Region:Middle East

Author(s):Dev

Product Code:KRAD1608

Pages:97

Published On:November 2025

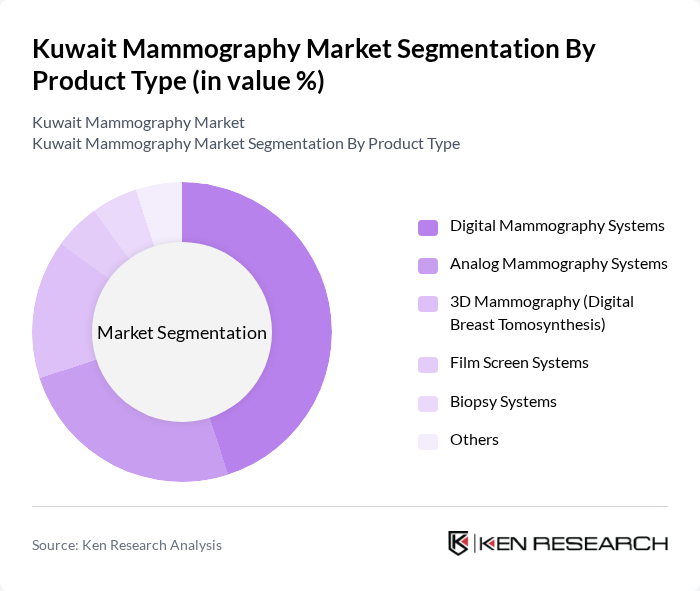

By Product Type:The product type segmentation includes various mammography systems and related equipment. The market is primarily driven by the increasing adoption of digital technologies, which offer enhanced imaging capabilities, improved workflow efficiency, and better patient outcomes. Digital mammography systems are gaining traction due to their superior image quality and diagnostic accuracy, while analog systems maintain a significant share in cost-sensitive settings. The demand for 3D mammography (digital breast tomosynthesis) is rising, as it provides more detailed imaging, supporting earlier and more accurate diagnosis. Biopsy systems and film screen systems remain relevant for specific clinical needs and budget-constrained facilities .

By Technology:The technology segmentation highlights the various methodologies employed in mammography. Full-Field Digital Mammography (FFDM) leads the market due to its superior image quality, faster processing times, and integration with hospital information systems. Computer-Aided Detection (CAD) systems are increasingly adopted to assist radiologists in identifying subtle abnormalities, improving diagnostic accuracy and workflow efficiency. Contrast-Enhanced Mammography is emerging as a valuable tool for complex cases and high-risk patient populations, while other technologies—including AI-enabled platforms—are gradually expanding their footprint in specialized centers .

The Kuwait Mammography Market is characterized by a dynamic mix of regional and international players. Leading participants such as GE Healthcare, Siemens Healthineers, Hologic, Inc., Philips Healthcare, Fujifilm Medical Systems, Canon Medical Systems, Agfa HealthCare, Carestream Health, Mindray Medical International, Konica Minolta Healthcare, Planmed Oy, Metaltronica S.p.A., IMS Giotto S.p.A., Neusoft Medical Systems, EIZO Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait mammography market appears promising, driven by increasing government support and technological advancements. The integration of telemedicine into screening processes is expected to enhance accessibility, particularly for women in remote areas in future. Additionally, the growing trend towards personalized healthcare solutions will likely lead to tailored screening programs, improving early detection rates. These developments, combined with ongoing awareness campaigns, are anticipated to significantly improve breast cancer outcomes in the region.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Digital Mammography Systems Analog Mammography Systems D Mammography (Digital Breast Tomosynthesis) Film Screen Systems Biopsy Systems Others |

| By Technology | Full-Field Digital Mammography (FFDM) Computer-Aided Detection (CAD) Contrast-Enhanced Mammography Others |

| By End-User | Hospitals Diagnostic Imaging Centers Specialty Clinics Research Institutions Others |

| By Geography | Urban Areas Rural Areas Others |

| By Service Type | Screening Services Diagnostic Services Follow-up Services Others |

| By Payment Model | Out-of-Pocket Payments Insurance Coverage Government Subsidies Others |

| By Technology Adoption | Conventional Technology Advanced Technology (AI, CAD, 3D Tomosynthesis) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Hospital Mammography Services | 60 | Radiologists, Hospital Administrators |

| Private Clinic Mammography Offerings | 50 | Clinic Managers, Technicians |

| Patient Awareness and Attitudes | 100 | Women aged 30-65, Health Advocates |

| Insurance Coverage for Mammography | 40 | Insurance Providers, Policy Analysts |

| Technological Advancements in Mammography | 40 | Medical Device Manufacturers, R&D Managers |

The Kuwait Mammography Market is valued at approximately USD 20 million, reflecting its share within the broader Kuwait breast imaging market, which is valued at USD 17.6 million. This growth is driven by increased awareness and government initiatives promoting women's health.