Region:Asia

Author(s):Shubham

Product Code:KRAA0993

Pages:100

Published On:August 2025

By Type:The market is segmented into various types of warehousing services, including Public Warehousing, Private Warehousing, Contract Warehousing, Automated Warehousing, Cold Storage Warehousing, Cross-Docking Warehousing, Bonded Warehousing, Distribution Centers, and Others. Contract Warehousing is currently the leading sub-segment due to its flexibility, scalability, and cost-effectiveness, allowing businesses to adjust operations according to demand without the burden of long-term commitments. Automated Warehousing is also experiencing rapid growth, driven by labor shortages and the need for operational efficiency through robotics, IoT, and data analytics .

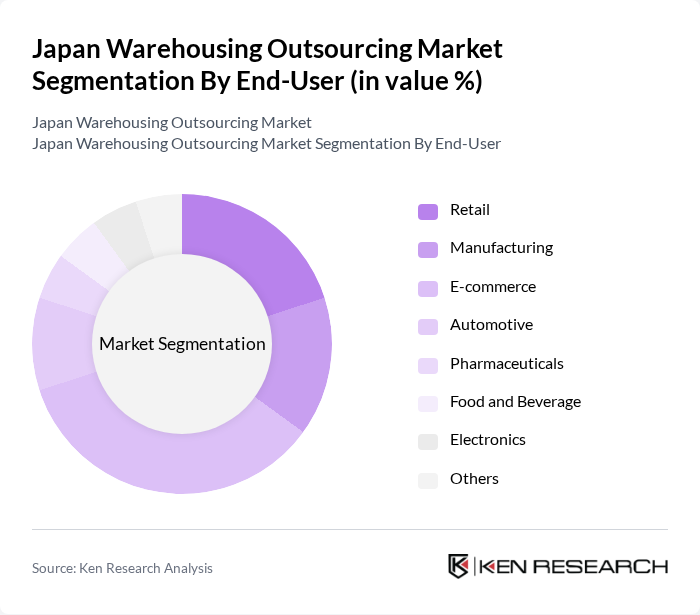

By End-User:The end-user segmentation includes Retail, Manufacturing, E-commerce, Automotive, Pharmaceuticals, Food and Beverage, Electronics, and Others. The E-commerce sector is the dominant end-user, driven by the rapid growth of online shopping, omnichannel retailing, and the need for efficient order fulfillment and distribution networks. This trend has led to increased demand for specialized warehousing solutions capable of handling high volumes of small, frequent orders, as well as returns management .

The Japan Warehousing Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nippon Express, Yamato Holdings, Sagawa Express, Seino Holdings, Hitachi Transport System, Kintetsu World Express, Mitsui-Soko Holdings, Marubeni Logistics, Asahi Logistics, Kuehne + Nagel, Geodis, DB Schenker, CEVA Logistics, DSV, Yusen Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan warehousing outsourcing market appears promising, driven by technological innovations and evolving consumer expectations. As companies increasingly adopt automation and AI, operational efficiencies are expected to improve significantly. Additionally, the shift towards omnichannel distribution will necessitate more sophisticated warehousing solutions. The focus on sustainability will also shape investment strategies, encouraging logistics providers to adopt eco-friendly practices and technologies, further enhancing their competitive edge.

| Segment | Sub-Segments |

|---|---|

| By Type | Public Warehousing Private Warehousing Contract Warehousing Automated Warehousing Cold Storage Warehousing Cross-Docking Warehousing Bonded Warehousing Distribution Centers Others |

| By End-User | Retail Manufacturing E-commerce Automotive Pharmaceuticals Food and Beverage Electronics Others |

| By Service Type | Storage Services Inventory Management Order Fulfillment Transportation Services Value-Added Services (e.g., packaging, labeling, kitting) Reverse Logistics Others |

| By Location | Urban Areas Suburban Areas Rural Areas Port Proximity Airport Proximity Industrial Zones Others |

| By Technology Adoption | Manual Warehousing Semi-Automated Warehousing Fully Automated Warehousing IoT-Enabled Warehousing Robotics-Integrated Warehousing Others |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Performance-Based Pricing Others |

| By Contract Type | Short-Term Contracts Long-Term Contracts Spot Contracts Framework Agreements Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Warehousing Operations | 100 | Warehouse Managers, Logistics Coordinators |

| Pharmaceutical Distribution Centers | 60 | Supply Chain Directors, Compliance Officers |

| Automotive Parts Warehousing | 50 | Operations Managers, Inventory Control Specialists |

| Food and Beverage Storage Solutions | 40 | Quality Assurance Managers, Logistics Supervisors |

| E-commerce Fulfillment Centers | 80 | eCommerce Operations Managers, Warehouse Supervisors |

The Japan Warehousing Outsourcing Market is valued at approximately USD 14 billion, driven by the increasing demand for efficient supply chain management, e-commerce growth, and advanced storage solutions.