Region:Middle East

Author(s):Dev

Product Code:KRAD4465

Pages:98

Published On:December 2025

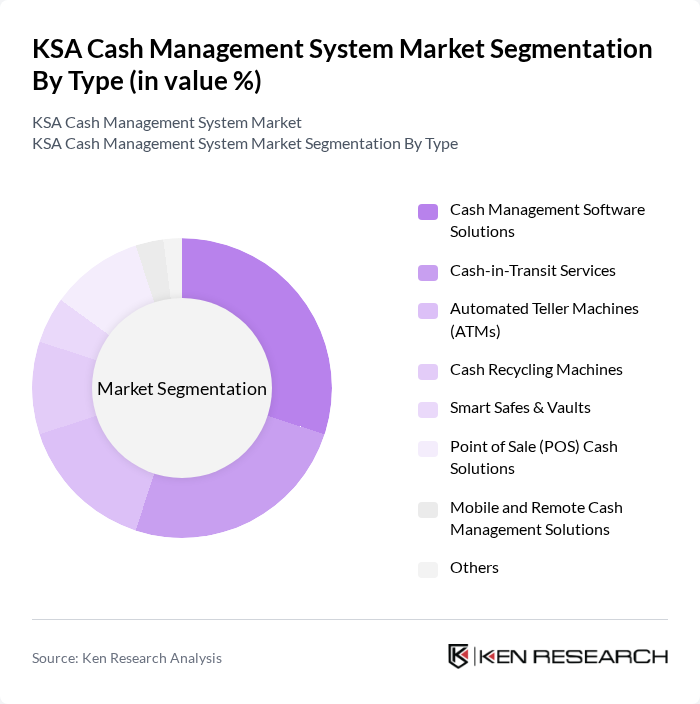

By Type:This segmentation includes various solutions and services that cater to cash management needs.

The Cash Management Software Solutions segment is widely viewed as a leading and fast?growing component of the market, reflecting banks’ and corporates’ need to centralize liquidity, automate reconciliation, and gain real?time visibility over multi?bank cash positions. Companies in KSA are increasingly adopting software platforms that offer real?time dashboards, automated payment workflows, integration with ERP systems, APIs for open banking connectivity, and advanced analytics for forecasting and risk management, driven by broader digital transformation, cybersecurity requirements, and pressure to optimize working capital.

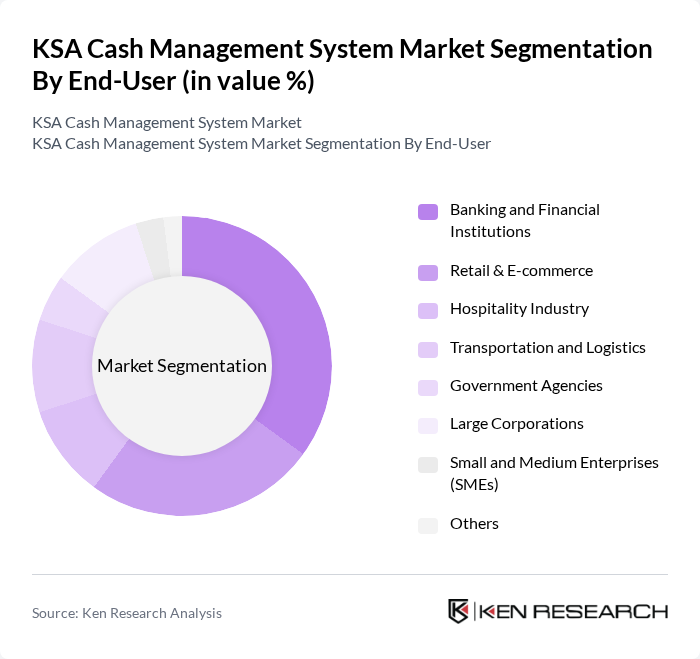

By End-User:This segmentation focuses on the various sectors utilizing cash management solutions.

The Banking and Financial Institutions segment legitimately leads adoption of cash management systems in Saudi Arabia, as banks deploy sophisticated treasury, liquidity, and payment hubs to support corporate clients, streamline internal operations, and comply with SAMA and Basel?aligned risk frameworks. Rapid growth of retail and e?commerce, along with digital wallets and instant payments, also drives demand from merchants and marketplaces for integrated POS, settlement, and reconciliation solutions, while large corporates and government entities invest in centralized cash pooling and payables/receivables automation to align with Vision 2030 efficiency targets.

The KSA Cash Management System market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, FIS (Fidelity National Information Services, Inc.), Temenos AG, ACI Worldwide, Inc., Finastra Group Holdings Limited, Kyriba Corp., Fiserv, Inc., Tata Consultancy Services Limited (TCS), NCR Voyix Corporation, Diebold Nixdorf, Incorporated, National Cash Management Systems (NCMS), Saudi Arabia, Riyad Bank – Cash Management Solutions, Saudi Awwal Bank (SAB) – Cash & Liquidity Management, Al Rajhi Bank – Transaction & Cash Management Solutions contribute to innovation, geographic expansion, and service delivery in this space.

The KSA cash management system market is poised for significant transformation as digitalization continues to reshape the financial landscape. In the future, advancements in technology, particularly in artificial intelligence and machine learning, are expected to enhance operational efficiencies and customer experiences. Additionally, the growing emphasis on regulatory compliance will drive banks to invest in innovative solutions. As the market evolves, collaboration with fintech companies will likely create new opportunities for growth and innovation, positioning the sector for a robust future.

| Segment | Sub-Segments |

|---|---|

| By Type | Cash Management Software Solutions Cash-in-Transit Services Automated Teller Machines (ATMs) Cash Recycling Machines Smart Safes & Vaults Point of Sale (POS) Cash Solutions Mobile and Remote Cash Management Solutions Others |

| By End-User | Banking and Financial Institutions Retail & E-commerce Hospitality Industry Transportation and Logistics Government Agencies Large Corporations Small and Medium Enterprises (SMEs) Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid Others |

| By Service Type | Implementation and Integration Services Managed Services Consulting and Advisory Services Maintenance and Support Services Others |

| By Industry Vertical | Banking, Financial Services and Insurance (BFSI) Retail & Wholesale Trade Hospitality and Entertainment Transportation & Logistics Government & Public Sector Healthcare Education Others |

| By Geographic Presence | Central Region (Riyadh and Surrounding Areas) Western Region (Makkah, Madinah, Jeddah) Eastern Region (Dammam, Khobar, Dhahran) Northern Region Southern Region Others |

| By Customer Size | Large Enterprises Medium Enterprises Small Enterprises Micro Enterprises |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector Cash Management | 110 | Bank Managers, Treasury Officers |

| Retail Cash Handling Solutions | 85 | Store Managers, Financial Controllers |

| Healthcare Cash Flow Management | 65 | Finance Directors, Operations Managers |

| SME Cash Management Practices | 95 | Business Owners, Financial Advisors |

| Technology Adoption in Cash Management | 50 | IT Managers, System Analysts |

The KSA Cash Management System market is valued at approximately USD 474 million, driven by the increasing adoption of digital banking solutions and the expansion of e-commerce transactions, as well as the need for efficient treasury and liquidity management processes among businesses.