Region:North America

Author(s):Shubham

Product Code:KRAA1865

Pages:85

Published On:August 2025

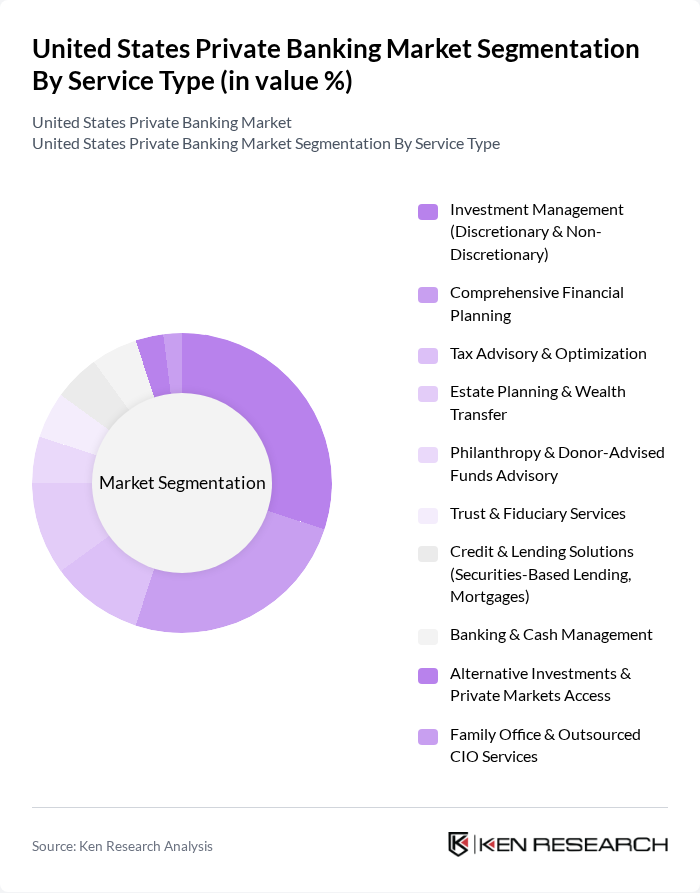

By Service Type:The service type segmentation of the market includes various offerings tailored to meet the diverse needs of affluent clients. Investment management, which encompasses both discretionary and non-discretionary services, is a leading segment due to the increasing complexity of investment strategies and the demand for professional management of assets. Comprehensive financial planning is also gaining traction as clients seek holistic approaches to wealth management, integrating tax optimization, estate planning, and philanthropic advisory services .

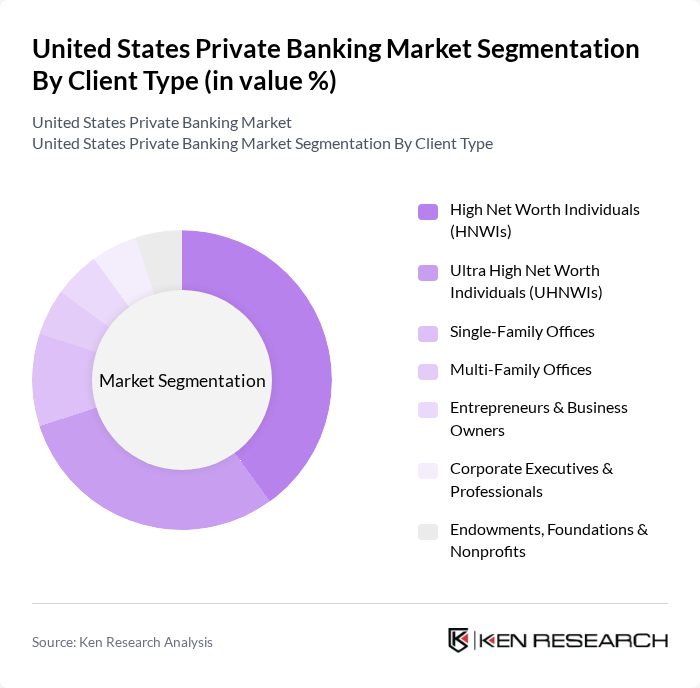

By Client Type:This segmentation focuses on the various client categories served by private banking institutions. High-net-worth individuals (HNWIs) and ultra-high-net-worth individuals (UHNWIs) represent the largest client segments, driven by their substantial asset bases and complex financial needs. Single-family offices and multi-family offices are also significant, as they require specialized services to manage and preserve wealth across generations. The growing number of entrepreneurs and business owners seeking tailored financial solutions further fuels the demand for private banking services .

The United States Private Banking Market is characterized by a dynamic mix of regional and international players. Leading participants such as JPMorgan Chase & Co. (J.P. Morgan Private Bank), Bank of America Private Bank (formerly U.S. Trust), Wells Fargo Wealth & Investment Management (Abbot Downing legacy), Citigroup Private Bank, Goldman Sachs Private Wealth Management, Morgan Stanley Private Wealth Management, UBS Global Wealth Management (U.S.), Northern Trust Wealth Management, BNY Mellon Wealth Management, Charles Schwab Private Client Services, Raymond James Private Client Group, Rockefeller Capital Management (Rockefeller Global Family Office), PNC Private Bank (including PNC Private Bank Hawthorn), Ameriprise Financial (Ameriprise Private Wealth), Fidelity Private Wealth Management contribute to innovation, geographic expansion, and service delivery in this space.

The future of the United States private banking market appears promising, driven by the increasing wealth of HNWIs and the growing demand for personalized services. As technology continues to evolve, banks will likely enhance their digital offerings, improving client engagement and operational efficiency. Additionally, the focus on sustainable investments is expected to reshape client portfolios, creating new avenues for growth. Overall, the market is poised for continued expansion, adapting to changing client needs and economic conditions.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Investment Management (Discretionary & Non-Discretionary) Comprehensive Financial Planning Tax Advisory & Optimization Estate Planning & Wealth Transfer Philanthropy & Donor-Advised Funds Advisory Trust & Fiduciary Services Credit & Lending Solutions (Securities-Based Lending, Mortgages) Banking & Cash Management Alternative Investments & Private Markets Access Family Office & Outsourced CIO Services |

| By Client Type | High Net Worth Individuals (HNWIs) Ultra High Net Worth Individuals (UHNWIs) Single-Family Offices Multi-Family Offices Entrepreneurs & Business Owners Corporate Executives & Professionals Endowments, Foundations & Nonprofits |

| By Geographic Presence | Northeast (New York, Boston, Philadelphia) Midwest (Chicago, Minneapolis, Detroit) South (Miami, Dallas, Atlanta, Houston) West (San Francisco Bay Area, Los Angeles, Seattle) Mountain & Southwest (Denver, Phoenix) |

| By Distribution Channel | Relationship Managers & Private Bankers (Direct) Digital & Mobile Private Banking Platforms Registered Investment Advisors (RIA) & Financial Advisors Broker-Dealer & Investment Bank Referrals Strategic Partnerships (Fintech, Custodians, Law/CPA Firms) |

| By Investment Strategy | Active Management Passive & Factor-Based Management Alternatives (Hedge Funds, Private Equity, Real Assets) Thematic & Impact/Sustainable Investing (ESG) Customized UMA/SMA Portfolios |

| By Risk Profile | Capital Preservation (Conservative) Balanced (Moderate) Growth-Oriented (Aggressive) Opportunistic/Alternatives-Heavy |

| By Fee Structure | Flat/Retainer Fees Percentage of Assets Under Management (AUM-based) Performance/Carry-Linked Fees Advisory + Product/Platform Fees (Blended) Subscription/Hybrid Digital Advisory Models |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| High-Net-Worth Individuals | 120 | Affluent Clients, Wealth Managers |

| Private Banking Executives | 100 | Senior Management, Relationship Managers |

| Investment Advisors | 80 | Portfolio Managers, Financial Planners |

| Regulatory Compliance Officers | 60 | Compliance Managers, Risk Officers |

| Wealth Management Consultants | 70 | Industry Analysts, Strategic Advisors |

The United States Private Banking Market is valued at approximately USD 110115 billion, driven by the increasing wealth of high-net-worth individuals (HNWIs) and ultra-high-net-worth individuals (UHNWIs), along with a growing demand for personalized financial services and investment management solutions.