Japan Reverse Logistics Solutions Market Overview

- The Japan Reverse Logistics Solutions Market is valued at USD 45 billion, based on a five-year historical analysis. This growth is primarily driven by increasing environmental consciousness among consumers and businesses, the rapid expansion of e-commerce, and the implementation of strict regulations promoting responsible waste management and recycling. Companies are increasingly adopting reverse logistics strategies to minimize costs, comply with regulations, and enhance customer satisfaction, leading to a robust market environment .

- Tokyo, Osaka, and Yokohama are the dominant cities in the Japan Reverse Logistics Solutions Market. Tokyo, as the capital, serves as a major economic hub with a high concentration of businesses and consumers, while Osaka and Yokohama benefit from their strategic locations and advanced logistics infrastructure. This urbanization and industrialization contribute significantly to the market's growth in these regions .

- Recent regulatory initiatives by the Japanese government have focused on enhancing resource efficiency and promoting recycling, encouraging businesses to adopt reverse logistics practices to reduce waste and foster sustainable economic growth. These regulations mandate companies to develop and implement strategies for the effective management of product returns and end-of-life products .

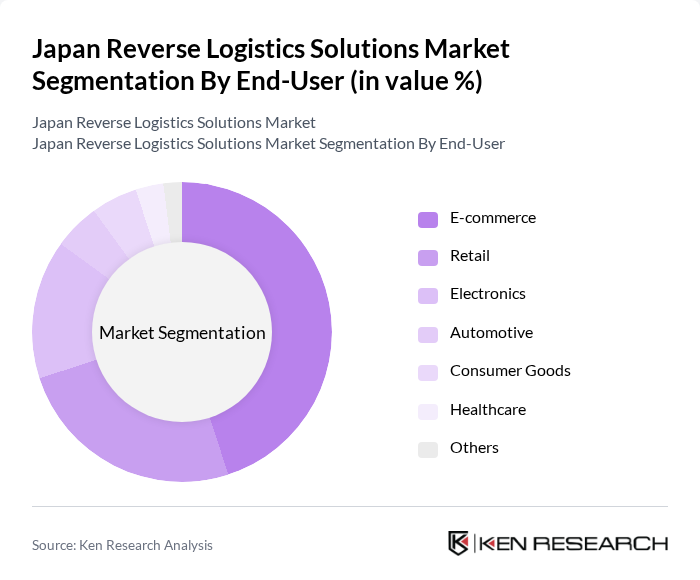

Japan Reverse Logistics Solutions Market Segmentation

By Return Type:The return type segmentation includes various subsegments such as Returns (Product Returns, End-of-Life Returns), Reusable Packaging, Remanufacturing, Recycling, Refurbishing/Repair Services, and Others. Among these, Returns (Product Returns, End-of-Life Returns) is the leading subsegment, driven by the rapid growth of e-commerce and consumer demand for hassle-free return processes. The increasing focus on sustainability has also led to a rise in recycling and remanufacturing activities, as companies seek to minimize waste and enhance resource recovery .

By End-User:The end-user segmentation encompasses E-commerce, Retail, Electronics, Automotive, Consumer Goods, Healthcare, and Others. The E-commerce sector is the dominant end-user, fueled by the exponential growth of online shopping and the increasing consumer expectation for easy return processes. Retail and Electronics also contribute significantly to the market, as these sectors are heavily reliant on effective reverse logistics to manage returns and enhance customer satisfaction .

Japan Reverse Logistics Solutions Market Competitive Landscape

The Japan Reverse Logistics Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as Yamato Holdings Co., Ltd., Sagawa Express Co., Ltd., Nippon Express Co., Ltd., Seino Holdings Co., Ltd., Hitachi Transport System, Ltd., Kintetsu World Express, Inc., Japan Post Co., Ltd., Rakuten, Inc., Daiseki Co., Ltd., Marubeni Corporation, Mitsui-Soko Holdings Co., Ltd., Kuehne + Nagel Ltd., Geodis Japan, APL Logistics, CEVA Logistics, DB Schenker, FedEx Corporation, Deutsche Post AG (DHL) contribute to innovation, geographic expansion, and service delivery in this space.

Japan Reverse Logistics Solutions Market Industry Analysis

Growth Drivers

- Increasing E-commerce Activities:The e-commerce sector in Japan is projected to reach ¥20 trillion (approximately $177 billion) in future, driven by a 7–8% annual growth rate. This surge in online shopping necessitates efficient reverse logistics solutions to manage returns effectively. With over 80% of consumers expecting hassle-free return processes, companies are investing in robust reverse logistics frameworks to enhance customer satisfaction and streamline operations, thereby boosting market demand significantly.

- Rising Environmental Concerns:Japan's commitment to sustainability is evident, with the government aiming for a 46% reduction in greenhouse gas emissions in future. This has led to increased pressure on businesses to adopt eco-friendly practices, including efficient waste management and recycling through reverse logistics. In future, the market for sustainable logistics solutions is expected to grow, as companies seek to align with consumer preferences for environmentally responsible practices, driving demand for innovative reverse logistics solutions.

- Technological Advancements in Logistics:The integration of advanced technologies such as AI and IoT in logistics is transforming the reverse logistics landscape in Japan. In future, investments in logistics technology are expected to exceed ¥1 trillion (around $9 billion), enhancing tracking, inventory management, and return processing. These advancements not only improve operational efficiency but also reduce costs, making reverse logistics more attractive for businesses looking to optimize their supply chains and enhance customer experiences.

Market Challenges

- High Operational Costs:The reverse logistics process can be costly, with estimates indicating that returns can account for up to 30% of total logistics costs. In Japan, where labor costs are among the highest globally, companies face significant financial burdens in managing returns. This challenge is exacerbated by the need for specialized handling and processing of returned goods, which can deter businesses from investing in comprehensive reverse logistics solutions, limiting market growth.

- Complex Regulatory Compliance:Japan's regulatory environment for waste management and recycling is intricate, with numerous laws governing the disposal of returned products. Companies must navigate these regulations to avoid penalties, which can be time-consuming and costly. In future, compliance costs are expected to rise, further complicating the reverse logistics landscape. This complexity can hinder the adoption of efficient reverse logistics practices, posing a significant challenge for businesses in the market.

Japan Reverse Logistics Solutions Market Future Outlook

The future of the Japan reverse logistics solutions market appears promising, driven by the increasing integration of technology and a strong focus on sustainability. As businesses adapt to evolving consumer expectations and regulatory pressures, the demand for efficient return processes will likely rise. Companies are expected to invest in innovative solutions that enhance operational efficiency and reduce environmental impact, positioning themselves competitively in a rapidly changing market landscape. The emphasis on customer experience will also shape future developments in this sector.

Market Opportunities

- Growth in Circular Economy Practices:The circular economy is gaining traction in Japan, with the government promoting initiatives to reduce waste and encourage recycling. In future, businesses adopting circular practices are expected to see a 20% increase in operational efficiency, creating opportunities for reverse logistics providers to offer tailored solutions that facilitate product returns and recycling, thus enhancing sustainability efforts.

- Expansion of Third-Party Logistics Providers:The demand for third-party logistics (3PL) services is on the rise, with the market projected to grow to ¥8 trillion (approximately $72 billion) in future. This expansion presents opportunities for reverse logistics providers to partner with 3PLs, offering specialized services that streamline return processes and improve overall supply chain efficiency, catering to the needs of e-commerce businesses.