Region:Middle East

Author(s):Rebecca

Product Code:KRAD7573

Pages:82

Published On:December 2025

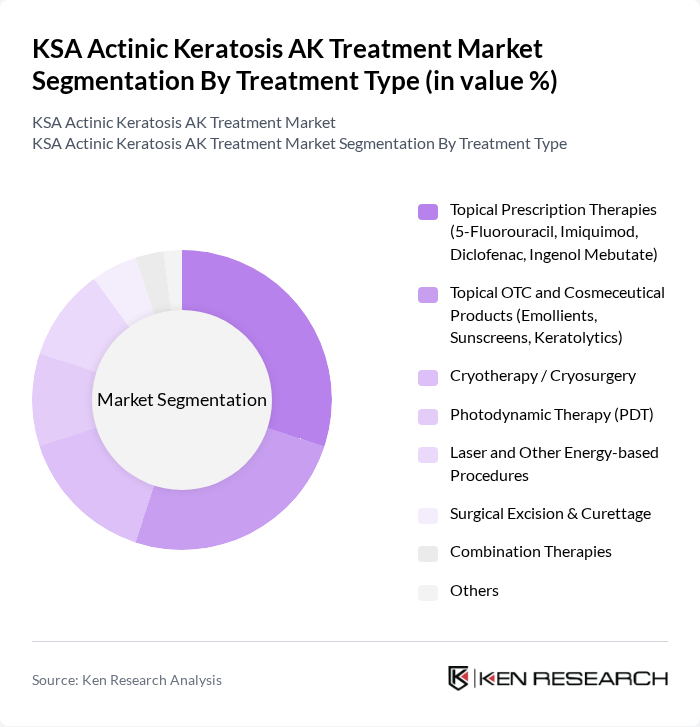

By Treatment Type:The treatment type segmentation includes various methods used to manage actinic keratosis. The subsegments are as follows:

The treatment type segmentation reveals that Topical Prescription Therapies, particularly 5-Fluorouracil and Imiquimod, dominate the market due to their proven efficacy as first-line field therapies, favorable safety profiles, and convenience for outpatient or home-based use. Patients prefer these therapies as they can be self-administered, reducing the need for repeated clinic visits, while cryotherapy and photodynamic therapy remain widely used for lesion-directed treatment in dermatology settings. The growing trend towards preventive skincare, routine use of broad-spectrum sunscreens, and the increasing incidence of actinic keratosis in fair?skinned and chronically sun?exposed populations further bolster demand for these treatments, alongside heightened awareness of the link between actinic keratosis and non?melanoma skin cancer risk.

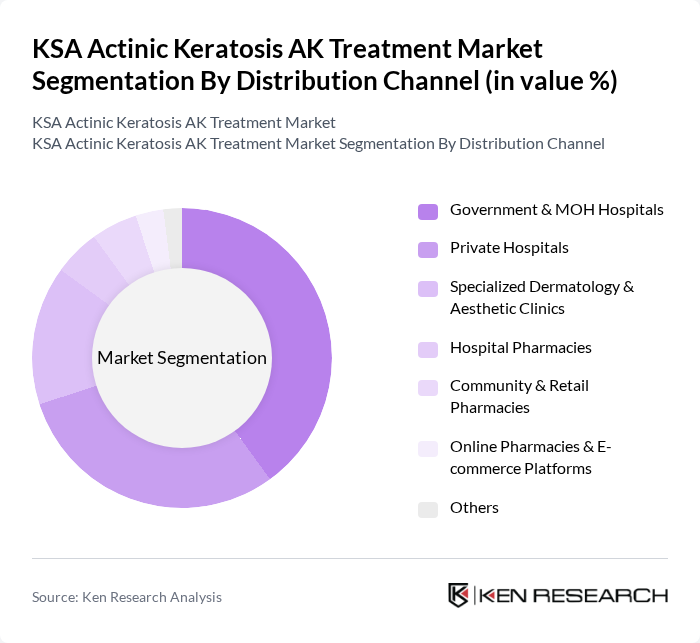

By Distribution Channel:This segmentation focuses on the various channels through which actinic keratosis treatments are distributed. The subsegments are as follows:

The distribution channel analysis indicates that Government & MOH Hospitals lead the market due to their extensive geographical coverage, dominant share of hospital beds, and the central role of public facilities in delivering specialist dermatology services under the Saudi health system. These hospitals often provide reimbursed or subsidized treatments, making care more accessible to a broad segment of the population, while private hospitals and specialized dermatology and aesthetic clinics cater to patients seeking shorter waiting times, premium services, and advanced procedure-based therapies such as photodynamic therapy and laser treatments. The rise of community and online pharmacies in Saudi Arabia, supported by e?prescription platforms such as Wasfaty and growing e?commerce adoption, is gradually changing the landscape by improving access and convenience for prescription refills and OTC photoprotection and skincare products used alongside actinic keratosis treatment.

The KSA Actinic Keratosis AK Treatment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Galderma S.A., Almirall S.A., LEO Pharma A/S, Sun Pharmaceutical Industries Ltd., Bausch Health Companies Inc., Novartis AG, Pfizer Inc., Cipla Ltd., Mylan N.V. (Viatris Inc.), Pierre Fabre Dermo-Cosmétique, Beiersdorf AG (Eucerin), Jamjoom Pharma, Tabuk Pharmaceuticals Manufacturing Company, SPIMACO ADDWAEIH (Saudi Pharmaceutical Industries & Medical Appliances Corporation), Jamjoom Medical Solutions contribute to innovation, geographic expansion, and service delivery in this space.

The future of the KSA Actinic Keratosis treatment market appears promising, driven by technological advancements and increasing healthcare investments. The integration of telemedicine is expected to enhance patient access to dermatological care, particularly in underserved areas. Additionally, ongoing research into novel treatment modalities will likely lead to more effective and affordable options, further expanding the market. As awareness continues to grow, the demand for preventive care and early intervention will shape the future landscape of AK treatments in the region.

| Segment | Sub-Segments |

|---|---|

| By Treatment Type | Topical Prescription Therapies (5-Fluorouracil, Imiquimod, Diclofenac, Ingenol Mebutate) Topical OTC and Cosmeceutical Products (Emollients, Sunscreens, Keratolytics) Cryotherapy / Cryosurgery Photodynamic Therapy (PDT) Laser and Other Energy-based Procedures Surgical Excision & Curettage Combination Therapies Others |

| By Distribution Channel | Government & MOH Hospitals Private Hospitals Specialized Dermatology & Aesthetic Clinics Hospital Pharmacies Community & Retail Pharmacies Online Pharmacies & E-commerce Platforms Others |

| By Patient Demographics | Age Group (18–44 years, 45–64 years, 65+ years) Gender (Male, Female) Nationality (Saudi Nationals, Expatriates) Occupational UV Exposure (Outdoor Workers, Indoor Workers) Skin Phototype (I–II, III–IV, V–VI) Others |

| By Geographic Region | Riyadh & Central Region Makkah Region (including Jeddah) Madinah & Western Region Eastern Province Northern Region Southern Region Others |

| By Treatment Setting | Hospital-based Outpatient Departments Day-care / Ambulatory Surgical Centers Private Dermatology Clinics Home-based / Self-administered Treatments Others |

| By Insurance Coverage | Council of Health Insurance (CHI)–Covered Private Insurance Government-funded Coverage (MOH, National Guard, Military, Security Forces) Self-Pay (Out-of-pocket) Corporate Plans Others |

| By Clinical Presentation and Disease Burden | Single Lesion AK Multiple Lesion / Field Cancerization AK Recurrent or Refractory AK Immunocompromised Patients (e.g., Transplant Recipients) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dermatology Clinics | 100 | Dermatologists, Clinic Managers |

| Pharmacies and Drugstores | 80 | Pharmacists, Store Managers |

| Patient Focus Groups | 50 | Patients with Actinic Keratosis, Caregivers |

| Healthcare Providers | 70 | General Practitioners, Nurse Practitioners |

| Health Insurance Companies | 60 | Policy Analysts, Claims Managers |

The KSA Actinic Keratosis AK Treatment Market is valued at approximately USD 60 million, reflecting a five-year historical analysis. This growth is driven by the rising prevalence of actinic keratosis and increased awareness of skin health.