Region:Global

Author(s):Geetanshi

Product Code:KRAA2349

Pages:83

Published On:August 2025

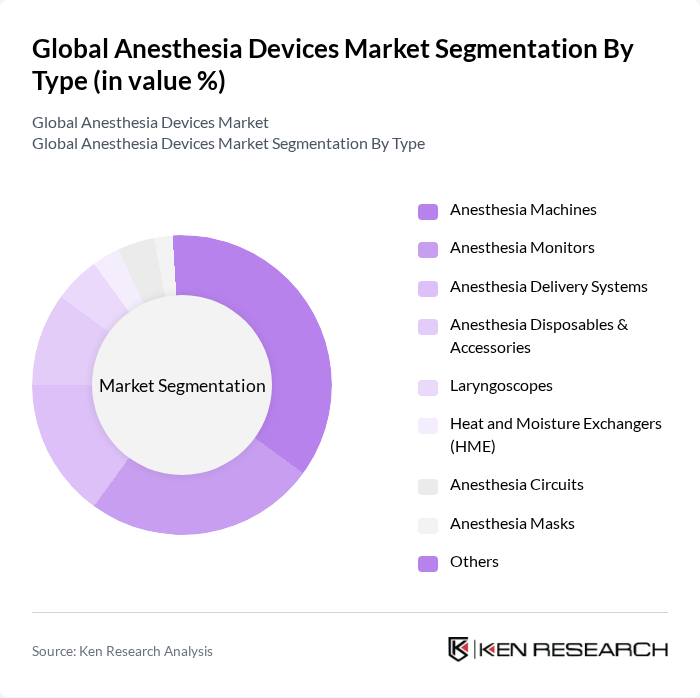

By Type:The anesthesia devices market is segmented into various types, including anesthesia machines, anesthesia monitors, anesthesia delivery systems, anesthesia disposables & accessories, laryngoscopes, heat and moisture exchangers (HME), anesthesia circuits, anesthesia masks, and others. Among these, anesthesia machines and monitors are the most significant contributors to market growth due to their essential role in surgical procedures and patient monitoring. The market is further propelled by the adoption of integrated anesthesia workstations and advanced monitoring technologies that improve perioperative safety and efficiency.

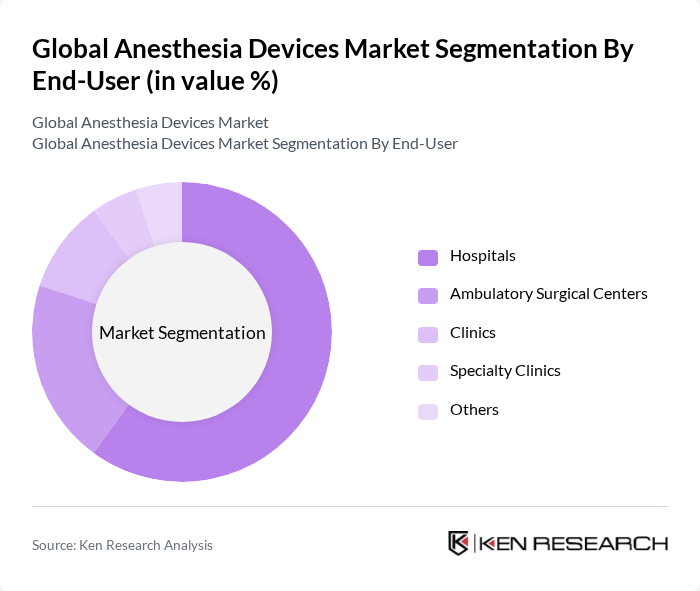

By End-User:The market is categorized by end-users, including hospitals, ambulatory surgical centers, clinics, specialty clinics, and others. Hospitals are the leading end-user segment, driven by the high volume of surgical procedures performed and the need for advanced anesthesia solutions to ensure patient safety and effective pain management. The increasing adoption of integrated anesthesia workstations and monitoring systems in hospitals further supports this dominance.

The Global Anesthesia Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic plc, GE Healthcare (General Electric Company), Philips Healthcare (Koninklijke Philips N.V.), Drägerwerk AG & Co. KGaA, Baxter International Inc., Smiths Medical (Smiths Group plc), Nihon Kohden Corporation, Hillrom (Baxter International Inc.), Mindray Medical International Limited, Fresenius Kabi AG, Getinge AB, Stryker Corporation, Olympus Corporation, Teleflex Incorporated, Ambu A/S, Masimo Corporation, B. Braun Melsungen AG, Mindray Bio-Medical Electronics Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the anesthesia devices market appears promising, driven by ongoing innovations and a growing emphasis on patient safety. As healthcare systems increasingly adopt minimally invasive surgical techniques, the demand for advanced anesthesia solutions will rise. Additionally, the integration of artificial intelligence and machine learning into anesthesia practices is expected to enhance monitoring and decision-making processes, further improving patient outcomes. These trends indicate a dynamic market landscape poised for significant advancements in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Anesthesia Machines Anesthesia Monitors Anesthesia Delivery Systems Anesthesia Disposables & Accessories Laryngoscopes Heat and Moisture Exchangers (HME) Anesthesia Circuits Anesthesia Masks Others |

| By End-User | Hospitals Ambulatory Surgical Centers Clinics Specialty Clinics Others |

| By Application | General Surgery Dental Surgery Orthopedic Surgery Cardiology Neurology Urology Ophthalmology Others |

| By Component | Hardware Software Services |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Price Range | Low Range Mid Range High Range |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Anesthesia Departments | 120 | Anesthesiologists, Nurse Anesthetists |

| Outpatient Surgery Centers | 80 | Surgeons, Facility Managers |

| Medical Device Distributors | 60 | Sales Managers, Product Specialists |

| Healthcare Procurement Officers | 50 | Procurement Directors, Supply Chain Managers |

| Clinical Research Organizations | 40 | Clinical Researchers, Regulatory Affairs Specialists |

The Global Anesthesia Devices Market is valued at approximately USD 17.5 billion, driven by factors such as the increasing prevalence of chronic diseases, a rise in surgical procedures, and advancements in anesthesia technology.