Region:Asia

Author(s):Dev

Product Code:KRAA1559

Pages:83

Published On:August 2025

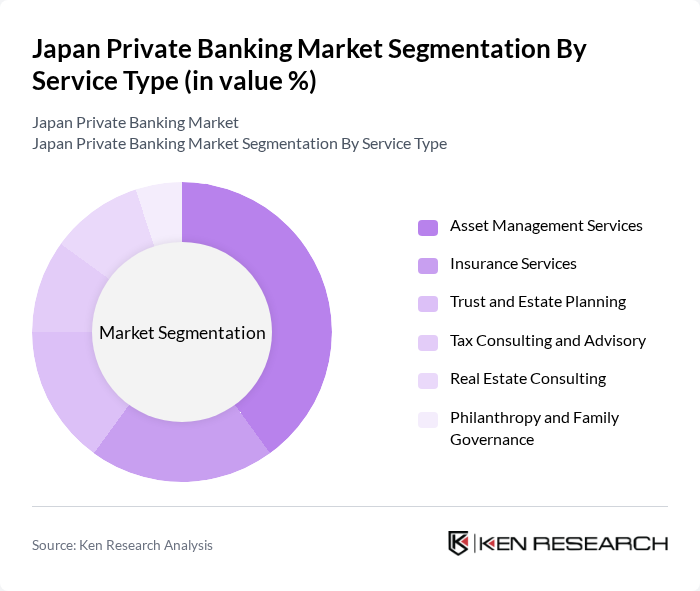

By Service Type:The service type segmentation includes various offerings that cater to the diverse needs of clients in the private banking sector. The subsegments are Asset Management Services, Insurance Services, Trust and Estate Planning, Tax Consulting and Advisory, Real Estate Consulting, and Philanthropy and Family Governance. Among these, Asset Management Services is the leading subsegment, driven by the increasing complexity of investment portfolios and the demand for tailored investment strategies. Clients are increasingly seeking professional management of their assets to optimize returns and mitigate risks, with market analyses consistently identifying wealth/asset management as the core revenue driver in Japan’s private banking proposition .

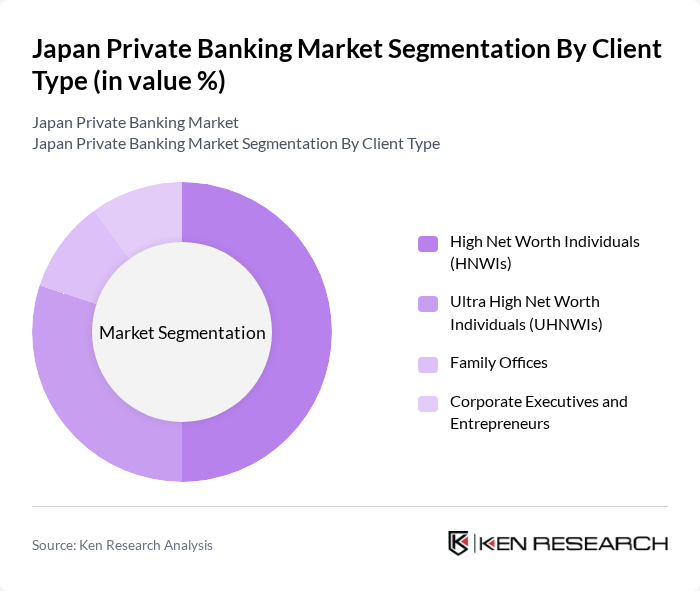

By Client Type:The client type segmentation encompasses various categories of clients served by private banking institutions. This includes High Net Worth Individuals (HNWIs), Ultra High Net Worth Individuals (UHNWIs), Family Offices, and Corporate Executives and Entrepreneurs. The HNWIs segment is the most significant, as it represents a large portion of the wealth in Japan. This demographic is increasingly seeking comprehensive wealth management solutions that address their unique financial goals and investment preferences, supported by rising numbers of affluent households and strong savings rates in Japan that feed demand for discretionary and advisory wealth services .

The Japan Private Banking Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mitsubishi UFJ Financial Group, Inc. (MUFG Private Banking), Sumitomo Mitsui Trust Holdings, Inc. (SMTB/SMBC Trust Bank PRESTIA), Nomura Holdings, Inc. (Nomura Wealth Management), Mizuho Financial Group, Inc. (Mizuho Private Wealth Management), Japan Post Bank Co., Ltd., SBI Holdings, Inc. (SBI Wealth/Neo Mobile), Daiwa Securities Group Inc. (Daiwa Wealth Management), SMBC Group (Sumitomo Mitsui Financial Group, Inc. – SMBC Private Wealth), Tokai Tokyo Financial Holdings, Inc., Aozora Bank, Ltd., Resona Holdings, Inc., The Shizuoka Bank, Ltd., The Chiba Bank, Ltd., Fukuoka Financial Group, Inc., Mitsubishi UFJ Trust and Banking Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of Japan's private banking market appears promising, driven by technological advancements and a growing focus on personalized services. As financial institutions increasingly adopt AI and data analytics, they will enhance client engagement and service delivery. Furthermore, the shift towards sustainable investments is expected to reshape product offerings, aligning with global trends. In future, the integration of digital solutions and ESG-focused strategies will likely redefine competitive dynamics, positioning firms to better meet client needs in a rapidly evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Asset Management Services Insurance Services Trust and Estate Planning Tax Consulting and Advisory Real Estate Consulting Philanthropy and Family Governance |

| By Client Type | High Net Worth Individuals (HNWIs) Ultra High Net Worth Individuals (UHNWIs) Family Offices Corporate Executives and Entrepreneurs |

| By Distribution Channel | Relationship Manager–Led (Direct) Digital and Robo-Advisor Platforms Independent Financial Advisors Bank and Securities Subsidiaries (Wealth Management Units) |

| By Investment Strategy | Discretionary Portfolio Management (Active) Advisory and Model Portfolios (Passive/Index) Alternatives (Private Equity, Hedge Funds, Real Assets) Tactical/Goal-Based Asset Allocation |

| By Geographic Focus | Domestic (Japan) Investments International (Developed Markets) International (Emerging Markets) Cross-Border and Offshore Booking |

| By Risk Profile | Conservative Moderate Aggressive |

| By Asset Class | Equities Fixed Income Cash and Money Market Alternatives (PE/HF/Private Credit) Real Estate Structured Products and Derivatives |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| High-Net-Worth Individuals | 150 | Affluent Clients |

| Private Banking Executives | 100 | Senior Management, Relationship Managers |

| Investment Advisors | 80 | Financial Advisors, Portfolio Managers |

| Regulatory Experts | 50 | Compliance Officers, Legal Advisors |

| Market Analysts | 70 | Industry Analysts, Economic Researchers |

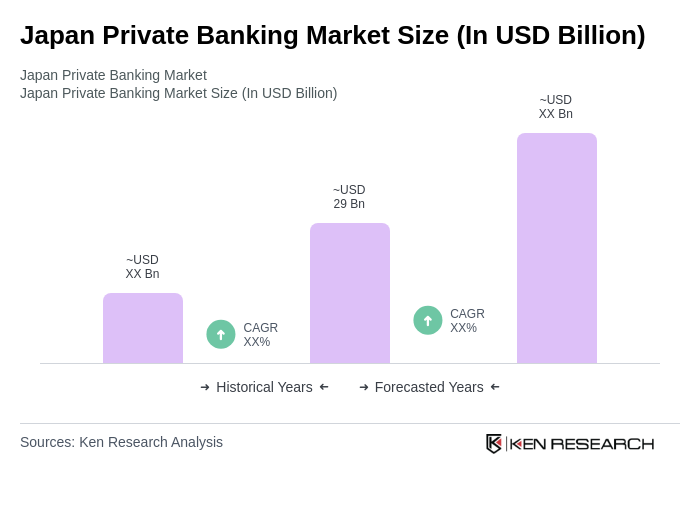

The Japan Private Banking Market is valued at approximately USD 29 billion, reflecting the fees and revenues generated from private banking and wealth management services, supported by the increasing wealth of high-net-worth individuals (HNWIs) in the country.