Region:Global

Author(s):Geetanshi

Product Code:KRAA0299

Pages:94

Published On:August 2025

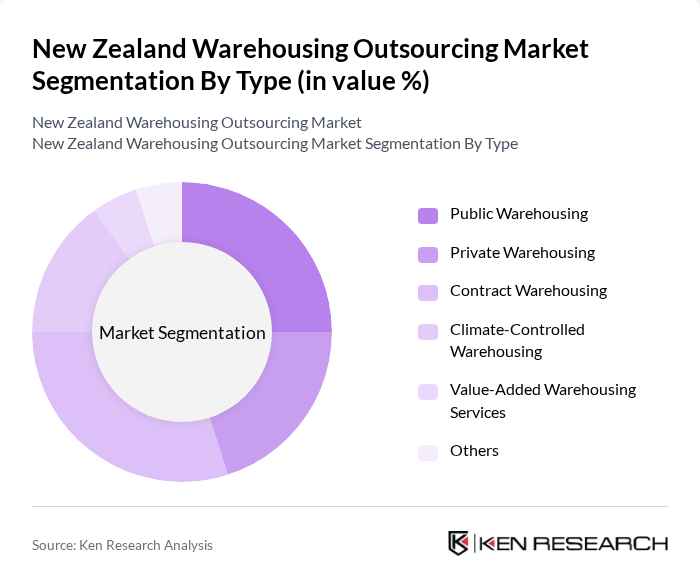

By Type:The market is segmented into various types of warehousing services, including Public Warehousing, Private Warehousing, Contract Warehousing, Climate-Controlled Warehousing, Value-Added Warehousing Services, and Others. Among these, Contract Warehousing is currently the leading sub-segment due to its flexibility and cost-effectiveness, allowing businesses to scale operations without the burden of owning physical assets. Public Warehousing is also significant, catering to small and medium enterprises that require short-term storage solutions. The demand for Climate-Controlled Warehousing is rising, driven by the need for specialized storage for perishable goods and pharmaceuticals. Value-added services such as packaging, labeling, and inventory management are increasingly important as companies seek integrated logistics solutions .

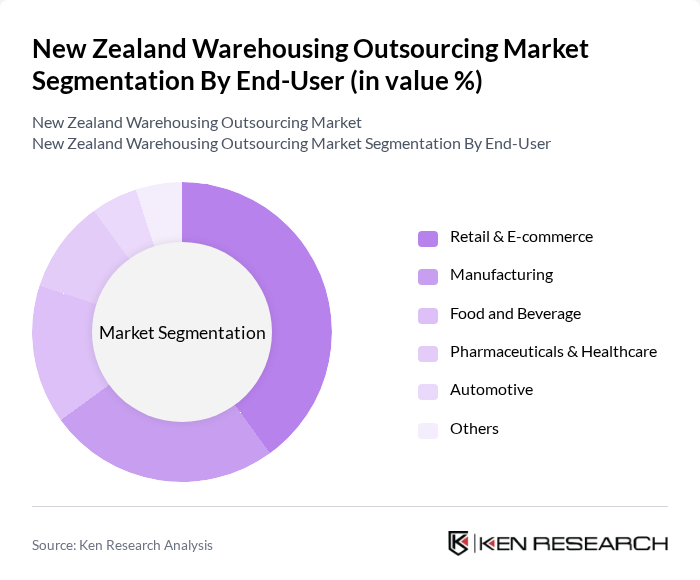

By End-User:The end-user segmentation includes Retail & E-commerce, Manufacturing, Food and Beverage, Pharmaceuticals & Healthcare, Automotive, and Others. The Retail & E-commerce sector is the dominant end-user, driven by the rapid growth of online shopping and the need for efficient logistics solutions. Manufacturing also plays a crucial role, as companies require warehousing for raw materials and finished goods. The Food and Beverage sector is increasingly relying on specialized warehousing to ensure product quality and compliance with safety regulations. Pharmaceuticals and healthcare are also driving demand for climate-controlled and secure storage solutions .

The New Zealand Warehousing Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mainfreight Limited, Toll Group, NZ Post, Freightways Limited, C3 Limited, PBT Transport, Fliway Group, Kuehne + Nagel, DB Schenker, CEVA Logistics, DHL Supply Chain (New Zealand), DSV Solutions, Mondiale VGL, Move Logistics Group, C.H. Robinson contribute to innovation, geographic expansion, and service delivery in this space.

The New Zealand warehousing outsourcing market is poised for significant evolution, driven by the increasing integration of technology and the growing emphasis on sustainability. As businesses adapt to changing consumer behaviors, the demand for flexible warehousing solutions will rise. Additionally, the focus on reducing carbon footprints will encourage logistics providers to adopt eco-friendly practices. By future, these trends are expected to reshape the competitive landscape, fostering innovation and collaboration among industry players.

| Segment | Sub-Segments |

|---|---|

| By Type | Public Warehousing Private Warehousing Contract Warehousing Climate-Controlled Warehousing Value-Added Warehousing Services Others |

| By End-User | Retail & E-commerce Manufacturing Food and Beverage Pharmaceuticals & Healthcare Automotive Others |

| By Service Type | Storage Services Inventory Management Order Fulfillment & Distribution Transportation & Last-Mile Delivery Cross-Docking Services Others |

| By Technology | Warehouse Management Systems (WMS) Automated Storage and Retrieval Systems (AS/RS) Robotics and Automation Internet of Things (IoT) Solutions Data Analytics & AI Integration Others |

| By Geographic Region | Auckland Region Wellington Region Canterbury Region Waikato/Bay of Plenty Otago/Southland Other Regions |

| By Client Type | Small and Medium Enterprises (SMEs) Large Enterprises Government Agencies Non-Profit Organizations Others |

| By Contract Type | Fixed-Term Contracts Flexible Contracts Performance-Based Contracts Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Warehousing Outsourcing | 60 | Logistics Managers, Supply Chain Directors |

| Manufacturing Supply Chain Management | 50 | Operations Managers, Procurement Officers |

| E-commerce Fulfillment Services | 70 | eCommerce Managers, Warehouse Supervisors |

| Third-Party Logistics Providers | 40 | Business Development Managers, Account Executives |

| Cold Chain Logistics | 45 | Quality Assurance Managers, Logistics Coordinators |

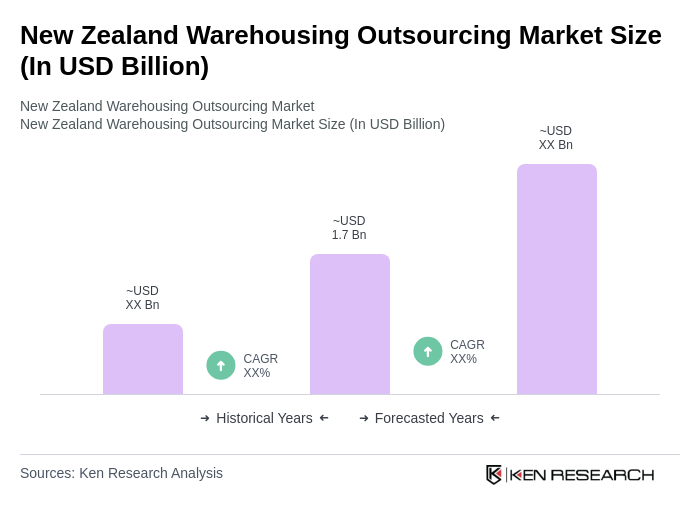

The New Zealand Warehousing Outsourcing Market is valued at approximately USD 1.7 billion, reflecting a significant growth driven by the increasing demand for efficient supply chain solutions, particularly in the retail and e-commerce sectors.