Region:Asia

Author(s):Shubham

Product Code:KRAC0800

Pages:88

Published On:August 2025

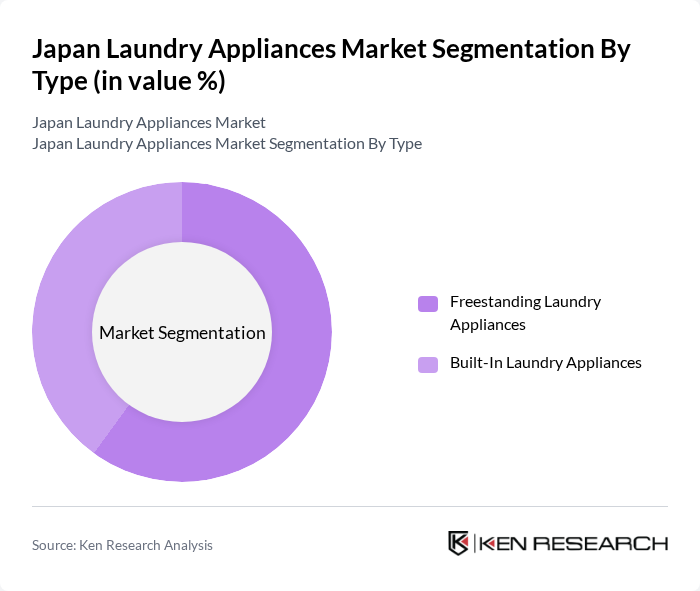

By Type:The market is segmented into Freestanding Laundry Appliances and Built-In Laundry Appliances. Freestanding appliances are popular due to their flexibility and ease of installation, while built-in options cater to consumers seeking space-saving solutions in modern homes.

Freestanding Laundry Appliances dominate the market, accounting for a significant portion of sales. Their popularity stems from consumer preferences for flexibility in placement and ease of use. These appliances are often favored in households where space is not a constraint, allowing for larger capacities and more features. Built-In Laundry Appliances, while gaining traction due to their aesthetic appeal and space-saving designs, still lag behind in overall market share.

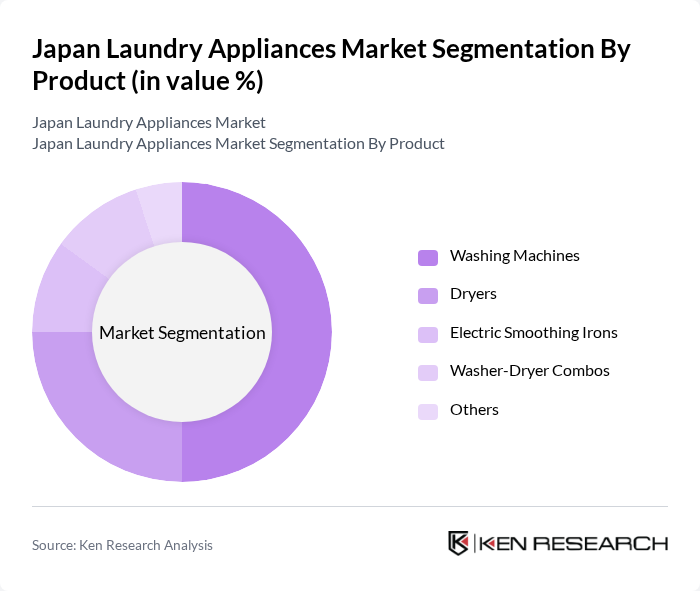

By Product:The market is segmented into Washing Machines, Dryers, Electric Smoothing Irons, Washer-Dryer Combos, and Others. Washing Machines are the most widely used product, driven by their essential role in household laundry.

The Japan Laundry Appliances Market is characterized by a dynamic mix of regional and international players. Leading participants such as Panasonic Corporation, Hitachi, Ltd., Toshiba Corporation, Sharp Corporation, LG Electronics Japan, Samsung Electronics Japan, Miele Japan Co., Ltd., Electrolux Japan Ltd., Haier Japan Sales Co., Ltd., Whirlpool Japan K.K., Arcelik Japan (Beko), BSH Home Appliances Ltd. (Bosch, Siemens), Smeg Japan Co., Ltd., Daikin Industries, Ltd. (Laundry Solutions), AEG Japan contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan laundry appliances market appears promising, driven by ongoing technological innovations and a growing emphasis on sustainability. As consumers increasingly prioritize energy-efficient and eco-friendly products, manufacturers are likely to invest in developing appliances that meet these demands. Additionally, the rise of e-commerce platforms will facilitate easier access to a wider range of products, enhancing consumer choice and potentially boosting sales in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Freestanding Laundry Appliances Built-In Laundry Appliances |

| By Product | Washing Machines Dryers Electric Smoothing Irons Washer-Dryer Combos Others |

| By Technology | Automatic Semi-Automatic / Manual Others |

| By Distribution Channel | Supermarkets and Hypermarkets Specialty Stores Online Other Distribution Channels |

| By End-User | Residential Commercial Industrial |

| By Price Range | Budget Mid-Range Premium |

| By Brand | Domestic Brands International Brands Private Labels |

| By Features | Energy Efficient Smart Technology Multi-Functionality Compact Design |

| By Application | Household Use Commercial Use Institutional Use Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Washing Machine Users | 100 | Homeowners, Renters |

| Commercial Laundry Service Providers | 60 | Business Owners, Operations Managers |

| Retail Appliance Sales Representatives | 40 | Sales Managers, Store Owners |

| Online Appliance Shoppers | 80 | eCommerce Users, Tech-Savvy Consumers |

| Appliance Repair Technicians | 50 | Service Technicians, Repair Shop Owners |

The Japan Laundry Appliances Market is valued at approximately USD 3.4 billion, driven by urbanization, technological advancements, and a focus on energy efficiency and convenience in laundry solutions.