Region:Middle East

Author(s):Dev

Product Code:KRAD3339

Pages:96

Published On:November 2025

By Type:The market is segmented into various types, includingCash Management Software Solutions(covering treasury management, liquidity forecasting, and reconciliation modules),Cash-in-Transit Services(secure physical movement of cash between locations),Automated Teller Machines (ATMs)(including smart and multi-functional ATMs),Cash Recycling Machines(automated deposit and withdrawal units),Smart Safes & Vaults(real-time cash monitoring and secure storage),Point of Sale (POS) Systems(integrated with digital payment acceptance),Mobile Cash Management Solutions(mobile-based treasury and cash tracking), andOthers(such as kiosk-based solutions and remote cash capture). Each of these subsegments plays a crucial role in enhancing the efficiency, security, and real-time visibility of cash management processes for enterprises and financial institutions .

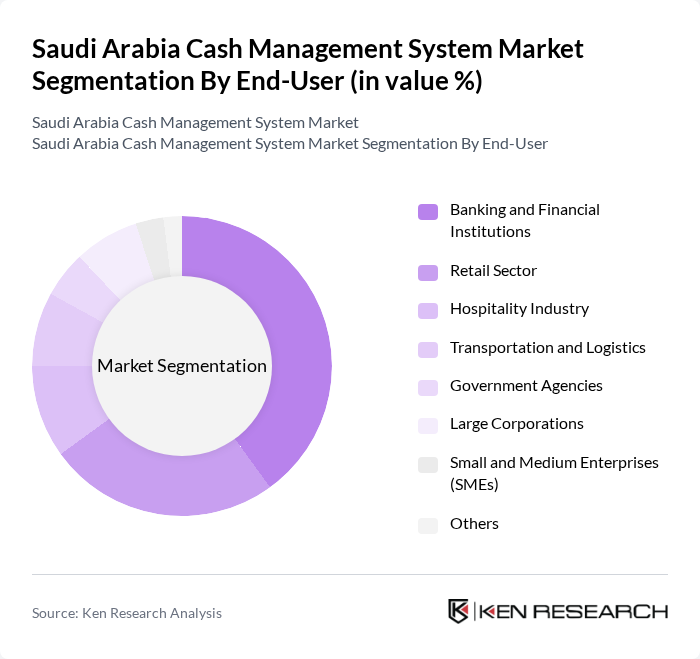

By End-User:The end-user segmentation includesBanking and Financial Institutions(adopting integrated cash management platforms for liquidity and compliance),Retail Sector(leveraging POS and smart safe solutions for real-time cash tracking),Hospitality Industry(streamlining cash operations across hotels and restaurants),Transportation and Logistics(managing fare and freight cash flows),Government Agencies(implementing secure cash collection and disbursement),Large Corporations(centralized treasury and cash pooling),Small and Medium Enterprises (SMEs)(adopting modular cash management tools), andOthers(including education and healthcare). Each sector has unique cash management needs, driving the demand for tailored, sector-specific solutions .

The Saudi Arabia Cash Management System Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Rajhi Bank, Saudi National Bank (SNB), Riyad Bank, Arab National Bank, Banque Saudi Fransi, Saudi British Bank (SABB), Alinma Bank, Gulf International Bank, Bank Aljazira, Saudi Investment Bank, Alawwal Bank, STC Pay, Al Amthal Group, G4S Saudi Arabia, Transguard Group, NCR Corporation, Diebold Nixdorf, Wincor Nixdorf, Loomis Saudi Arabia, Emirates NBD, First Abu Dhabi Bank (FAB), Qatar National Bank (QNB) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cash management system market in Saudi Arabia appears promising, driven by technological advancements and increasing digital adoption. As businesses increasingly recognize the benefits of automated cash handling, the market is likely to witness a surge in demand for innovative solutions. Additionally, the integration of AI and machine learning technologies will enhance operational efficiency, enabling businesses to optimize cash flow management. The government's continued support for digital transformation will further bolster market growth, creating a dynamic landscape for cash management solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Cash Management Software Solutions Cash-in-Transit Services Automated Teller Machines (ATMs) Cash Recycling Machines Smart Safes & Vaults Point of Sale (POS) Systems Mobile Cash Management Solutions Others |

| By End-User | Banking and Financial Institutions Retail Sector Hospitality Industry Transportation and Logistics Government Agencies Large Corporations Small and Medium Enterprises (SMEs) Others |

| By Region | Central Region Eastern Region Western Region Southern Region Northern Region |

| By Technology | Cloud-Based Solutions On-Premise Solutions Hybrid Solutions IoT-Enabled Cash Management AI-Driven Analytics Others |

| By Application | Cash Handling and Processing Cash Flow Management Risk Management Treasury and Liquidity Management Others |

| By Investment Source | Private Investments Government Funding Foreign Direct Investment (FDI) Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Cash Management Solutions | 100 | Treasury Managers, CFOs |

| Banking Sector Cash Handling | 60 | Branch Managers, Operations Heads |

| Retail Cash Management Practices | 50 | Finance Directors, Retail Managers |

| Fintech Innovations in Cash Management | 40 | Product Managers, Technology Officers |

| Government Cash Management Policies | 40 | Policy Makers, Financial Analysts |

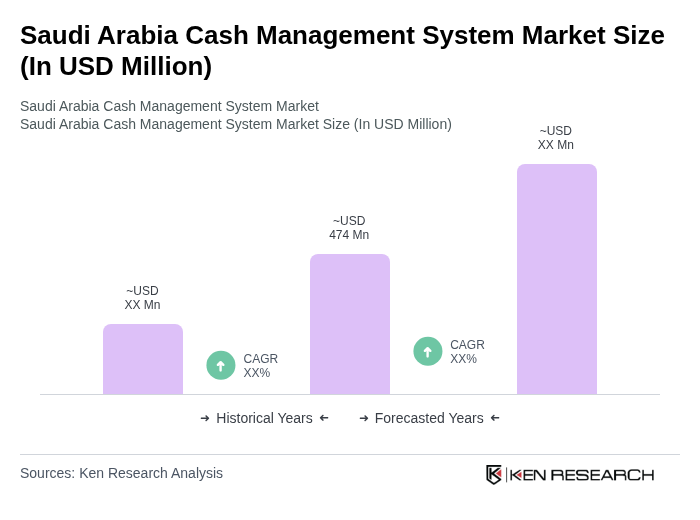

The Saudi Arabia Cash Management System market is valued at approximately USD 474 million, reflecting a significant growth driven by the adoption of digital payment solutions and the government's Vision 2030 initiative aimed at promoting a cashless economy.