Region:Middle East

Author(s):Shubham

Product Code:KRAA8596

Pages:87

Published On:November 2025

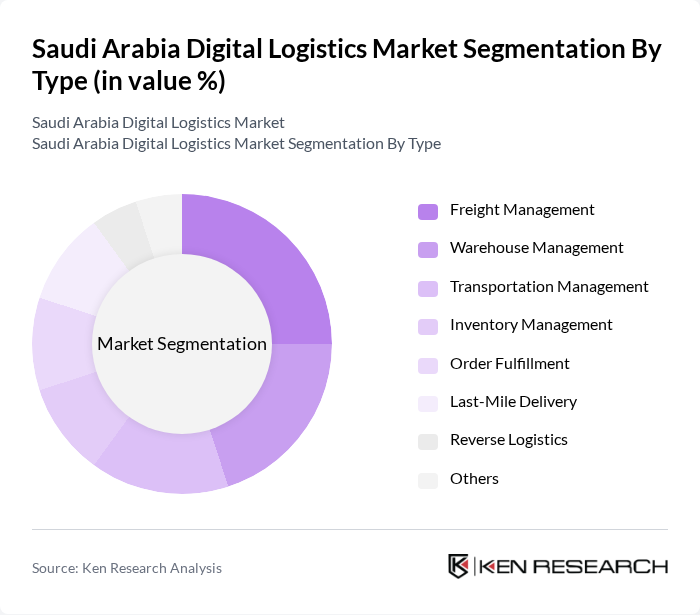

By Type:The market is segmented into various types, including Freight Management, Warehouse Management, Transportation Management, Inventory Management, Order Fulfillment, Last-Mile Delivery, Reverse Logistics, and Others. Each of these segments plays a crucial role in enhancing operational efficiency and meeting customer demands. Freight Management leads due to the increasing need for integrated transport solutions and real-time tracking, while Warehouse Management and Last-Mile Delivery are rapidly advancing with automation and smart technologies.

The Freight Management segment is currently leading the market due to the increasing demand for efficient transportation solutions and the rise of e-commerce. Companies are investing in advanced freight management systems to optimize their supply chains and reduce costs. The growing trend of just-in-time delivery and the need for real-time tracking are further propelling the growth of this segment. As businesses seek to enhance their logistics capabilities, Freight Management is expected to maintain its dominance.

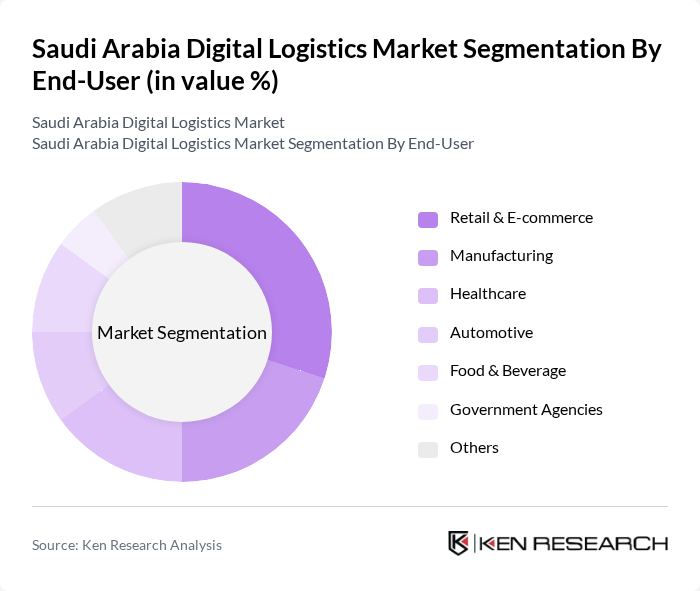

By End-User:The market is segmented by end-users, including Retail & E-commerce, Manufacturing, Healthcare, Automotive, Food & Beverage, Government Agencies, and Others. Each sector has unique logistics requirements that drive the demand for digital logistics solutions. Retail & E-commerce leads the market, supported by the rapid growth of online shopping, while Manufacturing and Healthcare are increasingly adopting digital logistics for supply chain optimization and regulatory compliance.

The Retail & E-commerce segment is the largest end-user in the market, driven by the exponential growth of online shopping and the need for efficient logistics solutions. The demand for fast and reliable delivery services has led retailers to adopt advanced logistics technologies. As consumer preferences shift towards online shopping, this segment is expected to continue its growth trajectory, making it a key player in the digital logistics landscape.

The Saudi Arabia Digital Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aramex, DHL Supply Chain, Agility Logistics, Saudi Post, Bahri (National Shipping Company of Saudi Arabia), Zajil Express, Shipa Delivery, FedEx, UPS, Kuehne + Nagel, DB Schenker, CEVA Logistics, Maersk Saudi Arabia Logistics, Naqel Express, DSV Panalpina contribute to innovation, geographic expansion, and service delivery in this space.

The future of the digital logistics market in Saudi Arabia appears promising, driven by ongoing technological advancements and government support. As e-commerce continues to expand, logistics companies are likely to adopt innovative solutions such as AI and IoT to enhance operational efficiency. Additionally, the push for sustainable practices will shape logistics strategies, with companies increasingly focusing on reducing their carbon footprint. Overall, the market is poised for significant transformation, aligning with global trends in logistics and supply chain management.

| Segment | Sub-Segments |

|---|---|

| By Type | Freight Management Warehouse Management Transportation Management Inventory Management Order Fulfillment Last-Mile Delivery Reverse Logistics Others |

| By End-User | Retail & E-commerce Manufacturing Healthcare Automotive Food & Beverage Government Agencies Others |

| By Service Type | Third-Party Logistics (3PL) Fourth-Party Logistics (4PL) Freight Brokerage Last-Mile Delivery Contract Logistics Others |

| By Technology | Cloud-based Solutions Mobile Applications AI and Machine Learning Internet of Things (IoT) Blockchain Robotics & Automation Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Customer Segment | Small and Medium Enterprises (SMEs) Large Enterprises Government Agencies Non-Governmental Organizations (NGOs) Others |

| By Policy Support | Subsidies for Digital Adoption Tax Incentives for Logistics Investments Grants for Technology Development Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Digital Logistics Solutions | 100 | Logistics Managers, E-commerce Directors |

| Manufacturing Supply Chain Optimization | 70 | Operations Managers, Supply Chain Analysts |

| Healthcare Logistics Management | 60 | Pharmaceutical Logistics Coordinators, Hospital Supply Chain Managers |

| Automotive Supply Chain Innovations | 50 | Procurement Managers, Logistics Directors |

| Technology Adoption in Logistics | 80 | IT Managers, Digital Transformation Officers |

The Saudi Arabia Digital Logistics Market is valued at approximately USD 430 million, driven by the rapid adoption of digital technologies, increased e-commerce activities, and government initiatives aimed at enhancing logistics efficiency and digital transformation.