Region:Middle East

Author(s):Rebecca

Product Code:KRAB7742

Pages:93

Published On:October 2025

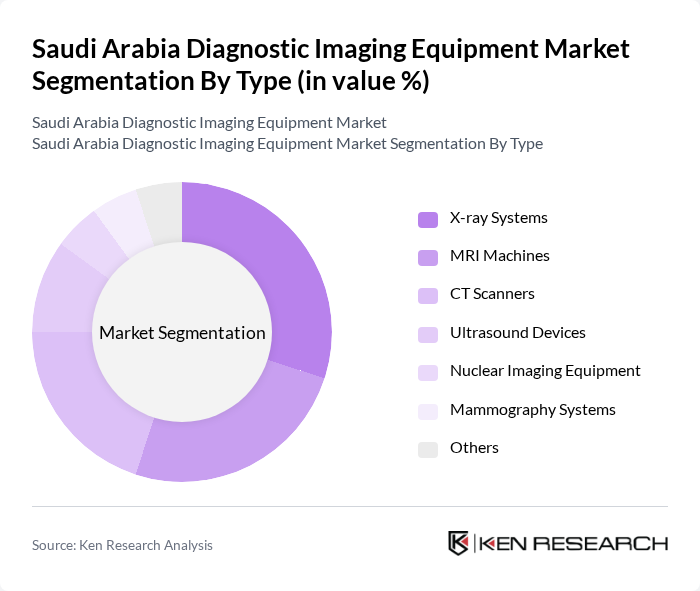

By Type:The diagnostic imaging equipment market is segmented into various types, including X-ray systems, MRI machines, CT scanners, ultrasound devices, nuclear imaging equipment, mammography systems, and others. Among these, X-ray systems and MRI machines are the most widely used due to their essential role in diagnosing a range of medical conditions. The increasing adoption of advanced imaging technologies and the growing demand for non-invasive diagnostic procedures are driving the growth of these segments.

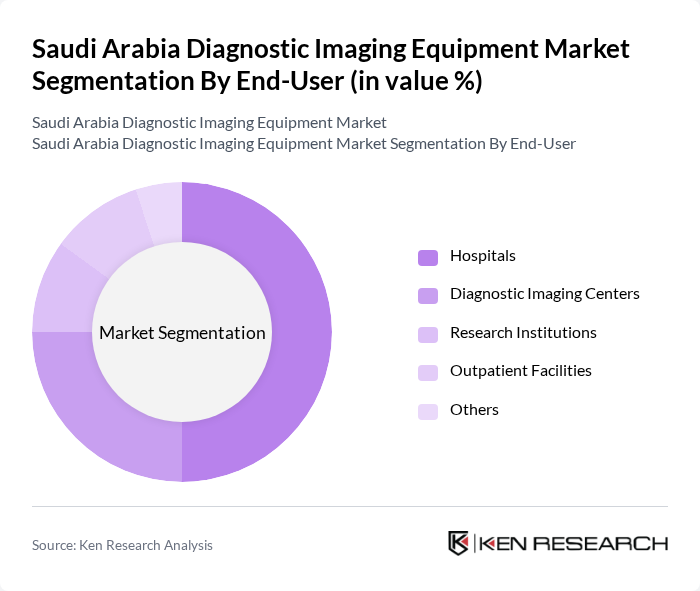

By End-User:The end-user segmentation includes hospitals, diagnostic imaging centers, research institutions, outpatient facilities, and others. Hospitals are the leading end-users of diagnostic imaging equipment, driven by the need for comprehensive diagnostic services and the increasing number of patients requiring imaging studies. The expansion of healthcare facilities and the rising demand for outpatient services are also contributing to the growth of diagnostic imaging centers.

The Saudi Arabia Diagnostic Imaging Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Healthineers, GE Healthcare, Philips Healthcare, Canon Medical Systems, Fujifilm Holdings Corporation, Hitachi Medical Corporation, Agfa-Gevaert Group, Carestream Health, Hologic, Inc., Mindray Medical International Limited, Samsung Medison, Varian Medical Systems, Shimadzu Corporation, Neusoft Medical Systems, Bracco Imaging S.p.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the diagnostic imaging equipment market in Saudi Arabia appears promising, driven by ongoing technological advancements and government initiatives aimed at enhancing healthcare services. The integration of artificial intelligence in imaging processes is expected to improve diagnostic accuracy and efficiency. Additionally, the shift towards value-based care will encourage healthcare providers to invest in high-quality imaging solutions that prioritize patient outcomes, further propelling market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | X-ray Systems MRI Machines CT Scanners Ultrasound Devices Nuclear Imaging Equipment Mammography Systems Others |

| By End-User | Hospitals Diagnostic Imaging Centers Research Institutions Outpatient Facilities Others |

| By Application | Oncology Cardiology Neurology Orthopedics Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Central Region Eastern Region Western Region Southern Region Others |

| By Price Range | Low-End Equipment Mid-Range Equipment High-End Equipment |

| By Technology | Digital Imaging Analog Imaging Hybrid Imaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Imaging Departments | 150 | Radiologists, Imaging Technologists |

| Private Clinics and Diagnostic Centers | 100 | Clinic Owners, Medical Directors |

| Healthcare Procurement Managers | 80 | Procurement Officers, Supply Chain Managers |

| Medical Equipment Distributors | 70 | Sales Managers, Product Specialists |

| Regulatory Bodies and Health Authorities | 50 | Policy Makers, Health Administrators |

The Saudi Arabia Diagnostic Imaging Equipment Market is valued at approximately USD 1.2 billion, driven by the increasing prevalence of chronic diseases, advancements in imaging technologies, and rising demand for early diagnosis and preventive healthcare.