Region:Middle East

Author(s):Dev

Product Code:KRAD4393

Pages:98

Published On:December 2025

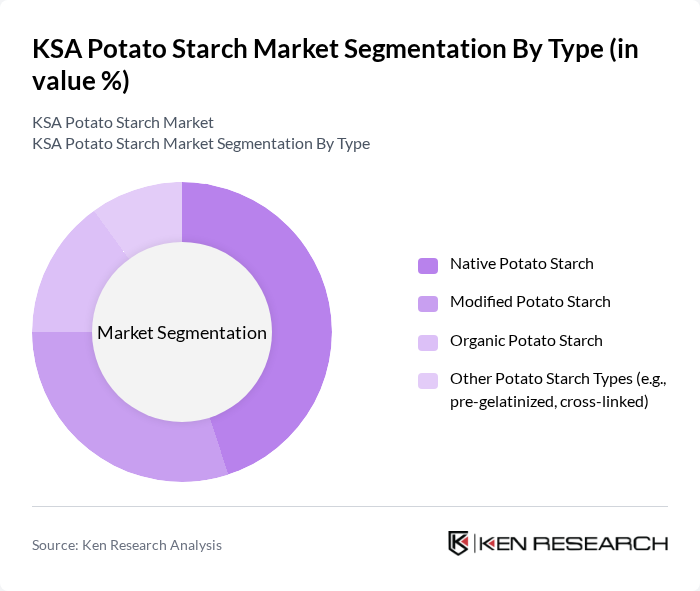

By Type:The potato starch market can be segmented into four main types: Native Potato Starch, Modified Potato Starch, Organic Potato Starch, and Other Potato Starch Types (e.g., pre-gelatinized, cross-linked). Among these, Native Potato Starch is the most widely used due to its versatility in food applications, while Modified Potato Starch is gaining traction for its enhanced functional properties. Organic Potato Starch is also witnessing increased demand as consumers shift towards healthier and more sustainable food options.

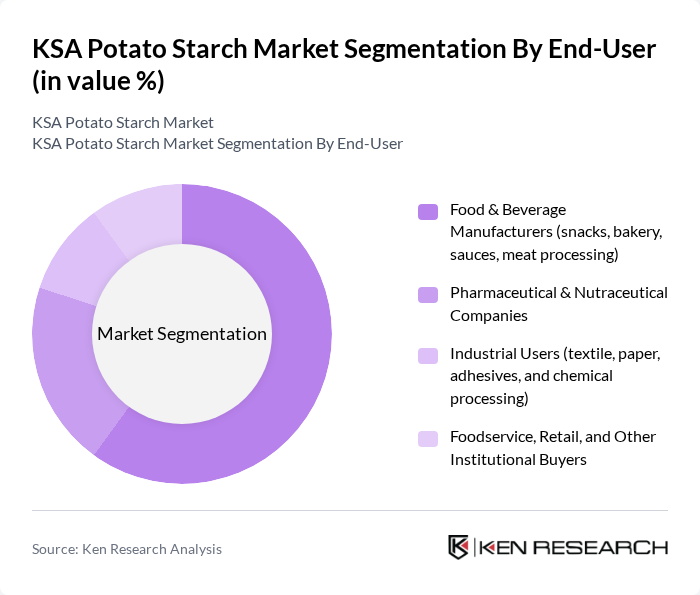

By End-User:The end-user segmentation includes Food & Beverage Manufacturers, Pharmaceutical & Nutraceutical Companies, Industrial Users, and Foodservice, Retail, and Other Institutional Buyers. Food & Beverage Manufacturers dominate the market, driven by the increasing use of potato starch in snacks, bakery products, sauces, and meat processing. The pharmaceutical sector is also growing, utilizing potato starch as a binding agent in tablet formulations.

The KSA Potato Starch Market is characterized by a dynamic mix of regional and international players. Leading participants such as Roquette Frères S.A., Emsland-Stärke GmbH (Emsland Group), Ingredion Incorporated, Cargill, Incorporated, Royal Avebe U.A., KMC amba (Kartoffelmelcentralen), Novidon B.V., Tereos S.A., Tate & Lyle PLC, Agrana Beteiligungs-AG, Südzucker AG (Beneo GmbH), Pepees S.A., AKV Langholt AmbA, Lyckeby Starch AB, and regional importers and distributors in Saudi Arabia contribute to innovation, geographic expansion, and service delivery in this space.

The KSA potato starch market is poised for significant growth, driven by evolving consumer preferences towards healthier and gluten-free products. As the food and beverage industry continues to expand, the demand for innovative applications of potato starch is expected to rise. Additionally, the increasing focus on sustainability and organic products will likely create new avenues for market players. With ongoing investments in production technology, the sector is set to enhance efficiency and product quality, positioning itself favorably for future developments.

| Segment | Sub-Segments |

|---|---|

| By Type | Native Potato Starch Modified Potato Starch Organic Potato Starch Other Potato Starch Types (e.g., pre?gelatinized, cross?linked) |

| By End-User | Food & Beverage Manufacturers (snacks, bakery, sauces, meat processing) Pharmaceutical & Nutraceutical Companies Industrial Users (textile, paper, adhesives, and chemical processing) Foodservice, Retail, and Other Institutional Buyers |

| By Application | Thickening and Gelling Agent Stabilizer and Binder Emulsifier and Texture Enhancer Clean?label and Gluten?free Formulations |

| By Distribution Channel | Direct B2B Sales to Food and Industrial Processors Importers and Specialized Ingredient Distributors Online and Regional Wholesale Platforms Retail and Cash?and?Carry Channels |

| By Packaging Type | Bulk Industrial Packaging (?25 kg bags, big bags) Foodservice and HoReCa Packs Retail Packs (consumer?size pouches and boxes) |

| By Region | Central Region (including Riyadh) Eastern Region (including Dammam and industrial hubs) Western Region (including Jeddah, Makkah, Madinah) Southern and Northern Regions |

| By Product Form | Dry Powdered Starch Pre?gelatinized and Instant Starch Blended Starch Formulations |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Manufacturing Sector | 100 | Production Managers, Quality Control Supervisors |

| Agricultural Producers | 80 | Farm Owners, Agricultural Consultants |

| Food Processing Equipment Suppliers | 60 | Sales Managers, Technical Support Engineers |

| Retail Sector Buyers | 70 | Category Managers, Purchasing Agents |

| Research Institutions | 50 | Food Scientists, Agricultural Researchers |

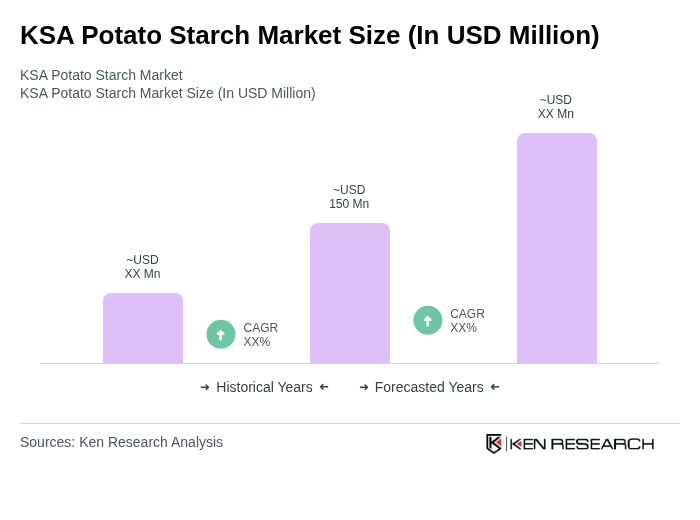

The KSA Potato Starch Market is valued at approximately USD 150 million, reflecting a robust growth trajectory driven by increasing demand for processed food products and health-conscious consumer preferences.