Region:Asia

Author(s):Rebecca

Product Code:KRAD0167

Pages:88

Published On:August 2025

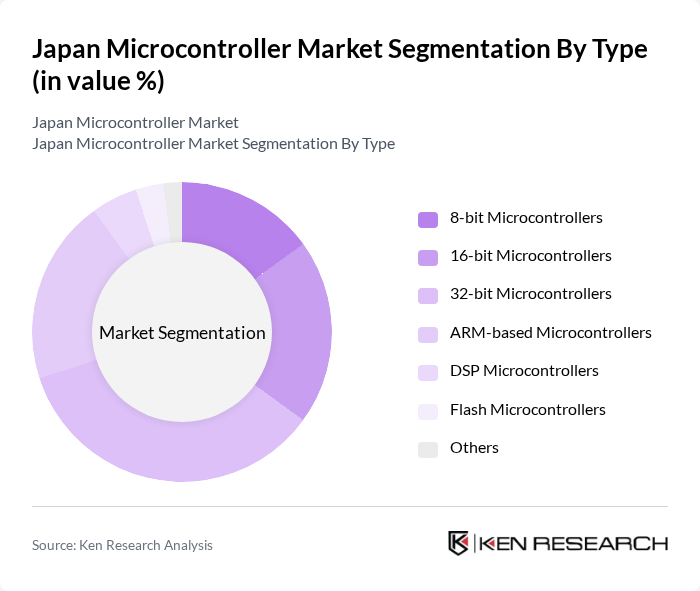

By Type:The microcontroller market is segmented by architecture, including 8-bit, 16-bit, and 32-bit microcontrollers, as well as ARM-based, DSP, Flash microcontrollers, and others. Among these, 32-bit microcontrollers hold the largest share due to their superior processing power and efficiency, making them ideal for complex applications in automotive, industrial automation, and advanced consumer electronics. ARM-based microcontrollers are also experiencing increased demand, driven by their versatility, low power consumption, and suitability for IoT devices and embedded systems .

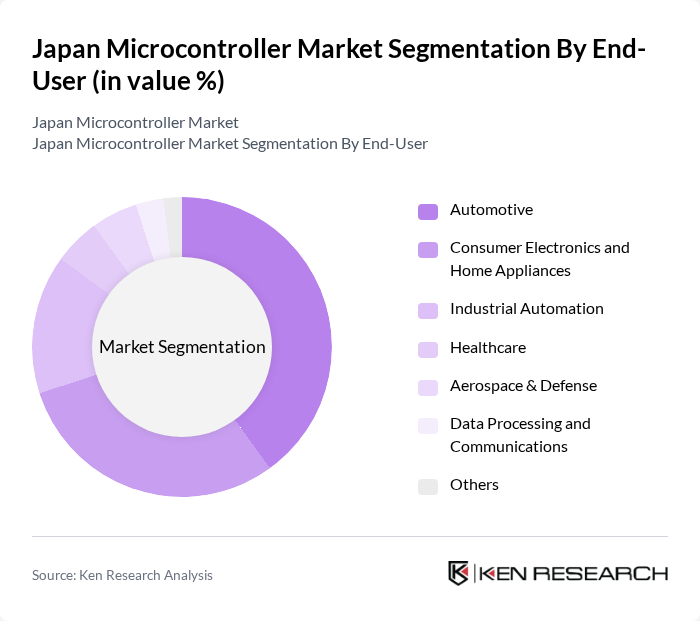

By End-User:The end-user segmentation includes automotive, consumer electronics and home appliances, industrial automation, healthcare, aerospace & defense, data processing and communications, and others. The automotive sector is the largest end-user of microcontrollers, driven by the increasing integration of advanced driver-assistance systems (ADAS), electric vehicle technologies, and safety features. Consumer electronics and home appliances also represent a significant portion of the market, as manufacturers focus on enhancing product functionality, connectivity, and energy efficiency. Industrial automation continues to be a key growth area due to the adoption of Industry 4.0 and smart manufacturing solutions .

The Japan Microcontroller Market is characterized by a dynamic mix of regional and international players. Leading participants such as Renesas Electronics Corporation, NXP Semiconductors N.V., Microchip Technology Inc., Texas Instruments Incorporated, STMicroelectronics N.V., Infineon Technologies AG, Cypress Semiconductor Corporation (now part of Infineon Technologies AG), Analog Devices, Inc., onsemi (ON Semiconductor Corporation), Silicon Laboratories Inc., Maxim Integrated Products, Inc. (now part of Analog Devices, Inc.), Atmel Corporation (now part of Microchip Technology Inc.), Broadcom Inc., Nordic Semiconductor ASA, and ROHM Semiconductor contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Japan microcontroller market appears promising, driven by technological advancements and increasing integration across various sectors. The rise of smart home technologies and the expansion of 5G networks are expected to create new avenues for growth. Additionally, the increasing adoption of AI in electronics will further enhance the capabilities of microcontrollers, making them indispensable in future applications. As sustainability becomes a priority, manufacturers will likely focus on developing energy-efficient solutions to meet evolving consumer demands.

| Segment | Sub-Segments |

|---|---|

| By Type | bit Microcontrollers bit Microcontrollers bit Microcontrollers ARM-based Microcontrollers DSP Microcontrollers Flash Microcontrollers Others |

| By End-User | Automotive Consumer Electronics and Home Appliances Industrial Automation Healthcare Aerospace & Defense Data Processing and Communications Others |

| By Application | Embedded Systems Robotics Smart Home Devices Wearable Technology IoT Devices Others |

| By Distribution Channel | Direct Sales Distributors Online Retail Value-Added Resellers Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Penetration Pricing Others |

| By Component | Microcontroller Units (MCUs) Development Tools Software Solutions Support Services Others |

| By Region | Kanto Kansai Chubu Kyushu Hokkaido Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Microcontroller Applications | 100 | Automotive Engineers, Product Development Managers |

| Consumer Electronics Microcontrollers | 60 | Product Managers, R&D Engineers |

| Industrial Automation Systems | 50 | Operations Managers, Automation Specialists |

| IoT Device Integration | 70 | IoT Developers, System Architects |

| Embedded Systems Design | 55 | Embedded Systems Engineers, Technical Leads |

The Japan Microcontroller Market is valued at approximately USD 3.1 billion, reflecting a robust growth trajectory driven by increasing automation demands across various sectors, including automotive, industrial, and consumer electronics.