Japan Blockchain in Fertilizer Supply Chains Market Overview

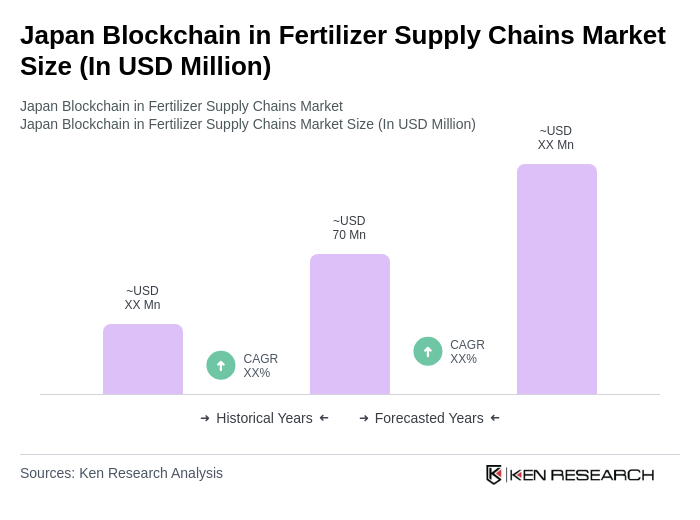

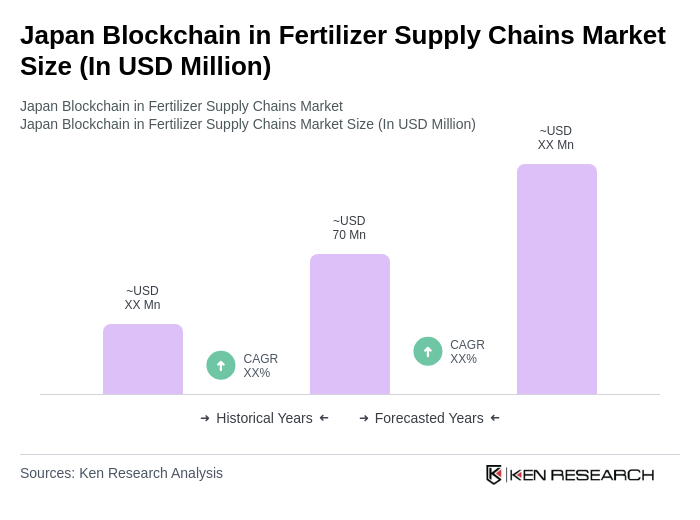

- The Japan Blockchain in Fertilizer Supply Chains Market is valued at USD 70 million, based on a five-year historical analysis. Growth is primarily driven by the increasing need for transparency and traceability in agricultural supply chains, as well as the rising adoption of digital technologies in the agriculture sector. Enhanced traceability, prevention of fraud, and improved supply chain efficiency are key benefits driving blockchain integration in fertilizer supply chains. Major corporations and government initiatives are accelerating adoption, with blockchain solutions increasingly seen as foundational for modernizing agricultural logistics and compliance tracking .

- Key regions dominating this market include Kanto and Kansai, primarily due to their robust agricultural infrastructure and technological advancements. Kanto, home to Tokyo, benefits from significant investments in technology and innovation, while Kansai has a strong agricultural base and is a hub for logistics and distribution, facilitating the adoption of blockchain solutions .

- The Act on the Protection of Personal Information (APPI), revised by the Personal Information Protection Commission in 2022, provides the regulatory framework for blockchain-based data sharing in agricultural supply chains. This regulation mandates strict data protection, interoperability standards, and compliance requirements for all stakeholders using digital platforms in fertilizer distribution and usage tracking .

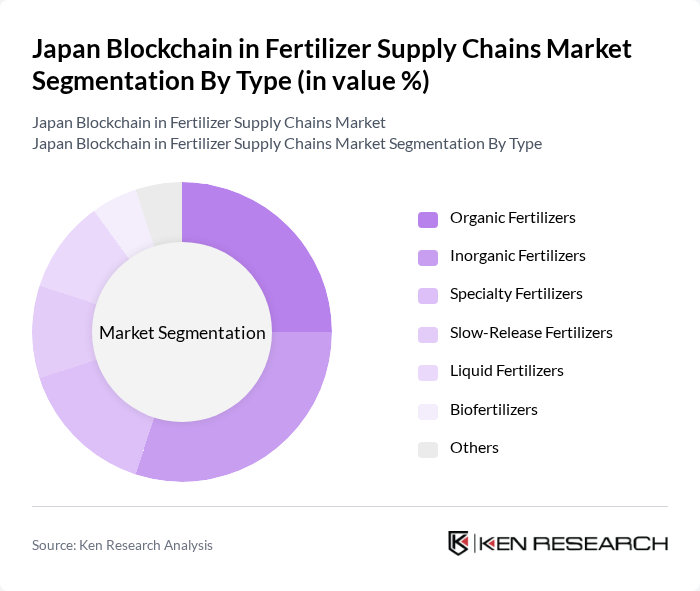

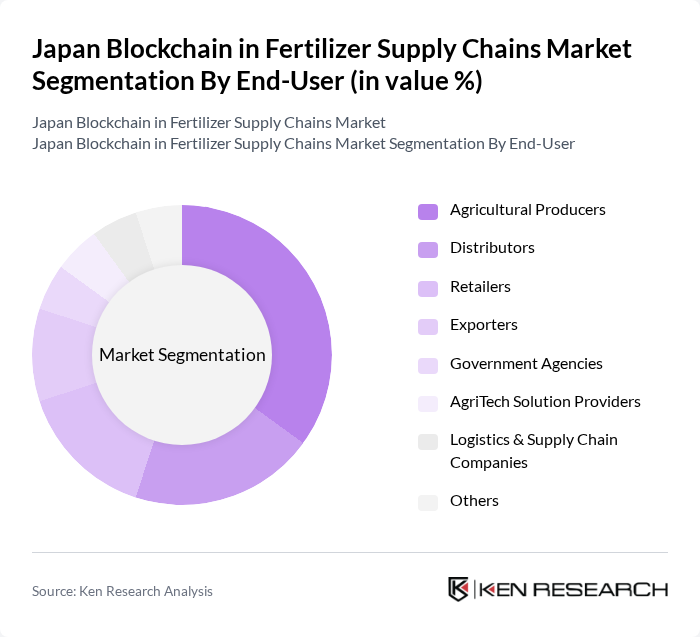

Japan Blockchain in Fertilizer Supply Chains Market Segmentation

By Type:The market is segmented into various types of fertilizers, including Organic Fertilizers, Inorganic Fertilizers, Specialty Fertilizers, Slow-Release Fertilizers, Liquid Fertilizers, Biofertilizers, and Others. Each type addresses specific agricultural needs and preferences, with blockchain solutions enabling improved traceability, quality assurance, and compliance monitoring across all fertilizer categories .

By End-User:The end-user segmentation includes Agricultural Producers, Distributors, Retailers, Exporters, Government Agencies, AgriTech Solution Providers, Logistics & Supply Chain Companies, and Others. Each segment plays a crucial role in the fertilizer supply chain, with blockchain adoption driven by the need for secure data exchange, regulatory compliance, and operational efficiency .

Japan Blockchain in Fertilizer Supply Chains Market Competitive Landscape

The Japan Blockchain in Fertilizer Supply Chains Market is characterized by a dynamic mix of regional and international players. Leading participants such as Yara International ASA, Nutrien Ltd., The Mosaic Company, CF Industries Holdings, Inc., Sumitomo Chemical Co., Ltd., ICL Group Ltd., K+S AG, Haifa Group, UPL Limited, OCP Group, EuroChem Group AG, Aglukon Spezialdünger GmbH, SQM S.A., Kisan Group, Agrium Inc., Mitsui & Co., Ltd., Fujitsu Limited, Hitachi, Ltd., VeChain Foundation, IBM Japan, Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

Japan Blockchain in Fertilizer Supply Chains Market Industry Analysis

Growth Drivers

- Increased Demand for Transparency:The Japanese agricultural sector is witnessing a significant push for transparency, with 80% of consumers expressing a preference for knowing the origin of their food products. This demand is driving the adoption of blockchain technology, which can provide immutable records of fertilizer sourcing and usage. The Ministry of Agriculture, Forestry and Fisheries (MAFF) reported that transparency initiatives could enhance consumer trust, potentially increasing market value by ¥350 billion in future.

- Enhanced Traceability of Fertilizer Products:The need for traceability in fertilizer supply chains is becoming critical, especially after incidents of contamination. In future, Japan's agricultural sector is expected to face losses exceeding ¥160 billion due to such issues. Blockchain technology offers a solution by enabling real-time tracking of fertilizer from production to application. This capability is expected to reduce losses and improve compliance with safety regulations, fostering a more resilient supply chain.

- Adoption of Sustainable Agricultural Practices:Japan's commitment to sustainable agriculture is evident, with the government aiming for a 35% reduction in chemical fertilizer use in future. Blockchain can facilitate this transition by providing data on fertilizer application and environmental impact. The Japan Agricultural Cooperatives (JA) reported that integrating blockchain could lead to a 25% increase in the adoption of eco-friendly practices, aligning with national sustainability goals and enhancing market competitiveness.

Market Challenges

- High Initial Implementation Costs:The adoption of blockchain technology in Japan's fertilizer supply chains faces significant barriers due to high initial costs. Implementing blockchain solutions can require investments ranging from ¥15 million to ¥60 million per company, depending on the scale. This financial burden is particularly challenging for small and medium-sized enterprises (SMEs), which constitute over 90% of the agricultural sector, potentially limiting widespread adoption and innovation.

- Lack of Standardization in Blockchain Solutions:The absence of standardized blockchain protocols poses a challenge for interoperability among different stakeholders in the fertilizer supply chain. Currently, over 65% of blockchain initiatives in agriculture operate on proprietary systems, leading to fragmented data and inefficiencies. This lack of cohesion can hinder collaboration and data sharing, ultimately affecting the overall effectiveness of blockchain applications in enhancing supply chain transparency and traceability.

Japan Blockchain in Fertilizer Supply Chains Market Future Outlook

The future of blockchain in Japan's fertilizer supply chains appears promising, driven by technological advancements and increasing regulatory support. As the government emphasizes digital transformation, more agricultural stakeholders are likely to adopt blockchain solutions. Additionally, the integration of artificial intelligence and machine learning with blockchain could enhance data analytics capabilities, leading to improved decision-making. This convergence of technologies is expected to foster innovation, streamline operations, and ultimately contribute to a more sustainable agricultural ecosystem in Japan.

Market Opportunities

- Integration with IoT for Smart Agriculture:The convergence of blockchain and Internet of Things (IoT) technologies presents a significant opportunity for enhancing fertilizer supply chains. By integrating IoT sensors with blockchain, real-time data on soil health and fertilizer application can be captured, leading to optimized usage. This synergy could potentially reduce fertilizer waste by up to 30%, significantly benefiting both farmers and the environment.

- Collaboration with Agricultural Tech Startups:Collaborating with agricultural tech startups can drive innovation in blockchain applications for fertilizer supply chains. Startups are often at the forefront of technological advancements, and partnerships could lead to the development of tailored solutions that address specific industry needs. Such collaborations could enhance efficiency and transparency, potentially increasing market competitiveness and attracting investment in the sector.