Region:Middle East

Author(s):Geetanshi

Product Code:KRAD3747

Pages:84

Published On:November 2025

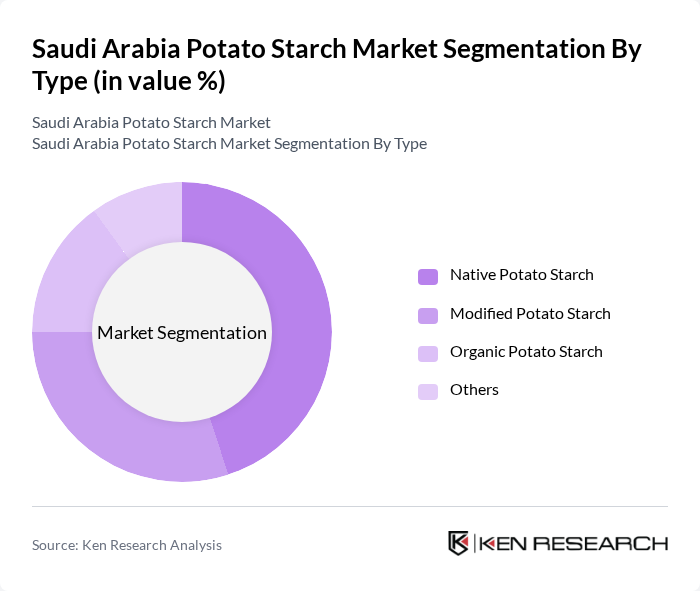

By Type:The potato starch market can be segmented into Native Potato Starch, Modified Potato Starch, Organic Potato Starch, and Others. Among these, Native Potato Starch is the most widely used due to its versatility in food applications, while Modified Potato Starch is gaining traction in the pharmaceutical and textile industries due to its enhanced properties. Organic Potato Starch is also witnessing growth as consumers increasingly prefer organic products, driven by rising health awareness and demand for clean-label ingredients.

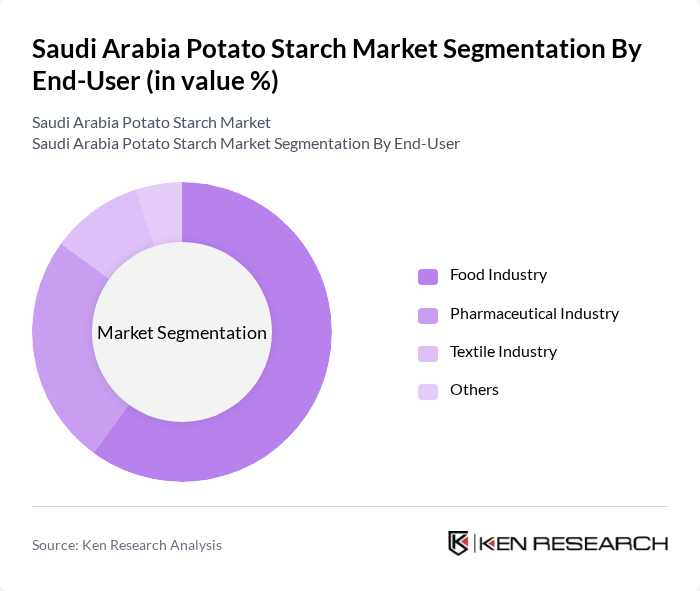

By End-User:The end-user segmentation includes the Food Industry, Pharmaceutical Industry, Textile Industry, and Others. The Food Industry is the dominant segment, driven by the increasing use of potato starch in processed foods, snacks, and sauces. The Pharmaceutical Industry is also significant, utilizing modified starches for drug formulations, while the Textile Industry employs starch for sizing and finishing processes. The growing demand for plant-based and gluten-free products is further boosting the use of potato starch across these sectors.

The Saudi Arabia Potato Starch Market is characterized by a dynamic mix of regional and international players. Leading participants such as Roquette Frères, Emsland Group, Ingredion Incorporated, Cargill, Incorporated, Avebe U.A., KMC Kartoffelmelcentralen A.M.B.A., Novidon Starch B.V., Solvay S.A., Tate & Lyle PLC, AAK AB, Beneo GmbH, SÜDZUCKER AG, Cargill Starches and Sweeteners, PGP International, Inc., Beneo-Orafti S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia potato starch market is poised for significant growth, driven by evolving consumer preferences and technological advancements in food processing. As health-conscious trends continue to shape the food industry, the demand for gluten-free and organic products is expected to rise. Additionally, innovations in processing technology will enhance the efficiency and quality of potato starch production, making it a more attractive option for food manufacturers. The integration of sustainable practices will further bolster market growth, aligning with global environmental standards.

| Segment | Sub-Segments |

|---|---|

| By Type | Native Potato Starch Modified Potato Starch Organic Potato Starch Others |

| By End-User | Food Industry Pharmaceutical Industry Textile Industry Others |

| By Application | Thickening Agent Stabilizer Emulsifier Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Others |

| By Packaging Type | Bulk Packaging Retail Packaging Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Product Form | Powdered Form Liquid Form Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Manufacturing Sector | 45 | Production Managers, Quality Control Supervisors |

| Agricultural Producers | 38 | Farm Owners, Agricultural Consultants |

| Starch Processing Facilities | 32 | Plant Managers, Operations Directors |

| Retail and Distribution Channels | 28 | Supply Chain Managers, Procurement Officers |

| Food Product Developers | 25 | R&D Managers, Product Innovation Specialists |

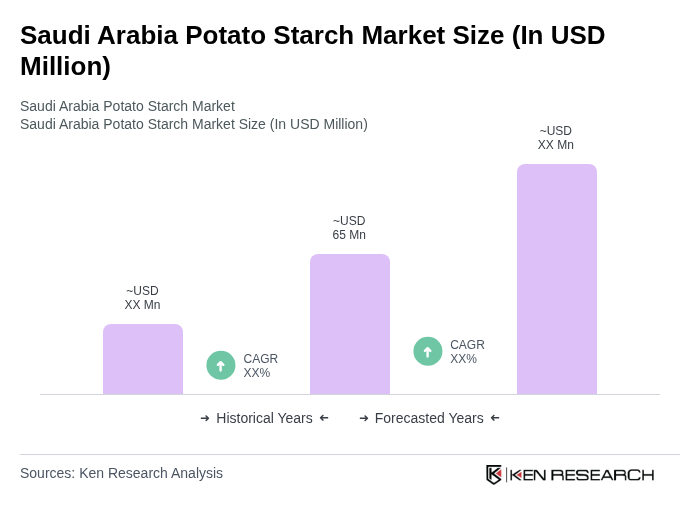

The Saudi Arabia Potato Starch Market is valued at approximately USD 65 million, driven by increasing demand for processed food products and health-conscious consumers seeking gluten-free alternatives.