Region:Europe

Author(s):Dev

Product Code:KRAB2086

Pages:89

Published On:October 2025

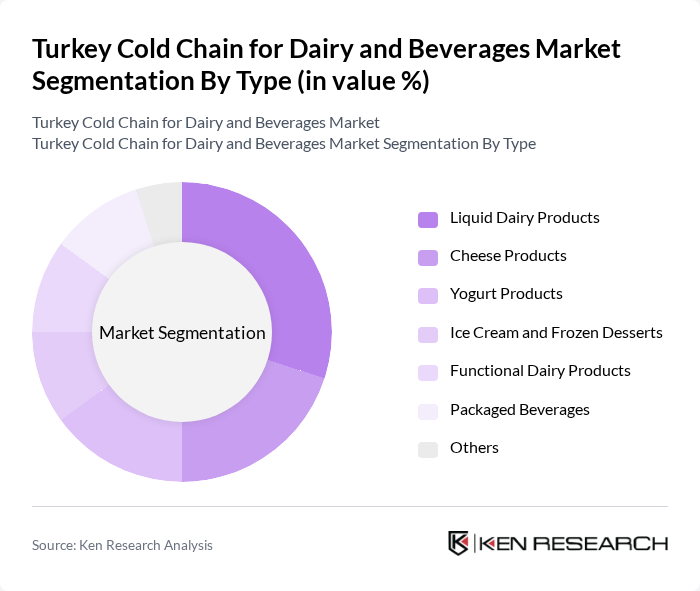

By Type:The market is segmented into Liquid Dairy Products, Cheese Products, Yogurt Products, Ice Cream and Frozen Desserts, Functional Dairy Products, Packaged Beverages, and Others. Liquid Dairy Products and Packaged Beverages are the leading segments, driven by high consumption rates and the growing trend of on-the-go and health-oriented products. Cheese and yogurt products are also experiencing increased demand due to their nutritional benefits and popularity in Turkish cuisine. Functional dairy products are gaining traction as consumers become more health-conscious and seek added-value products such as probiotics and fortified options.

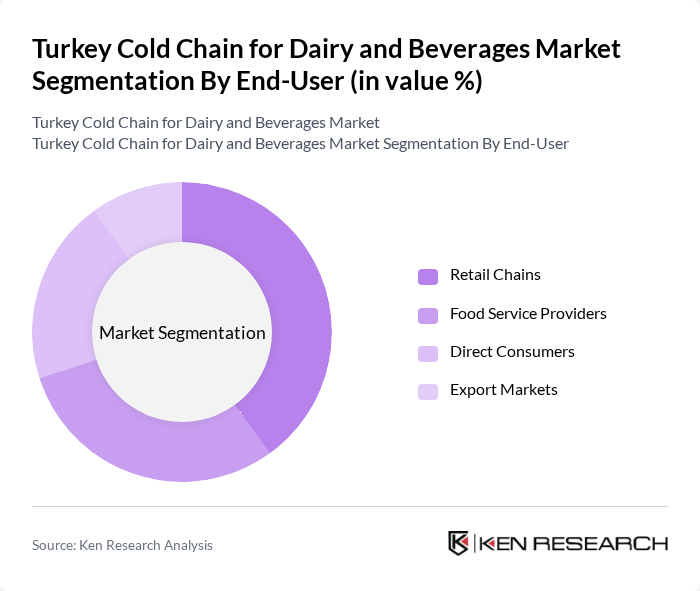

By End-User:The end-user segmentation includes Retail Chains, Food Service Providers, Direct Consumers, and Export Markets. Retail Chains are the dominant segment, supported by the proliferation of supermarkets and hypermarkets across Turkey. Food Service Providers are significant contributors, driven by the rising demand for dairy and beverage products in restaurants, cafes, and hospitality venues. Direct Consumers are becoming increasingly important due to the expansion of e-commerce and home delivery services, while Export Markets benefit from Turkey’s strategic location and robust agricultural production.

The Turkey Cold Chain for Dairy and Beverages Market features a dynamic mix of regional and international players. Leading participants such as P?nar Süt Mamulleri Sanayi A.?., Yörsan Süt ve Süt Ürünleri Sanayi A.?., Süta? Süt ve Besi Çiftlikleri A.?., TAT G?da Sanayi A.?., Danone Türkiye, Nestlé Türkiye, Coca-Cola ?çecek A.?., Anadolu Efes Birac?l?k ve Malt Sanayi A.?., Uluda? ?çecek Türk A.?., Ak G?da Sanayi ve Ticaret A.?., Eker Süt Ürünleri G?da Sanayi ve Ticaret A.?., Ülker Bisküvi Sanayi A.?., B?M Birle?ik Ma?azalar A.?., Metro Cash & Carry Türkiye, CarrefourSA, Migros Ticaret A.?., Tetra Pak Türkiye, Arçelik A.?., Sütçüo?lu Süt ve Süt Ürünleri A.?., and PepsiCo Türkiye contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Turkey cold chain for dairy and beverages market appears promising, driven by technological advancements and increasing consumer demand for quality products. The integration of IoT technologies is expected to enhance monitoring and efficiency in cold chain operations. Additionally, the growing trend towards organic and health-conscious products will likely spur further investments in cold chain logistics, ensuring that fresh dairy products meet consumer expectations for quality and safety.

| Segment | Sub-Segments |

|---|---|

| By Type | Liquid Dairy Products Cheese Products Yogurt Products Ice Cream and Frozen Desserts Functional Dairy Products Packaged Beverages Others |

| By End-User | Retail Chains Food Service Providers Direct Consumers Export Markets |

| By Distribution Channel | Supermarkets and Hypermarkets Convenience Stores Online Retail Wholesale Distributors |

| By Packaging Type | Bottles Tetra Packs Cans Pouches |

| By Temperature Control | Chilled Frozen Ambient |

| By Product Origin | Domestic Products Imported Products |

| By Price Range | Premium Mid-Range Economy |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dairy Product Distribution | 100 | Logistics Managers, Supply Chain Coordinators |

| Beverage Cold Chain Operations | 80 | Operations Managers, Warehouse Supervisors |

| Retail Cold Storage Facilities | 70 | Facility Managers, Inventory Control Specialists |

| Food Safety Compliance in Cold Chain | 60 | Quality Assurance Managers, Regulatory Affairs Officers |

| Technological Innovations in Cold Chain | 40 | IT Managers, R&D Directors |

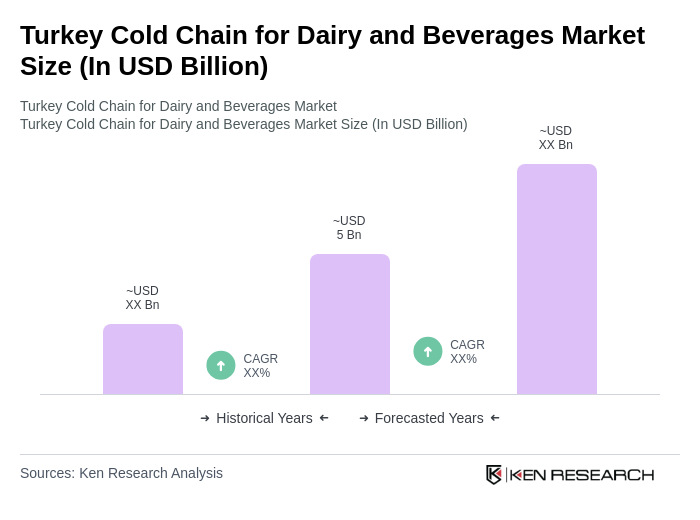

The Turkey Cold Chain for Dairy and Beverages Market is valued at approximately USD 5 billion, reflecting a robust growth driven by increasing consumer demand for fresh dairy products and beverages, along with advancements in cold chain logistics technology.