Region:Asia

Author(s):Geetanshi

Product Code:KRAC9354

Pages:81

Published On:November 2025

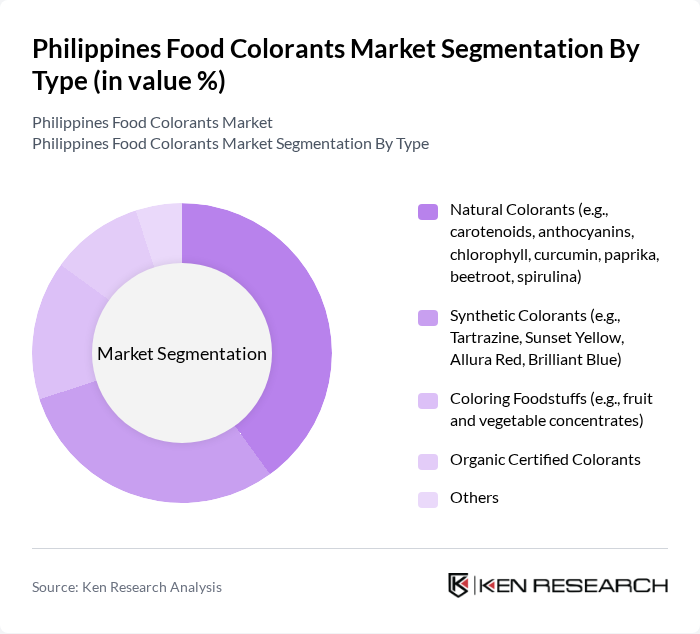

By Type:The market is segmented into various types of colorants, including natural, synthetic, coloring foodstuffs, organic certified colorants, and others. Each type serves different consumer preferences and regulatory requirements.

The natural colorants segment is currently dominating the market due to the increasing consumer preference for clean-label products and the rising awareness of health benefits associated with natural ingredients. Products like beetroot and spirulina are gaining traction as they are perceived as healthier alternatives to synthetic options. Additionally, the trend towards organic and natural food products is driving the demand for natural colorants, making them a preferred choice among food manufacturers. Carotenoids, anthocyanins, and chlorophyll are the most widely used natural colorants, favored for their stability and health benefits .

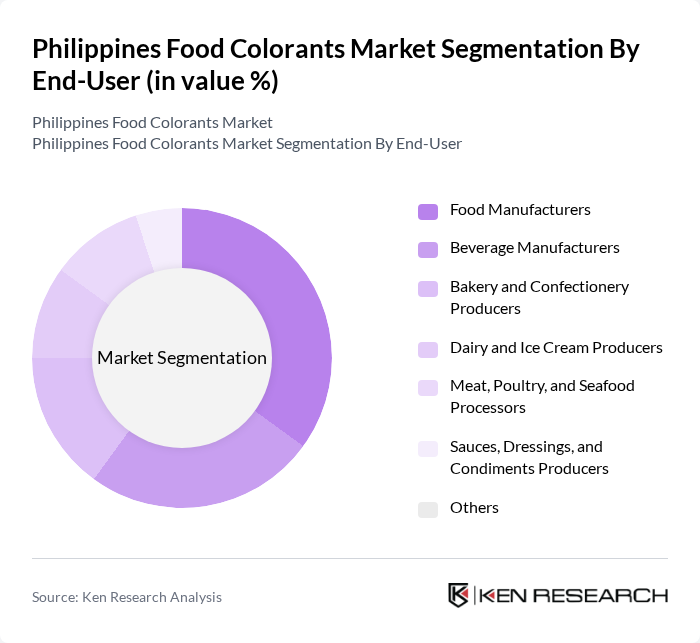

By End-User:The market is segmented based on end-users, including food manufacturers, beverage manufacturers, bakery and confectionery producers, dairy and ice cream producers, meat, poultry, and seafood processors, sauces, dressings, and condiments producers, and others. Each segment has unique requirements and applications for food colorants.

The food manufacturers segment leads the market due to the high volume of colorants required for various processed food products. The increasing demand for visually appealing food products, along with the trend of product innovation in the food sector, drives the need for diverse colorant options. Additionally, the beverage industry is also a significant contributor, as colorful drinks attract consumers and enhance brand identity. The bakery and confectionery segment is also expanding, fueled by product innovation and consumer demand for vibrant, attractive goods .

The Philippines Food Colorants Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sensient Technologies Corporation, D.D. Williamson & Co., Inc. (DDW, The Color House), Chr. Hansen Holding A/S, Naturex S.A. (a Givaudan company), GNT Group B.V., BASF SE, Archer Daniels Midland Company (ADM), Kalsec Inc., Roha Dyechem Pvt. Ltd., Allied Biotech Corporation, DIC Corporation, San-Ei Gen F.F.I., Inc., Guangzhou Leader Bio-Technology Co., Ltd., MC Food Specialties Inc. (Mitsubishi Corporation Group), PT. Mega Suryamas (regional distributor active in Southeast Asia) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Philippines food colorants market appears promising, driven by the increasing consumer preference for natural ingredients and sustainable practices. As the food and beverage sector continues to expand, manufacturers are likely to invest in innovative colorant technologies that align with health trends. Additionally, the growing emphasis on clean label products will further encourage the adoption of natural colorants, fostering a competitive landscape that prioritizes quality and transparency in food production.

| Segment | Sub-Segments |

|---|---|

| By Type | Natural Colorants (e.g., carotenoids, anthocyanins, chlorophyll, curcumin, paprika, beetroot, spirulina) Synthetic Colorants (e.g., Tartrazine, Sunset Yellow, Allura Red, Brilliant Blue) Coloring Foodstuffs (e.g., fruit and vegetable concentrates) Organic Certified Colorants Others |

| By End-User | Food Manufacturers Beverage Manufacturers Bakery and Confectionery Producers Dairy and Ice Cream Producers Meat, Poultry, and Seafood Processors Sauces, Dressings, and Condiments Producers Others |

| By Application | Beverages (carbonated drinks, juices, energy drinks) Snacks (chips, extruded snacks) Processed Foods (ready meals, canned foods) Bakery and Confectionery (cakes, candies, chocolates) Dairy Products (yogurt, flavored milk, ice cream) Meat, Poultry, and Seafood Products Sauces and Dressings Others |

| By Distribution Channel | Direct Sales (B2B) Distributors/Wholesalers Online Retail Supermarkets and Hypermarkets Specialty Stores Others |

| By Region | Luzon Visayas Mindanao Others |

| By Product Form | Liquid Colorants Powdered Colorants Gel Colorants Emulsions and Pastes Others |

| By Regulatory Compliance | FDA Approved Colorants Halal Certified Colorants Organic Certified Colorants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Manufacturers | 100 | Production Managers, Quality Assurance Officers |

| Retail Sector Insights | 60 | Category Managers, Purchasing Agents |

| Food Colorant Suppliers | 40 | Sales Directors, Product Development Managers |

| Consumer Preferences | 90 | General Consumers, Health-Conscious Shoppers |

| Regulatory Bodies and Associations | 40 | Regulatory Affairs Specialists, Policy Makers |

The Philippines Food Colorants Market is valued at approximately USD 124 million, reflecting a significant growth trend driven by the increasing demand for both natural and synthetic colorants in the food and beverage industry.