Region:Asia

Author(s):Geetanshi

Product Code:KRAB0109

Pages:95

Published On:August 2025

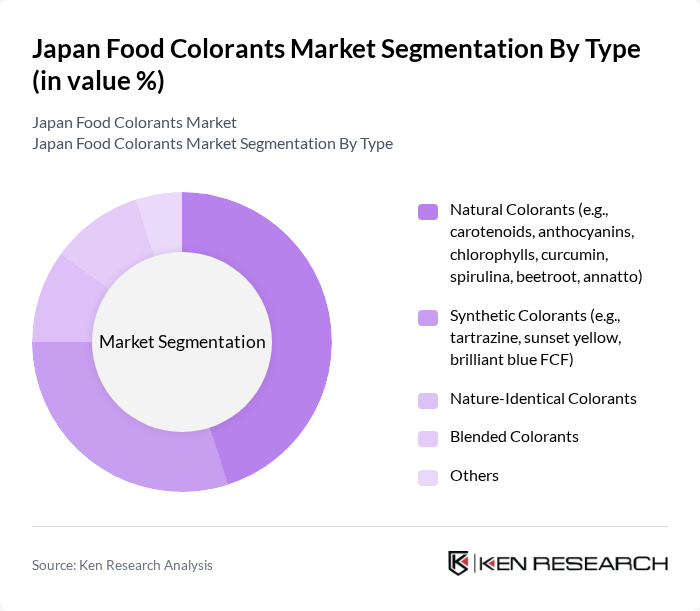

By Type:The food colorants market in Japan is segmented into natural colorants, synthetic colorants, nature-identical colorants, blended colorants, and others. Natural colorants, such as carotenoids and anthocyanins, are gaining popularity due to increasing consumer preference for clean-label and plant-based products. Synthetic colorants remain widely used because of their cost-effectiveness and stability, but face growing scrutiny due to health and safety concerns. The market is also witnessing growth in blended colorants, which combine the benefits of both natural and synthetic options to meet diverse formulation needs and regulatory requirements .

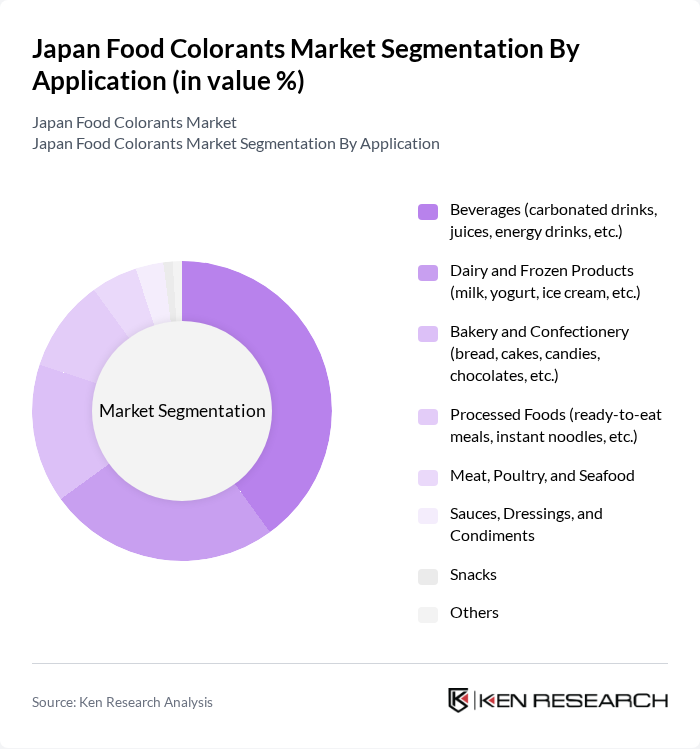

By Application:Food colorants in Japan are used across a diverse range of applications, including beverages, dairy and frozen products, bakery and confectionery, processed foods, meat, poultry, seafood, sauces, dressings, condiments, snacks, and others. The beverage segment is the largest consumer of food colorants, driven by the demand for visually appealing drinks and the popularity of convenience beverages. Dairy and frozen products also utilize colorants to enhance product appeal, while the bakery and confectionery segment is increasingly adopting natural colorants to align with consumer preferences for healthier and more transparent ingredient lists .

The Japan Food Colorants Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ajinomoto Co., Inc., DIC Corporation, San-Ei Gen F.F.I., Inc., Maruzen Chemicals Co., Ltd., Sensient Technologies Corporation, Chr. Hansen Holding A/S, Givaudan SA, DSM-Firmenich AG, Kalsec Inc., Naturex S.A. (a Givaudan company), Archer Daniels Midland Company, BASF SE, Roquette Frères, Kikkoman Corporation, and Takasago International Corporation contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Japan food colorants market appears promising, driven by the increasing consumer preference for natural ingredients and the expansion of the food and beverage sector. Innovations in colorant applications are expected to enhance product offerings, while collaborations with food manufacturers will facilitate the integration of natural colorants into a wider range of products. Additionally, the ongoing trend towards clean label products will further propel the demand for natural colorants, ensuring sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Natural Colorants (e.g., carotenoids, anthocyanins, chlorophylls, curcumin, spirulina, beetroot, annatto) Synthetic Colorants (e.g., tartrazine, sunset yellow, brilliant blue FCF) Nature-Identical Colorants Blended Colorants Others |

| By Application | Beverages (carbonated drinks, juices, energy drinks, etc.) Dairy and Frozen Products (milk, yogurt, ice cream, etc.) Bakery and Confectionery (bread, cakes, candies, chocolates, etc.) Processed Foods (ready-to-eat meals, instant noodles, etc.) Meat, Poultry, and Seafood Sauces, Dressings, and Condiments Snacks Others |

| By End-User | Food Manufacturers Beverage Producers Confectionery Companies Dairy Producers Food Service Providers Others |

| By Distribution Channel | Direct Sales Online Retail Supermarkets/Hypermarkets Specialty Stores Wholesale Distributors Others |

| By Formulation | Liquid Colorants Powder Colorants Gel Colorants Paste Colorants Others |

| By Packaging Type | Bottles Pouches Bulk Containers Sachets Others |

| By Price Range | Economy Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Manufacturers | 120 | Production Managers, Quality Assurance Officers |

| Food Colorant Suppliers | 60 | Sales Directors, Product Managers |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| Research Institutions | 50 | Food Scientists, Academic Researchers |

| Retail Sector Insights | 50 | Category Managers, Marketing Executives |

The Japan Food Colorants Market is valued at approximately USD 225 million, reflecting a significant demand for both natural and synthetic colorants across various food and beverage applications, driven by consumer preferences for aesthetics and quality.