Region:Asia

Author(s):Geetanshi

Product Code:KRAB0039

Pages:88

Published On:August 2025

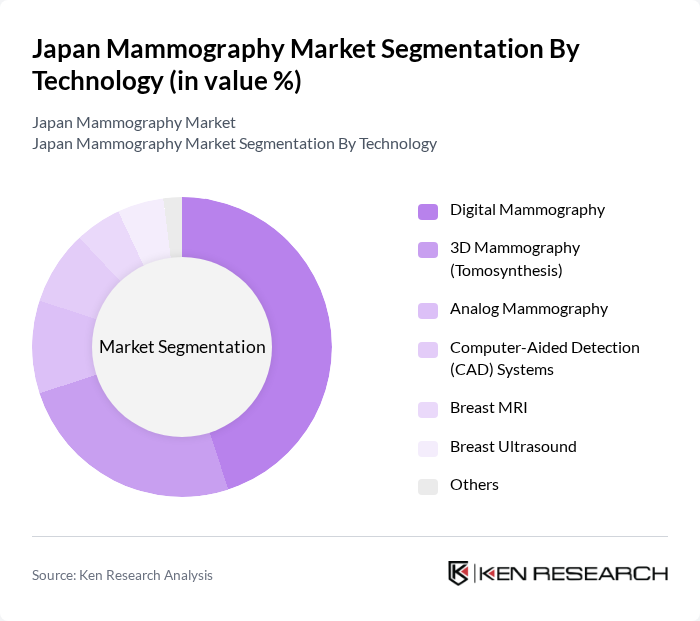

By Technology:The technology segment of the Japan Mammography Market includes various advanced imaging techniques. The subsegments are Digital Mammography, 3D Mammography (Tomosynthesis), Analog Mammography, Computer-Aided Detection (CAD) Systems, Breast MRI, Breast Ultrasound, and Others. Digital Mammography is currently leading the market due to its superior image quality and efficiency in detecting abnormalities compared to traditional methods. The adoption of 3D Mammography is also on the rise, as it provides more detailed images, enhancing diagnostic accuracy.

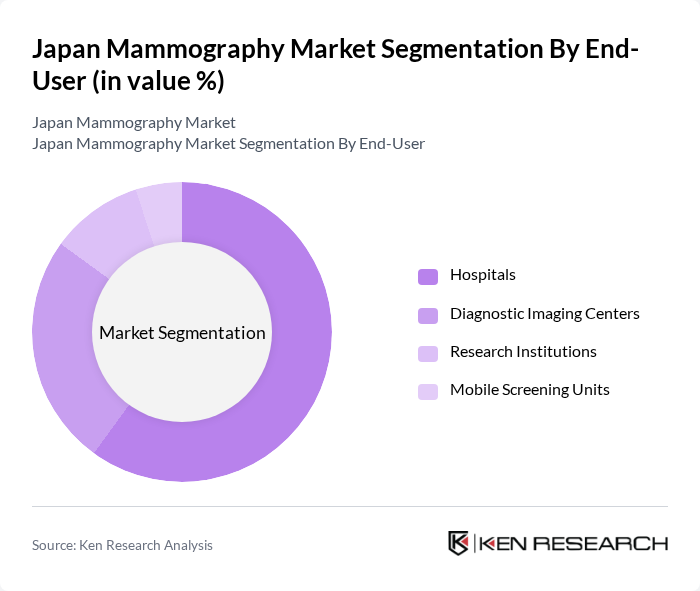

By End-User:The end-user segment encompasses Hospitals, Diagnostic Imaging Centers, Research Institutions, and Mobile Screening Units. Hospitals dominate this segment due to their comprehensive healthcare services and the availability of advanced imaging technologies. Diagnostic Imaging Centers are also significant players, providing specialized services that cater to a growing demand for breast cancer screening and diagnosis. The trend towards mobile screening units is gaining traction, especially in rural areas, to enhance accessibility.

The Japan Mammography Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fujifilm Holdings Corporation, Canon Medical Systems Corporation, Hologic, Inc., GE Healthcare, Siemens Healthineers, Philips Healthcare, Agfa-Gevaert Group, Hitachi, Ltd., Carestream Health, Shimadzu Corporation, Konica Minolta, Inc., Neusoft Medical Systems Co., Ltd., Planmed Oy, EIZO Corporation, Toshiba Medical Systems Corporation (now Canon Medical Systems Corporation) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan mammography market appears promising, driven by technological advancements and increased government support. The integration of artificial intelligence in imaging analysis is expected to enhance diagnostic accuracy and efficiency, addressing the shortage of trained radiologists. Additionally, the growing trend towards personalized medicine will likely lead to tailored screening protocols, improving patient outcomes. As awareness of breast cancer continues to rise, the demand for accessible and effective mammography services will remain strong, fostering market growth.

| Segment | Sub-Segments |

|---|---|

| By Technology | Digital Mammography D Mammography (Tomosynthesis) Analog Mammography Computer-Aided Detection (CAD) Systems Breast MRI Breast Ultrasound Others |

| By End-User | Hospitals Diagnostic Imaging Centers Research Institutions Mobile Screening Units |

| By Application | Screening Diagnosis Follow-up |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Pricing Range | Premium Mid-range Budget |

| By Region | Major Cities Rural Areas |

| By Policy Support | Government Subsidies Tax Incentives Public Awareness Campaigns |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Radiology Departments | 100 | Radiologists, Imaging Technologists |

| Private Diagnostic Clinics | 60 | Clinic Owners, Medical Directors |

| Healthcare Policy Makers | 40 | Health Ministry Officials, Public Health Experts |

| Patient Advocacy Groups | 50 | Patient Representatives, Community Health Workers |

| Medical Equipment Distributors | 45 | Sales Managers, Product Specialists |

The Japan Mammography Market is valued at approximately USD 120 million, reflecting a significant growth trend driven by the increasing prevalence of breast cancer, heightened awareness of early detection, and advancements in mammography technology.