Region:Asia

Author(s):Shubham

Product Code:KRAD0792

Pages:100

Published On:August 2025

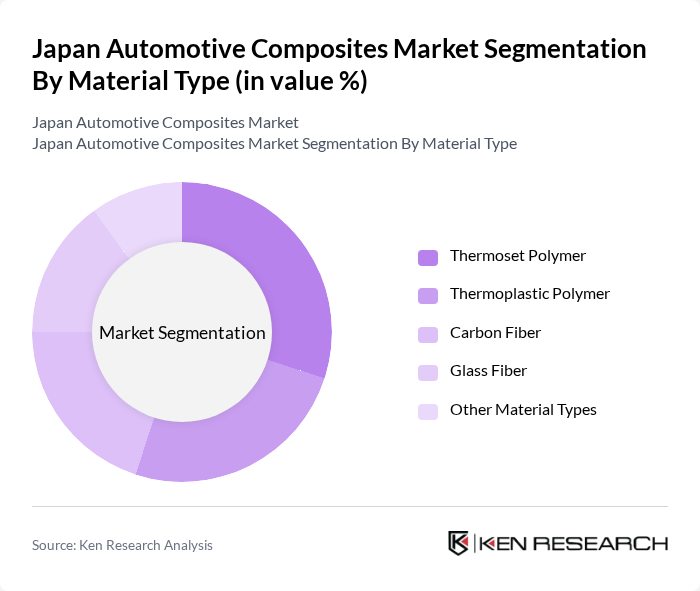

By Material Type:The market is segmented into various material types, including thermoset polymer, thermoplastic polymer, carbon fiber, glass fiber, and other material types. Among these, thermoset polymers are gaining traction due to their superior mechanical properties and thermal stability, making them ideal for high-performance automotive applications. The increasing focus on lightweight materials is driving the demand for carbon fiber, which is also witnessing significant growth due to its strength-to-weight ratio. Thermoplastic polymers are also experiencing robust growth, attributed to their cost-effectiveness and ease of processing, which supports mass production in the automotive sector .

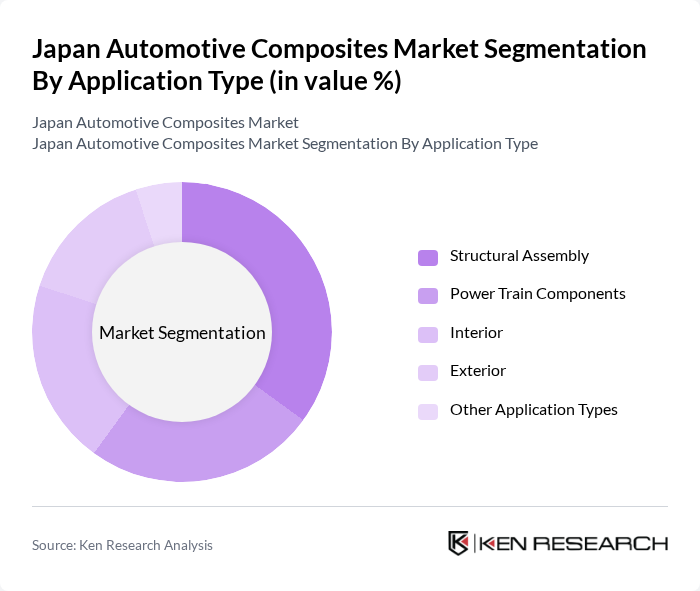

By Application Type:The application of composites in the automotive sector includes structural assembly, power train components, interior, exterior, and other application types. Structural assembly is the leading application due to the increasing need for lightweight and durable components that enhance vehicle performance and safety. The trend towards electric vehicles is also driving the demand for composites in power train components, as manufacturers seek to optimize weight and efficiency. Interior and exterior applications continue to expand as automakers leverage composites for improved design flexibility and enhanced passenger safety .

The Japan Automotive Composites Market is characterized by a dynamic mix of regional and international players. Leading participants such as Toray Industries, Inc., Mitsubishi Chemical Corporation, Teijin Limited, SGL Carbon SE, BASF SE, Owens Corning, Hexcel Corporation, Solvay S.A., Covestro AG, Jushi Group Co., Ltd., DuPont de Nemours, Inc., Huntsman Corporation, AOC, LLC, Mitsubishi Gas Chemical Company, Inc., Nippon Electric Glass Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Japan automotive composites market appears promising, driven by increasing investments in electric vehicle (EV) production and a growing emphasis on sustainability. As the government continues to support green technologies, manufacturers are likely to enhance their focus on lightweight composites to improve vehicle efficiency. Additionally, advancements in digital manufacturing processes will facilitate the integration of composites into mainstream automotive production, paving the way for innovative designs and enhanced performance in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Material Type | Thermoset Polymer Thermoplastic Polymer Carbon Fiber Glass Fiber Other Material Types |

| By Application Type | Structural Assembly Power Train Components Interior Exterior Other Application Types |

| By End-User | Passenger Vehicles Commercial Vehicles Electric Vehicles Luxury Vehicles Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Outlets Others |

| By Region | Kanto Region Kansai Region Chubu Region Northern Japan Southern Japan Others |

| By Price Range | Low Price Range Mid Price Range High Price Range Premium Price Range |

| By Material Source | Domestic Sourcing Imported Materials Recycled Materials Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Manufacturers | 100 | Product Development Managers, Materials Engineers |

| Commercial Vehicle Manufacturers | 80 | Procurement Managers, R&D Managers |

| Composite Material Suppliers | 60 | Sales Managers, Technical Support Engineers |

| Automotive Design Firms | 70 | Lead Designers, Innovation Managers |

| Regulatory Bodies and Associations | 40 | Policy Analysts, Industry Experts |

The Japan Automotive Composites Market is valued at approximately USD 1.6 billion, driven by the increasing demand for lightweight materials that enhance fuel efficiency and reduce emissions in the automotive sector.