Region:Middle East

Author(s):Rebecca

Product Code:KRAE1211

Pages:98

Published On:December 2025

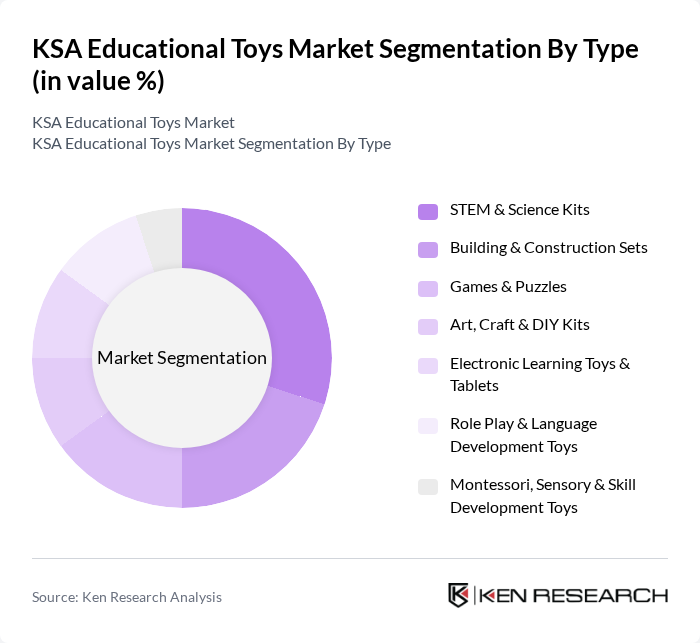

By Type:The KSA Educational Toys Market can be segmented into various types, including STEM & Science Kits, Building & Construction Sets, Games & Puzzles, Art, Craft & DIY Kits, Electronic Learning Toys & Tablets, Role Play & Language Development Toys, and Montessori, Sensory & Skill Development Toys. Among these, STEM & Science Kits are gaining significant traction due to the increasing emphasis on science and technology education in schools. Parents are increasingly investing in toys that not only entertain but also educate their children, making this sub-segment a leader in the market.

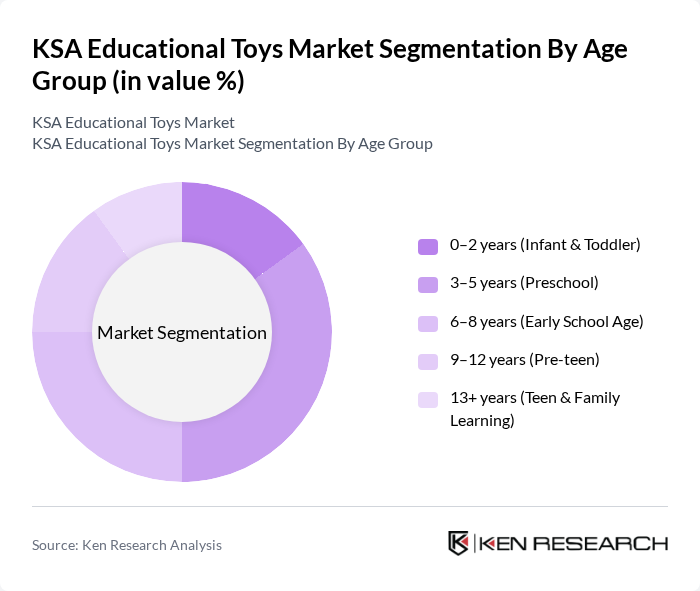

By Age Group:The market is also segmented by age group, which includes 0–2 years (Infant & Toddler), 3–5 years (Preschool), 6–8 years (Early School Age), 9–12 years (Pre-teen), and 13+ years (Teen & Family Learning). The Preschool age group is particularly dominant, as parents are increasingly recognizing the importance of early childhood education. This segment is characterized by a high demand for toys that promote language development and social skills, making it a key focus for manufacturers.

The KSA Educational Toys Market is characterized by a dynamic mix of regional and international players. Leading participants such as LEGO Group, Mattel, Inc., Hasbro, Inc., VTech Holdings Limited, LeapFrog Enterprises, Inc., Clementoni S.p.A., Ravensburger AG, Hape International AG, Learning Resources Ltd, Toy Triangle Co. Ltd. (Saudi Arabia), Jarir Marketing Company (Jarir Bookstore), Panda Retail Company, Abdullah Al Othaim Markets Company, Bin Salman Factory for Plastic & Toys, Noon AD Holdings (Noon.com – KSA) contribute to innovation, geographic expansion, and service delivery in this space.

The KSA educational toys market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As parents increasingly seek toys that foster learning, the demand for STEM-focused products is expected to rise. Additionally, the integration of technology into traditional toys will likely enhance engagement and educational value. With government support for early childhood education, the market is set to expand, creating a favorable environment for innovative product development and strategic partnerships with educational institutions.

| Segment | Sub-Segments |

|---|---|

| By Type | STEM & Science Kits Building & Construction Sets Games & Puzzles Art, Craft & DIY Kits Electronic Learning Toys & Tablets Role Play & Language Development Toys Montessori, Sensory & Skill Development Toys |

| By Age Group | –2 years (Infant & Toddler) –5 years (Preschool) –8 years (Early School Age) –12 years (Pre-teen) + years (Teen & Family Learning) |

| By Distribution Channel | Online Marketplaces (e.g., Noon, Amazon.sa) Supermarkets/Hypermarkets Bookstores & Stationery Chains Specialty Toy & Hobby Stores School & Institutional Supply Channels |

| By Material | Plastic Wood & Bamboo Fabric & Plush Paper & Cardboard Others (Metal, Silicone, Hybrid) |

| By Educational Focus | Cognitive & Problem-Solving Skills Motor & Sensory Skills Development STEM & Coding Skills Language, Literacy & Communication Social, Emotional & Values Education |

| By Brand Positioning | Premium International Brands Mid-range Mass Brands Value & Private Label Brands Eco-conscious & Niche Brands |

| By Market Segment | Public Schools & Kindergartens Private Schools & Nurseries Home Use Learning Centers, Clinics & Community Programs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Educational Toys | 120 | Store Managers, Product Buyers |

| Parents of Children Aged 3-10 | 150 | Parents, Guardians |

| Educators in Preschools and Kindergartens | 100 | Teachers, Curriculum Coordinators |

| Child Psychologists and Developmental Experts | 60 | Child Psychologists, Educational Consultants |

| Distributors and Wholesalers of Educational Toys | 70 | Distribution Managers, Sales Representatives |

The KSA Educational Toys Market is valued at approximately USD 200 million, driven by increasing parental awareness of educational play, a growing population of children aged 0-12 years, and rising disposable incomes.