Region:Asia

Author(s):Dev

Product Code:KRAB6022

Pages:95

Published On:October 2025

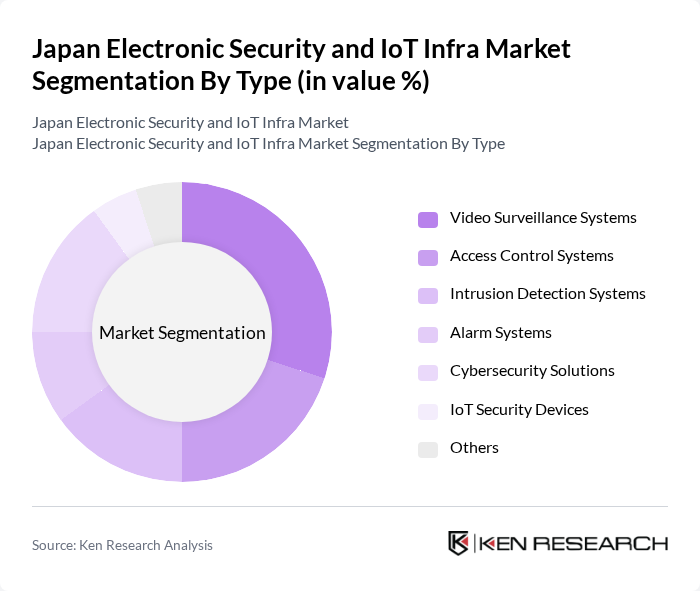

By Type:The market is segmented into various types, including Video Surveillance Systems, Access Control Systems, Intrusion Detection Systems, Alarm Systems, Cybersecurity Solutions, IoT Security Devices, and Others. Among these, Video Surveillance Systems and Cybersecurity Solutions are particularly prominent due to the increasing focus on safety and data protection in both public and private sectors. The demand for these solutions is driven by technological advancements and the need for comprehensive security measures.

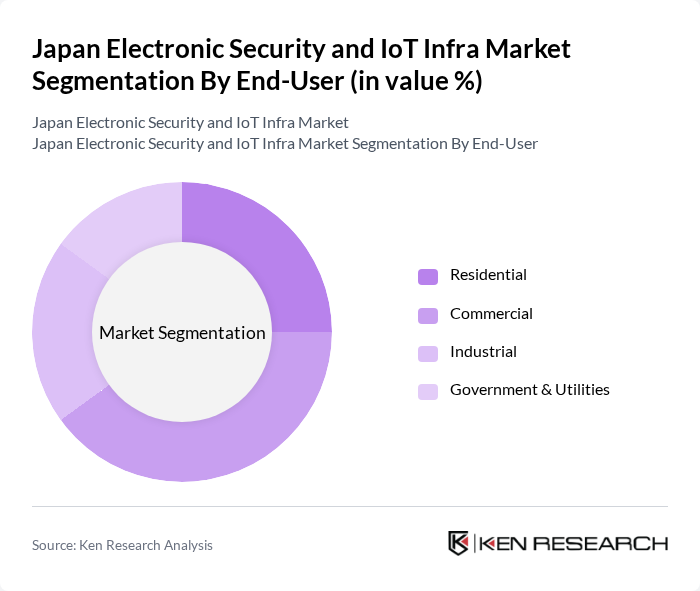

By End-User:The market is categorized into Residential, Commercial, Industrial, and Government & Utilities. The Commercial segment is leading due to the increasing need for security in businesses and public spaces, driven by rising crime rates and the need for asset protection. Additionally, the Industrial sector is witnessing growth as manufacturers adopt advanced security measures to protect their facilities and sensitive information.

The Japan Electronic Security and IoT Infra Market is characterized by a dynamic mix of regional and international players. Leading participants such as NEC Corporation, Hitachi, Ltd., Panasonic Corporation, Fujitsu Limited, Sony Corporation, Canon Inc., NTT Security Corporation, Secom Co., Ltd., ADT Security Services, Tyco International plc, Hikvision Digital Technology Co., Ltd., Dahua Technology Co., Ltd., Axis Communications AB, Genetec Inc., Johnson Controls International plc contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan Electronic Security and IoT Infra market appears promising, driven by technological advancements and increasing regulatory support. As businesses continue to prioritize cybersecurity, the integration of AI and machine learning into security systems is expected to enhance threat detection capabilities. Additionally, the shift towards cloud-based solutions will facilitate scalability and flexibility, allowing organizations to adapt to evolving security needs while ensuring compliance with stringent regulations.

| Segment | Sub-Segments |

|---|---|

| By Type | Video Surveillance Systems Access Control Systems Intrusion Detection Systems Alarm Systems Cybersecurity Solutions IoT Security Devices Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Home Automation Smart Buildings Public Safety Transportation Security |

| By Component | Hardware Software Services |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Distribution Mode | Retail Wholesale E-commerce |

| By Price Range | Low-End Mid-Range High-End |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Cybersecurity Strategies | 100 | Chief Information Security Officers, IT Security Managers |

| IoT Device Security Implementation | 80 | IoT Solution Architects, Product Managers |

| Surveillance System Adoption | 70 | Facility Managers, Security Directors |

| Access Control Systems Usage | 60 | Operations Managers, Security Consultants |

| Smart City Security Initiatives | 90 | Urban Planners, Government Officials |

The Japan Electronic Security and IoT Infra Market is valued at approximately USD 15 billion, driven by the increasing demand for advanced security solutions and the rapid adoption of IoT technologies across various sectors, including residential, commercial, and industrial applications.