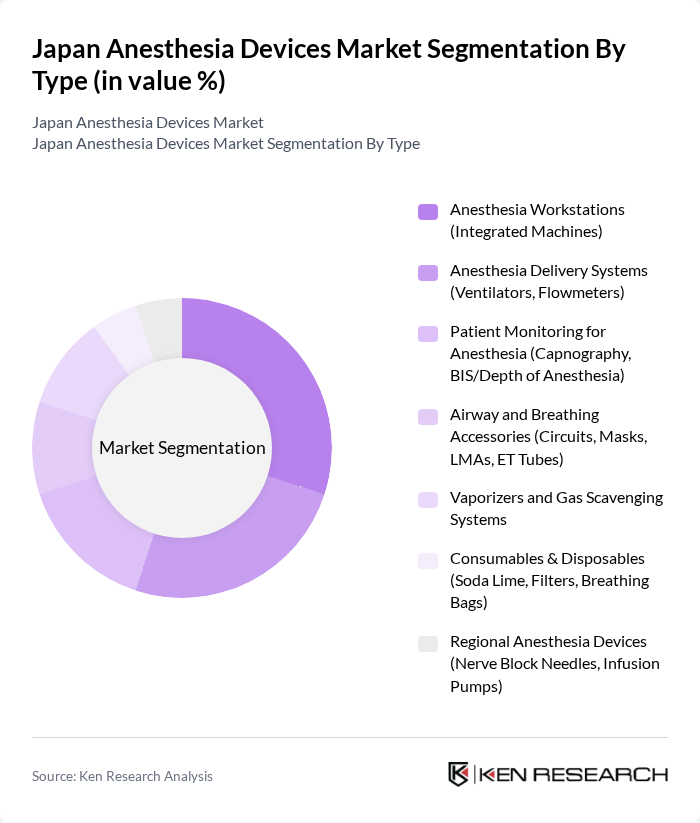

By Type:The market is segmented into various types of anesthesia devices, including anesthesia workstations, delivery systems, patient monitoring devices, airway accessories, vaporizers, consumables, and regional anesthesia devices. Among these, anesthesia workstations and delivery systems are particularly significant due to their essential role in ensuring effective anesthesia administration and patient safety during surgical procedures.

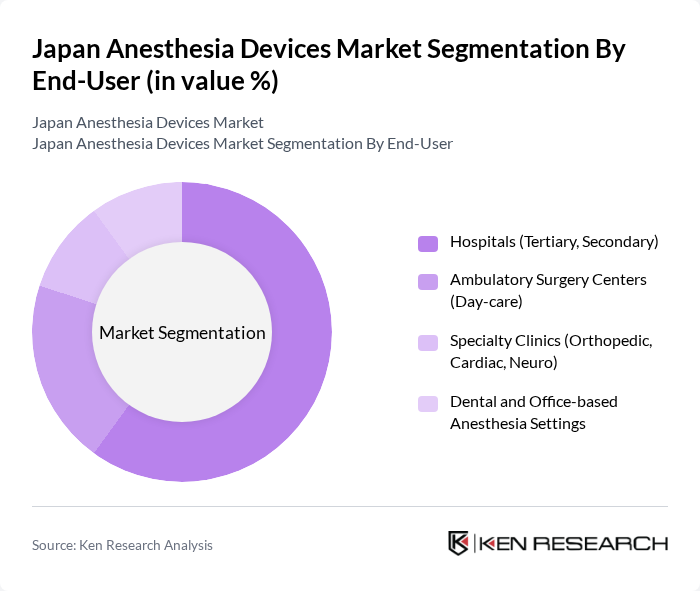

By End-User:The end-user segmentation includes hospitals, ambulatory surgery centers, specialty clinics, and dental settings. Hospitals, particularly tertiary and secondary care facilities, dominate the market due to high surgical volumes, comprehensive operating room fleets, and adoption of integrated anesthesia workstations with advanced monitoring.

The Japan Anesthesia Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Drägerwerk AG & Co. KGaA, GE HealthCare Technologies Inc., Mindray Medical International Limited, Nihon Kohden Corporation, Smiths Medical (ICU Medical, Inc.), Teleflex Incorporated, B. Braun Melsungen AG, Medtronic plc, Fisher & Paykel Healthcare Corporation Limited, Ambu A/S, Masimo Corporation, Fresenius Kabi AG, Fujifilm Healthcare Corporation, Canon Medical Systems Corporation, Olympus Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan anesthesia devices market appears promising, driven by ongoing technological innovations and a growing emphasis on patient safety. As the healthcare landscape evolves, the integration of artificial intelligence and telemedicine into anesthesia practices is expected to enhance efficiency and accessibility. Furthermore, the expansion of outpatient surgical centers will likely increase the demand for portable and user-friendly anesthesia devices, ensuring that patients receive high-quality care in diverse settings.

| Segment | Sub-Segments |

|---|---|

| By Type | Anesthesia Workstations (Integrated Machines) Anesthesia Delivery Systems (Ventilators, Flowmeters) Patient Monitoring for Anesthesia (Capnography, BIS/Depth of Anesthesia) Airway and Breathing Accessories (Circuits, Masks, LMAs, ET Tubes) Vaporizers and Gas Scavenging Systems Consumables & Disposables (Soda Lime, Filters, Breathing Bags) Regional Anesthesia Devices (Nerve Block Needles, Infusion Pumps) |

| By End-User | Hospitals (Tertiary, Secondary) Ambulatory Surgery Centers (Day-care) Specialty Clinics (Orthopedic, Cardiac, Neuro) Dental and Office-based Anesthesia Settings |

| By Application | General Surgery Orthopedic and Trauma Surgery Cardiothoracic and Vascular Surgery Neurosurgery Obstetrics & Gynecology ENT and Dental Procedures |

| By Distribution Channel | Direct Sales to Providers Authorized Distributors/Dealers E-Procurement/Online Tenders |

| By Region | Kanto Kansai Chubu Kyushu Tohoku Chugoku & Shikoku |

| By Price Range | Entry-Level/Value Devices Mid-Range Devices Premium/High-End Devices |

| By Policy Support | PMD Act Approvals & Fast-Track Designations Reimbursement Coverage (NHI Fee Schedule) Grants and R&D Programs (AMED, METI) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Anesthesia Machine Usage | 120 | Anesthesiologists, Hospital Administrators |

| Monitoring Devices in Surgery | 90 | Surgeons, Operating Room Managers |

| Disposable Anesthesia Supplies | 80 | Procurement Officers, Supply Chain Managers |

| Regional Market Insights | 100 | Healthcare Policy Makers, Medical Device Distributors |

| Technological Innovations in Anesthesia | 60 | Product Development Managers, Clinical Engineers |

The Japan Anesthesia Devices Market is valued at approximately USD 1.0 billion, driven by factors such as an increasing number of surgical procedures, an aging population, and advancements in anesthesia technology, particularly in workstations and monitoring systems.