Region:Asia

Author(s):Geetanshi

Product Code:KRAA0139

Pages:97

Published On:August 2025

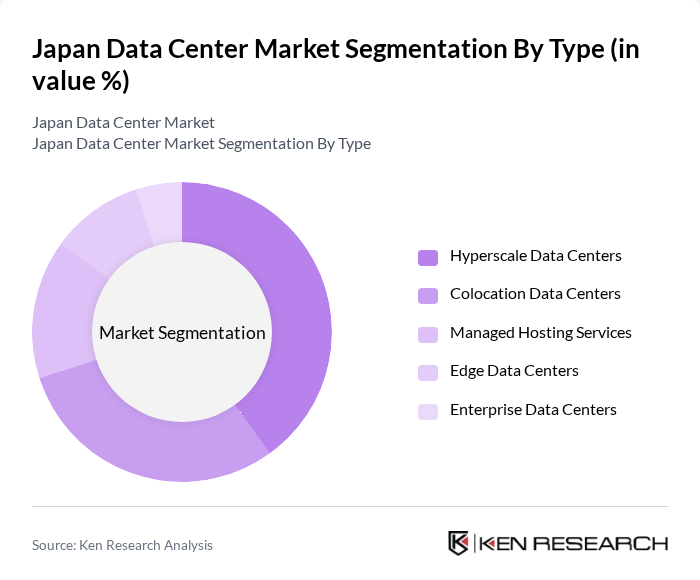

By Type:The market is segmented into various types, including Hyperscale Data Centers, Colocation Data Centers, Managed Hosting Services, Edge Data Centers, and Enterprise Data Centers. Hyperscale Data Centers are gaining traction due to their ability to scale rapidly and efficiently, catering to large enterprises and cloud service providers. Colocation Data Centers are also popular as they offer businesses the flexibility to rent space and resources without the need for significant capital investment.

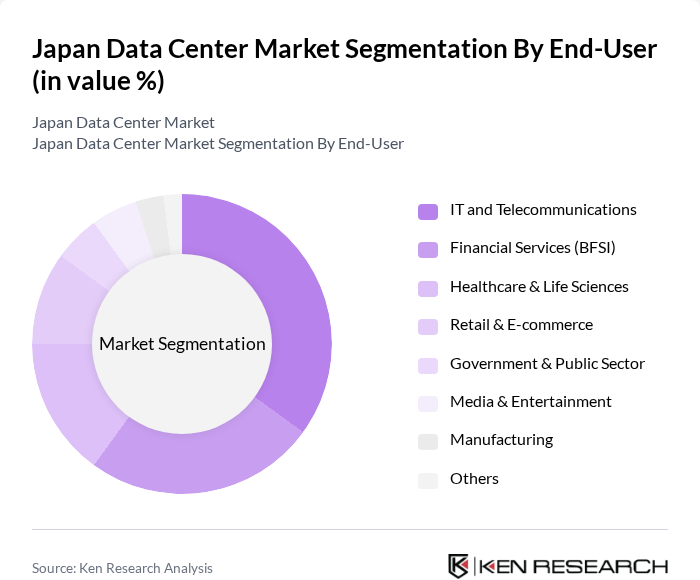

By End-User:The end-user segmentation includes IT and Telecommunications, Financial Services (BFSI), Healthcare & Life Sciences, Retail & E-commerce, Government & Public Sector, Media & Entertainment, Manufacturing, and Others. The IT and Telecommunications sector is the largest end-user, driven by the increasing demand for cloud services and data storage solutions. The BFSI sector follows closely, as financial institutions require robust data management and security solutions.

The Japan Data Center Market is characterized by a dynamic mix of regional and international players. Leading participants such as NTT Communications, Equinix, Digital Realty, Colt Data Centre Services, Fujitsu, NEC Corporation, SoftBank Corp., KDDI Corporation, MC Digital Realty, Hitachi, SCSK Corporation, GMO Internet Group, IIJ (Internet Initiative Japan), DMM.com, Sakura Internet, Amazon Web Services Japan, Microsoft Japan, Google Japan contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan data center market appears promising, driven by technological advancements and increasing digitalization. As businesses continue to embrace cloud solutions and IoT applications, data centers will need to adapt to evolving demands. The integration of AI and machine learning technologies is expected to enhance operational efficiencies, while investments in renewable energy sources will address sustainability concerns. Overall, the market is poised for significant transformation, with a focus on innovation and resilience in the face of challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Hyperscale Data Centers Colocation Data Centers Managed Hosting Services Edge Data Centers Enterprise Data Centers |

| By End-User | IT and Telecommunications Financial Services (BFSI) Healthcare & Life Sciences Retail & E-commerce Government & Public Sector Media & Entertainment Manufacturing Others |

| By Industry Vertical | BFSI Government Education Manufacturing Media & Entertainment Healthcare Others |

| By Service Type | Infrastructure as a Service (IaaS) Platform as a Service (PaaS) Software as a Service (SaaS) Disaster Recovery as a Service (DRaaS) Colocation Services Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid Others |

| By Geographic Region | Kanto (Tokyo, Yokohama) Kansai (Osaka, Kyoto) Chubu (Nagoya) Kyushu Hokkaido Others |

| By Energy Source | Renewable Energy Non-Renewable Energy Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Colocation Services | 100 | Data Center Managers, IT Directors |

| Cloud Services Adoption | 80 | Cloud Architects, CIOs |

| Managed Services Insights | 70 | Operations Managers, Service Delivery Heads |

| Data Center Infrastructure Trends | 90 | Facility Managers, Infrastructure Engineers |

| Regulatory Compliance in Data Centers | 60 | Compliance Officers, Risk Management Executives |

The Japan Data Center Market is valued at approximately USD 18 billion, driven by increasing demand for cloud services, big data analytics, and digital transformation initiatives across various sectors.