Region:Middle East

Author(s):Geetanshi

Product Code:KRAE0534

Pages:96

Published On:December 2025

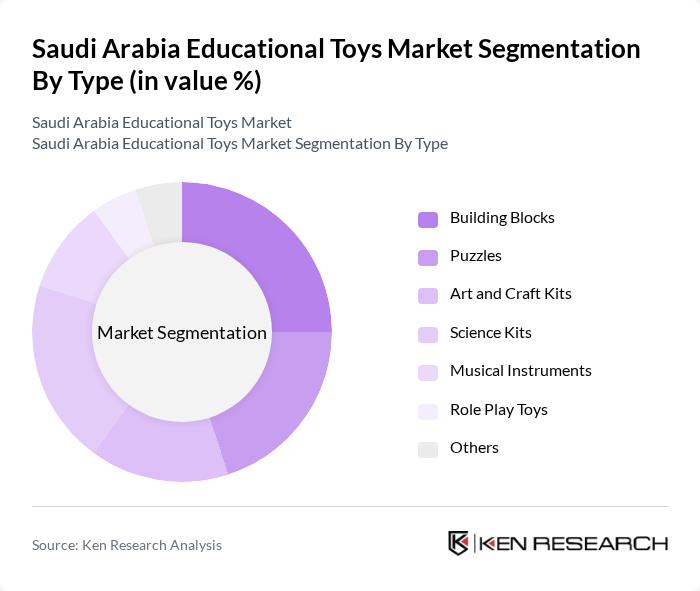

By Type:The educational toys market in Saudi Arabia is segmented into various types, including building blocks, puzzles, art and craft kits, science kits, musical instruments, role play toys, and others. Among these, building blocks and puzzles are particularly popular due to their ability to enhance cognitive skills and creativity in children. The demand for science kits is also on the rise as parents seek to encourage STEM learning from an early age.

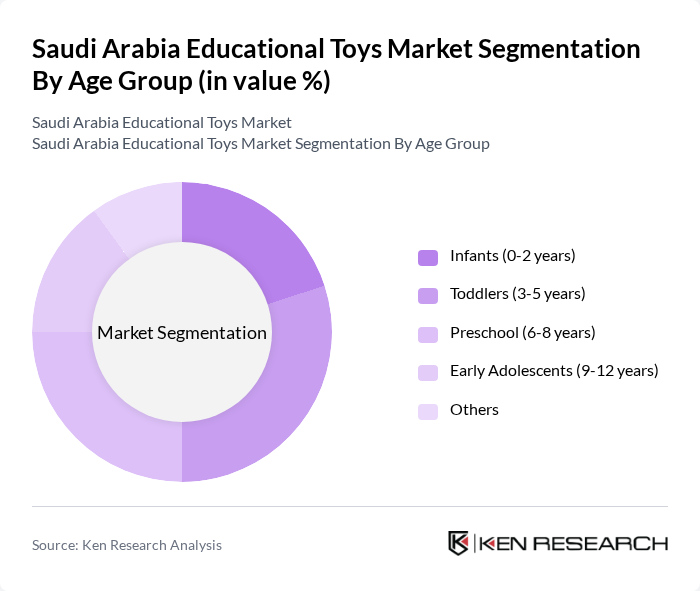

By Age Group:The educational toys market is also segmented by age group, including infants (0-2 years), toddlers (3-5 years), preschool (6-8 years), early adolescents (9-12 years), and others. The toddler segment holds a significant share as parents are keen on providing toys that aid in early development. The preschool segment is also growing as educational institutions increasingly incorporate toys into their learning environments.

The Saudi Arabia Educational Toys Market is characterized by a dynamic mix of regional and international players. Leading participants such as LEGO Group, Mattel, Inc., Hasbro, Inc., VTech Holdings Limited, Melissa & Doug, Ravensburger AG, LeapFrog Enterprises, Inc., Hape International AG, Galt Toys, Janod, Playmobil, Schleich GmbH, KidKraft, Green Toys Inc., B. toys contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia educational toys market is poised for significant growth, driven by increasing parental awareness and government support for early childhood education. As e-commerce continues to expand, manufacturers will likely leverage online platforms to reach a broader audience. Additionally, the trend towards eco-friendly and STEM-focused toys is expected to gain momentum, aligning with global sustainability goals and educational trends. This evolving landscape presents opportunities for innovation and collaboration within the industry, fostering a dynamic market environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Building Blocks Puzzles Art and Craft Kits Science Kits Musical Instruments Role Play Toys Others |

| By Age Group | Infants (0-2 years) Toddlers (3-5 years) Preschool (6-8 years) Early Adolescents (9-12 years) Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Toy Stores Department Stores Others |

| By Material | Wood Plastic Fabric Metal Others |

| By Educational Focus | Cognitive Development Motor Skills Development Social Skills Development Language Development Others |

| By Brand Type | International Brands Local Brands Private Labels Others |

| By Price Range | Low-End Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Educational Toys | 150 | Store Managers, Sales Representatives |

| Parents of Children Aged 3-10 | 200 | Parents, Guardians |

| Educational Institutions | 100 | Teachers, School Administrators |

| Child Development Experts | 50 | Child Psychologists, Educational Consultants |

| Online Retail Platforms | 80 | E-commerce Managers, Product Buyers |

The Saudi Arabia Educational Toys Market is valued at approximately USD 570 million, driven by factors such as a growing young population, rising disposable incomes, and increased awareness of the educational benefits of play in child development.