Region:Middle East

Author(s):Rebecca

Product Code:KRAD7538

Pages:96

Published On:December 2025

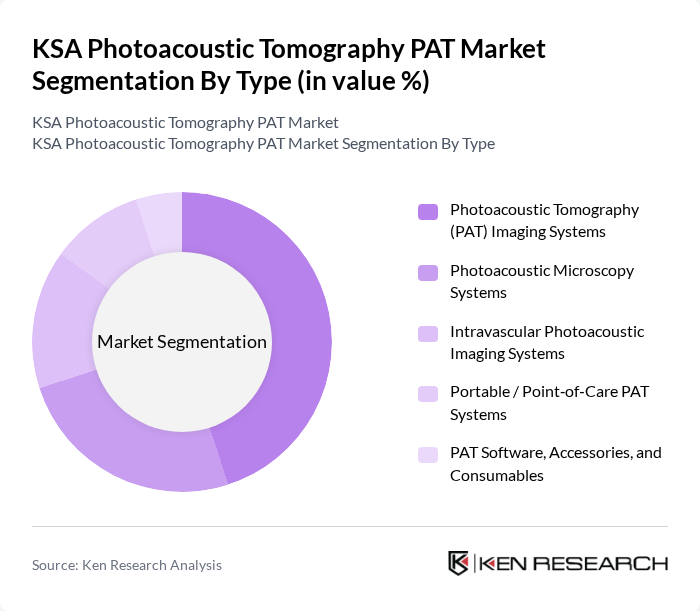

By Type:The market is segmented into various types of photoacoustic tomography systems, each catering to specific imaging needs and applications. The subsegments include Photoacoustic Tomography (PAT) Imaging Systems, Photoacoustic Microscopy Systems, Intravascular Photoacoustic Imaging Systems, Portable / Point?of?Care PAT Systems, and PAT Software, Accessories, and Consumables. Among these, Photoacoustic Tomography (PAT) Imaging Systems dominate the market due to their versatility and effectiveness in a wide range of clinical applications, particularly in oncology and vascular imaging.

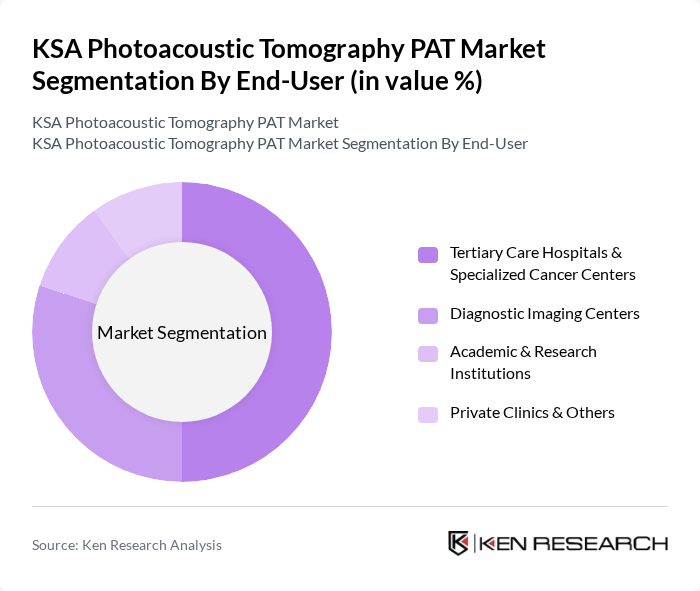

By End-User:The end-user segmentation includes Tertiary Care Hospitals & Specialized Cancer Centers, Diagnostic Imaging Centers, Academic & Research Institutions, and Private Clinics & Others. Tertiary Care Hospitals & Specialized Cancer Centers are the leading end-users, driven by their need for advanced diagnostic tools to support complex medical cases, particularly in oncology. The increasing focus on early detection and personalized treatment plans further enhances the demand for photoacoustic tomography in these settings.

The KSA Photoacoustic Tomography PAT Market is characterized by a dynamic mix of regional and international players. Leading participants such as iThera Medical GmbH, FUJIFILM VisualSonics Inc., Seno Medical Inc., ENDRA Life Sciences Inc., Advantest Corporation, PerkinElmer, Inc., Bruker Corporation, Canon Medical Systems Corporation, Siemens Healthineers AG, GE HealthCare Technologies Inc., Koninklijke Philips N.V., Mindray Bio-Medical Electronics Co., Ltd., TomoWave Laboratories, Inc., Optoacoustics Ltd., and Artemis Imaging, Inc. (including Imagio OA/US Technology) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the KSA photoacoustic tomography market appears promising, driven by technological advancements and increasing healthcare investments. The integration of artificial intelligence in imaging analysis is expected to enhance diagnostic accuracy and efficiency. Additionally, the shift towards personalized medicine will likely create a demand for tailored imaging solutions. As healthcare facilities expand and adopt innovative technologies, the PAT market is poised for growth, addressing the evolving needs of patients and healthcare providers alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Photoacoustic Tomography (PAT) Imaging Systems Photoacoustic Microscopy Systems Intravascular Photoacoustic Imaging Systems Portable / Point?of?Care PAT Systems PAT Software, Accessories, and Consumables |

| By End-User | Tertiary Care Hospitals & Specialized Cancer Centers Diagnostic Imaging Centers Academic & Research Institutions Private Clinics & Others |

| By Application | Oncology (e.g., breast cancer, skin melanoma, tumor angiogenesis) Vascular & Cardiology Imaging (e.g., blood oxygenation mapping) Neurology & Functional Brain Imaging Dermatology & Peripheral Microcirculation Preclinical & Translational Research |

| By Technology | Laser-based PAT Systems LED-based / Non-laser PAT Systems Hybrid PAT–Ultrasound Imaging Systems Other Hybrid & Multimodal PAT Platforms |

| By Region | Central Region (including Riyadh) Eastern Region (including Dammam/Al Khobar) Western Region (including Jeddah/Mecca/Medina) Southern & Northern Regions |

| By Distribution Channel | Direct Sales (Subsidiaries & Direct OEM Presence) Local Distributors & Agents Tender-based Institutional Procurement Online / Digital Procurement Platforms |

| By Pricing Model | Capital Equipment Sales Lease & Managed Service Agreements Pay?per?Use / Imaging-as-a-Service Models Software License & Maintenance Contracts |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospitals Utilizing PAT Technology | 100 | Radiologists, Imaging Department Heads |

| Research Institutions Focused on Biomedical Imaging | 80 | Biomedical Engineers, Research Scientists |

| Healthcare Equipment Distributors | 50 | Sales Managers, Product Specialists |

| Government Health Policy Makers | 40 | Health Economists, Policy Analysts |

| Private Clinics Adopting Advanced Imaging | 60 | Clinic Owners, Medical Directors |

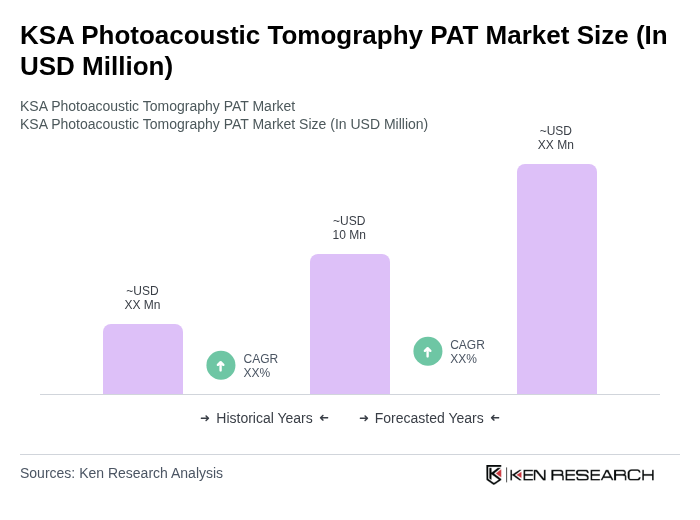

The KSA Photoacoustic Tomography PAT Market is valued at approximately USD 10 million, reflecting a five-year historical analysis. This growth is attributed to advancements in imaging technologies and increasing demand for non-invasive diagnostic procedures.