Region:Middle East

Author(s):Shubham

Product Code:KRAC2181

Pages:83

Published On:October 2025

By Type:The market is segmented into various types of insulation materials, including Thermal Insulation, Acoustic Insulation, Fire-Resistant Insulation, Vibration Insulation, Electric Insulation, Lightweight Insulation, and Others. Among these,Thermal Insulationremains the leading sub-segment due to its essential role in maintaining optimal temperatures and protecting sensitive aircraft systems from extreme external conditions. The growing emphasis on energy efficiency, weight reduction, and compliance with stringent fire safety standards has accelerated the adoption of advanced thermal insulation materials.Acoustic Insulationis also significant, driven by the need for noise reduction in both commercial and military aircraft to enhance passenger comfort and crew performance. The market is experiencing a shift toward lightweight, multi-functional insulation materials that improve fuel efficiency and reduce emissions .

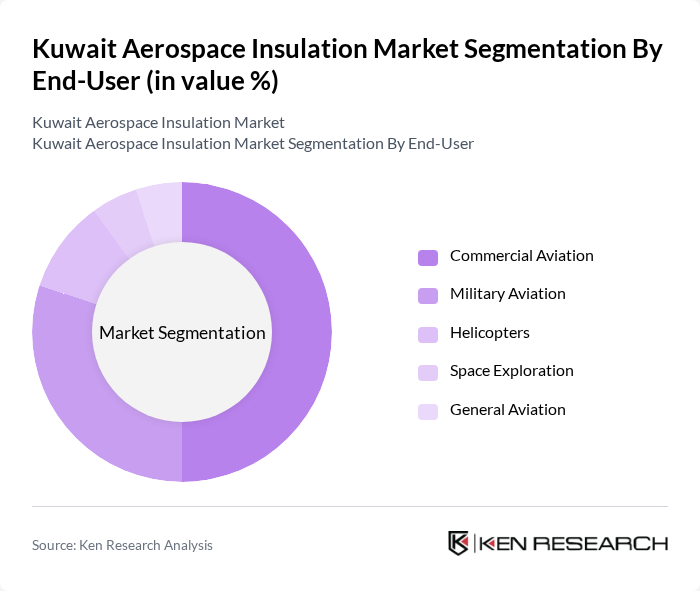

By End-User:The aerospace insulation market is categorized by end-users, including Commercial Aviation, Military Aviation, Helicopters, Space Exploration, and General Aviation.Commercial Aviationis the largest segment, supported by the increasing number of air travelers, fleet expansions by local airlines, and ongoing investments in airport infrastructure.Military Aviationfollows, with demand bolstered by defense modernization programs and the procurement of advanced aircraft requiring high-performance insulation for thermal, acoustic, and fire protection. Insulation demand inHelicoptersandSpace Explorationis also rising, as these segments require specialized materials for vibration damping, thermal management, and fire safety in challenging operational environments .

The Kuwait Aerospace Insulation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Safran S.A., DuPont de Nemours, Inc., 3M Company, BASF SE, Owens Corning, Armacell International S.A., Triumph Group, Inc., Zotefoams plc, Johns Manville, Rockwool International A/S, Kingspan Group, Morgan Advanced Materials plc, Elmelin Ltd., Insulfoam, Aerogel Technologies, LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait aerospace insulation market appears promising, driven by technological advancements and a growing emphasis on sustainability. As the industry shifts towards eco-friendly materials, manufacturers are expected to invest in research and development to create innovative insulation solutions. Additionally, the expansion of the commercial aviation sector in Kuwait, projected to grow by 12% annually, will further enhance the demand for high-performance insulation products, positioning the market for substantial growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Thermal Insulation Acoustic Insulation Fire-Resistant Insulation Vibration Insulation Electric Insulation Lightweight Insulation Others |

| By End-User | Commercial Aviation Military Aviation Helicopters Space Exploration General Aviation |

| By Application | Cabin Interiors Engine and Propulsion Systems Aerostructure Cargo Hold Others |

| By Material Type | Fiberglass Foam (Foamed Plastics, Polyimide, etc.) Mineral Wool Ceramic Materials Aerogel Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Price Range | Low Price Mid Price High Price |

| By Certification Type | ISO Certified FAA Approved EASA Approved Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Aerospace Manufacturing Facilities | 100 | Production Managers, Quality Assurance Engineers |

| Insulation Material Suppliers | 60 | Sales Directors, Product Development Managers |

| Regulatory Bodies and Standards Organizations | 40 | Policy Makers, Compliance Officers |

| Aerospace Research Institutions | 50 | Research Scientists, Academic Professors |

| End-Users in Aerospace Applications | 70 | Project Managers, Technical Directors |

The Kuwait Aerospace Insulation Market is valued at approximately USD 11 million, reflecting a growing segment of the global aerospace insulation market, which is valued at around USD 9.5 billion. This growth is driven by increased aviation infrastructure and fleet modernization in the region.