Region:Asia

Author(s):Geetanshi

Product Code:KRAA6787

Pages:93

Published On:September 2025

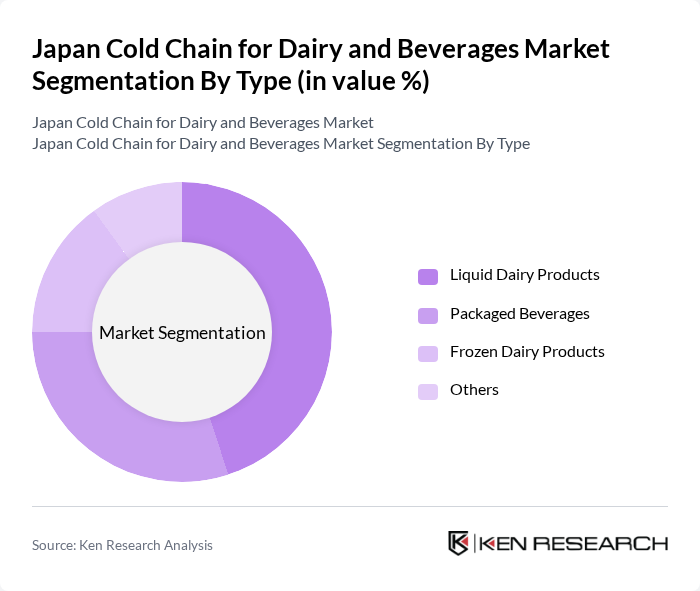

By Type:The market is segmented into various types, including Liquid Dairy Products, Packaged Beverages, Frozen Dairy Products, and Others. Among these, Liquid Dairy Products dominate the market due to their high consumption rates and the growing trend of health-conscious consumers opting for fresh milk and yogurt. Packaged Beverages also hold a significant share, driven by the increasing demand for ready-to-drink options. The Frozen Dairy Products segment is gaining traction as well, particularly in the dessert category.

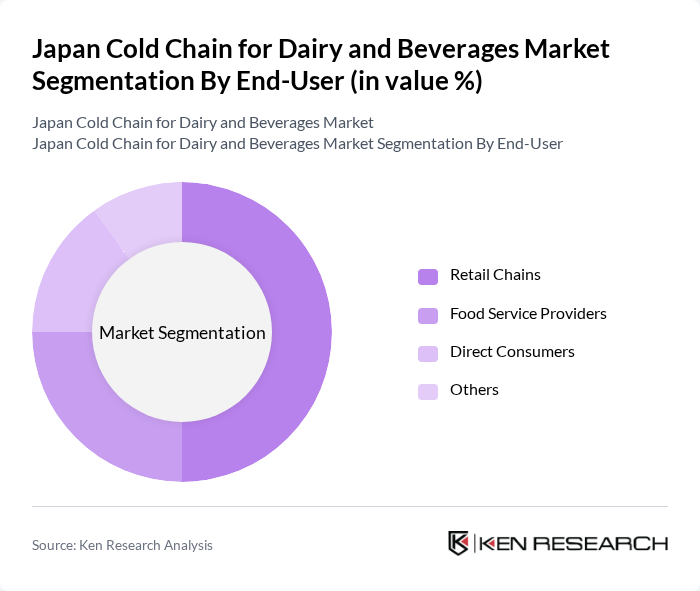

By End-User:The end-user segmentation includes Retail Chains, Food Service Providers, Direct Consumers, and Others. Retail Chains are the leading segment, driven by the increasing number of supermarkets and convenience stores that require efficient cold chain solutions for dairy and beverage products. Food Service Providers also represent a significant portion of the market, as restaurants and cafes demand high-quality perishable goods. Direct Consumers are increasingly purchasing dairy and beverages online, contributing to the growth of this segment.

The Japan Cold Chain for Dairy and Beverages Market is characterized by a dynamic mix of regional and international players. Leading participants such as Meiji Holdings Co., Ltd., Morinaga Milk Industry Co., Ltd., Yakult Honsha Co., Ltd., Asahi Group Holdings, Ltd., Kirin Holdings Company, Limited, Sapporo Holdings Limited, Coca-Cola Bottlers Japan Holdings Inc., Suntory Beverage & Food Limited, Ajinomoto Co., Inc., Nippon Dairy Industry Co., Ltd., Otsuka Pharmaceutical Co., Ltd., Takara Holdings Inc., Nissin Foods Holdings Co., Ltd., Kikkoman Corporation, House Foods Group Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cold chain for dairy and beverages in Japan appears promising, driven by technological innovations and evolving consumer preferences. As the market adapts to the increasing demand for fresh and organic products, investments in smart logistics solutions will enhance efficiency and sustainability. Furthermore, the integration of IoT technologies will facilitate real-time monitoring, ensuring product quality. These trends indicate a robust growth trajectory, positioning the market for significant advancements in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Liquid Dairy Products Packaged Beverages Frozen Dairy Products Others |

| By End-User | Retail Chains Food Service Providers Direct Consumers Others |

| By Distribution Channel | Online Retail Supermarkets Convenience Stores Others |

| By Packaging Type | Bottles Cartons Tetra Packs Others |

| By Temperature Control | Chilled Frozen Ambient Others |

| By Product Origin | Domestic Imported Others |

| By Price Range | Premium Mid-Range Budget Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dairy Product Distribution | 150 | Logistics Managers, Supply Chain Analysts |

| Beverage Cold Chain Management | 100 | Operations Directors, Warehouse Supervisors |

| Retail Cold Storage Solutions | 80 | Store Managers, Inventory Control Specialists |

| Food Safety Compliance in Cold Chain | 70 | Quality Assurance Managers, Regulatory Affairs Officers |

| Technological Innovations in Cold Chain | 90 | IT Managers, R&D Specialists |

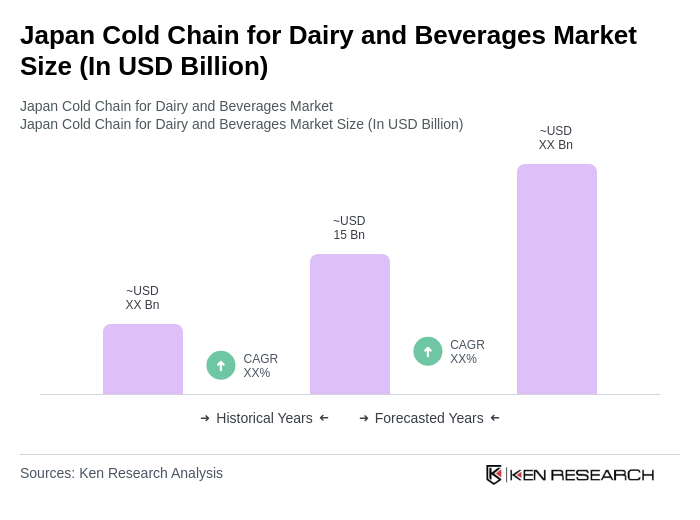

The Japan Cold Chain for Dairy and Beverages Market is valued at approximately USD 15 billion, reflecting a significant growth driven by the increasing demand for perishable goods and advancements in cold chain logistics and technology.