Region:Middle East

Author(s):Rebecca

Product Code:KRAD1570

Pages:98

Published On:November 2025

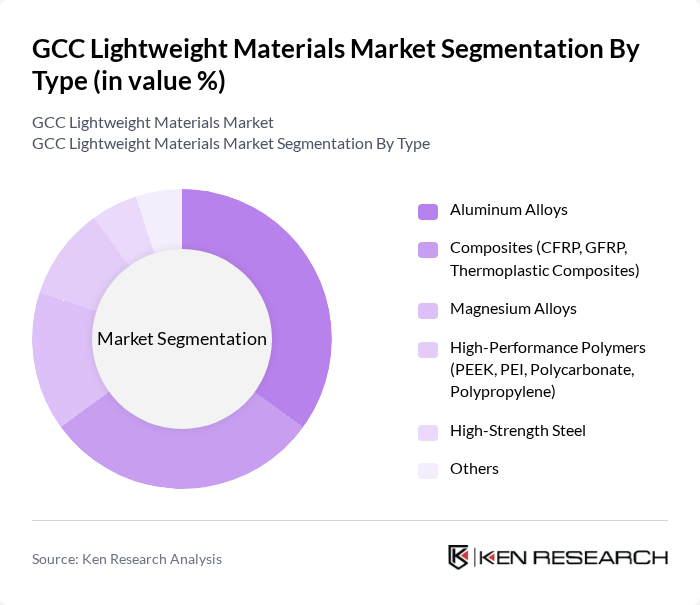

By Type:The market is segmented into various types of lightweight materials, including Aluminum Alloys, Composites (CFRP, GFRP, Thermoplastic Composites), Magnesium Alloys, High-Performance Polymers (PEEK, PEI, Polycarbonate, Polypropylene), High-Strength Steel, and Others. Among these, Aluminum Alloys and Composites are leading the market due to their excellent strength-to-weight ratios and versatility in applications across multiple industries.

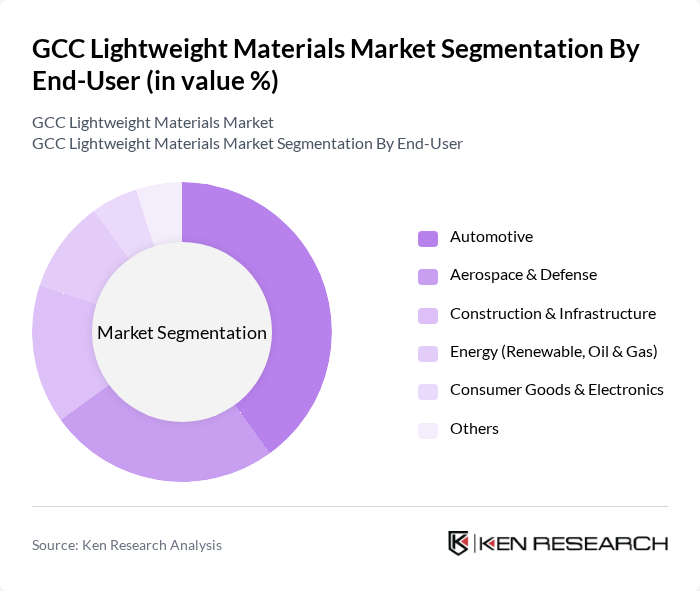

By End-User:The end-user segments include Automotive, Aerospace & Defense, Construction & Infrastructure, Energy (Renewable, Oil & Gas), Consumer Goods & Electronics, and Others. The Automotive sector is the largest consumer of lightweight materials, driven by the need for fuel-efficient vehicles and stringent emission regulations.

The GCC Lightweight Materials Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates Global Aluminium (EGA), SABIC (Saudi Basic Industries Corporation), Ma’aden (Saudi Arabian Mining Company), Qatar Aluminium Limited (Qatalum), Gulf Extrusions Co. LLC, Alcoa Corporation, Novelis Inc., Hexcel Corporation, Arconic Corporation, BASF SE, Owens Corning, Solvay S.A., Mitsubishi Chemical Corporation, Teijin Limited, SGL Carbon SE, Covestro AG, Huntsman Corporation, DuPont de Nemours, Inc., Toray Industries, Inc., 3M Company contribute to innovation, geographic expansion, and service delivery in this space.

The GCC lightweight materials market is poised for significant growth, driven by increasing environmental regulations and a shift towards sustainable practices. As industries adopt innovative materials, the demand for lightweight solutions is expected to rise, particularly in automotive and construction sectors. The integration of smart technologies and eco-friendly materials will further enhance product offerings, aligning with global sustainability trends. Collaborative efforts between governments and private sectors will likely accelerate the transition towards lightweight materials, fostering a more sustainable industrial landscape in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Aluminum Alloys Composites (CFRP, GFRP, Thermoplastic Composites) Magnesium Alloys High-Performance Polymers (PEEK, PEI, Polycarbonate, Polypropylene) High-Strength Steel Others |

| By End-User | Automotive Aerospace & Defense Construction & Infrastructure Energy (Renewable, Oil & Gas) Consumer Goods & Electronics Others |

| By Application | Structural Components Body-in-White (Automotive) Thermal & Acoustic Insulation Lightweight Packaging Energy Absorption & Crash Management Others |

| By Manufacturing Process | Casting Machining Forming Additive Manufacturing (3D Printing) Extrusion Others |

| By Region | Saudi Arabia United Arab Emirates (UAE) Qatar Kuwait Oman Bahrain Others |

| By Supply Chain | Raw Material Suppliers Material Manufacturers Component Fabricators Distributors End-Users Others |

| By Product Lifecycle Stage | Introduction Growth Maturity Decline Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Lightweight Materials | 100 | Product Engineers, Procurement Managers |

| Aerospace Composite Materials | 80 | R&D Directors, Quality Assurance Managers |

| Construction Material Innovations | 70 | Project Managers, Sustainability Officers |

| Consumer Goods Lightweight Packaging | 60 | Marketing Managers, Supply Chain Analysts |

| Industrial Applications of Lightweight Materials | 90 | Operations Managers, Technical Sales Representatives |

The GCC Lightweight Materials Market is valued at approximately USD 12.5 billion, reflecting a significant growth trend driven by the demand for lightweight materials in industries such as automotive and aerospace, which prioritize fuel efficiency and performance.