Region:Middle East

Author(s):Dev

Product Code:KRAE0007

Pages:120

Published On:December 2025

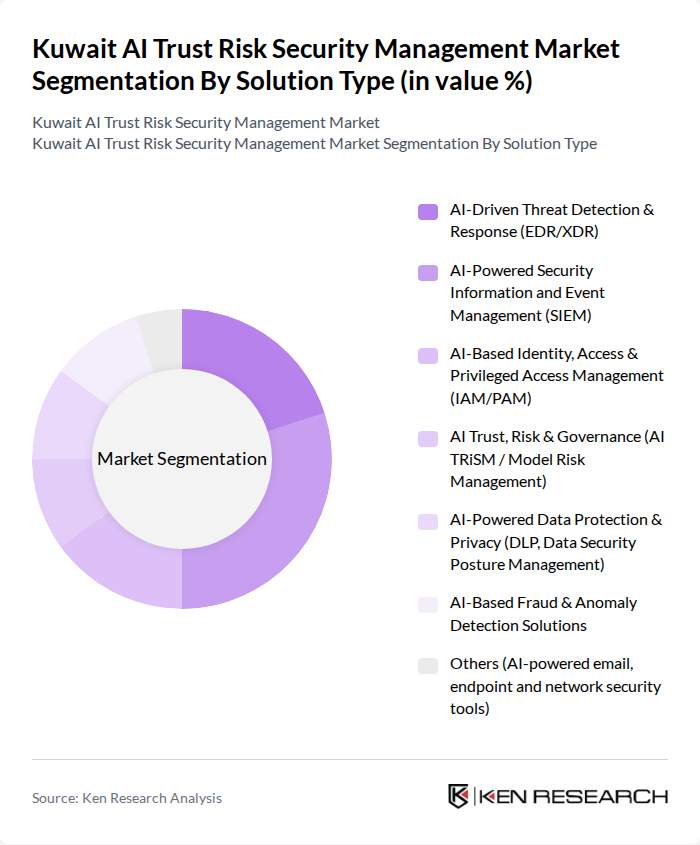

By Solution Type:

The solution type segmentation includes various subsegments such as AI-Driven Threat Detection & Response (EDR/XDR), AI-Powered Security Information and Event Management (SIEM), AI-Based Identity, Access & Privileged Access Management (IAM/PAM), AI Trust, Risk & Governance (AI TRiSM / Model Risk Management), AI-Powered Data Protection & Privacy (DLP, Data Security Posture Management), AI-Based Fraud & Anomaly Detection Solutions, and Others (AI-powered email, endpoint and network security tools). Among these, AI-Powered Security Information and Event Management (SIEM) is currently dominating the market due to its ability to provide real-time analysis of security alerts generated by applications and network hardware. The increasing complexity of cyber threats and the need for comprehensive security solutions are driving organizations to invest heavily in SIEM systems, making it a critical component of their security infrastructure.

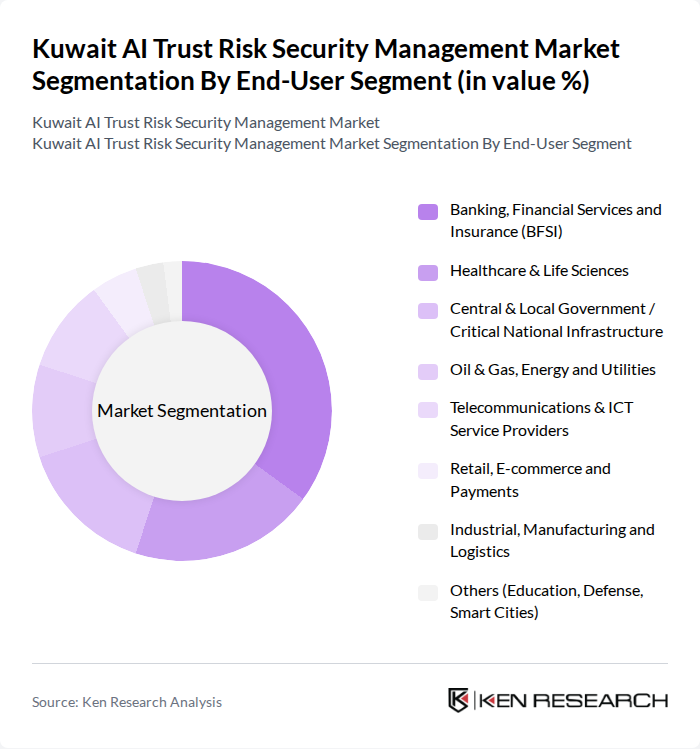

By End-User Segment:

This segmentation includes Banking, Financial Services and Insurance (BFSI), Healthcare & Life Sciences, Central & Local Government / Critical National Infrastructure, Oil & Gas, Energy and Utilities, Telecommunications & ICT Service Providers, Retail, E-commerce and Payments, Industrial, Manufacturing and Logistics, and Others (Education, Defense, Smart Cities). The Banking, Financial Services and Insurance (BFSI) sector is leading the market due to its high sensitivity to data breaches and regulatory compliance requirements. Financial institutions are increasingly adopting AI-driven security solutions to protect sensitive customer data and ensure compliance with stringent regulations, making BFSI the most significant contributor to the market.

The Kuwait AI Trust Risk Security Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Security, Cisco Systems, Palo Alto Networks, Fortinet, Check Point Software Technologies, Microsoft (Security, Compliance & Azure AI), Google Cloud Security (Chronicle, Mandiant), Amazon Web Services (AWS Security & AI Services), Splunk (including Splunk Enterprise Security), CrowdStrike, Darktrace, CyberArk, Zscaler, Proofpoint, Kuwait National Cyber Security Center (NCSC) & Government SOC Initiatives contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait AI trust risk security management market appears promising, driven by increasing investments in AI technologies and a growing emphasis on proactive security measures. As organizations recognize the importance of safeguarding their digital assets, the adoption of AI-driven solutions is expected to accelerate. Furthermore, the emergence of managed security service providers (MSSPs) will likely enhance service delivery, enabling businesses to better navigate the evolving cybersecurity landscape and comply with regulatory standards.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | AI-Driven Threat Detection & Response (EDR/XDR) AI-Powered Security Information and Event Management (SIEM) AI-Based Identity, Access & Privileged Access Management (IAM/PAM) AI Trust, Risk & Governance (AI TRiSM / Model Risk Management) AI-Powered Data Protection & Privacy (DLP, Data Security Posture Management) AI-Based Fraud & Anomaly Detection Solutions Others (AI-powered email, endpoint and network security tools) |

| By End-User Segment | Banking, Financial Services and Insurance (BFSI) Healthcare & Life Sciences Central & Local Government / Critical National Infrastructure Oil & Gas, Energy and Utilities Telecommunications & ICT Service Providers Retail, E?commerce and Payments Industrial, Manufacturing and Logistics Others (Education, Defense, Smart Cities) |

| By Organization Size | Large Enterprises (incl. SOEs and major conglomerates) Small and Medium Enterprises (SMEs) |

| By Deployment Mode | On-Premises Public Cloud Private Cloud Hybrid |

| By Service Type | Advisory & Consulting (AI risk, governance and compliance) Managed Security Services & Managed Detection and Response (MDR) System Integration & Implementation Services Training, Support & AI Model Validation Services Others (Red teaming, incident response retainers) |

| By Region | Kuwait City (Al Asimah) Al Ahmadi & industrial oil and gas hubs Hawalli & Farwaniya Others (Jahra, Mubarak Al-Kabeer, free zones & technology parks) |

| By Compliance & Policy Driver | National Cybersecurity & Data Protection Regulations Sectoral Regulations (CBK/Boursa Kuwait, MoH, CITRA, Oil & Gas) Government Cloud?First and Digital Transformation Programs International Standards Adoption (ISO 27001, NIST, PCI?DSS, GDPR?inspired) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Sector AI Risk Management | 110 | Risk Managers, Compliance Officers |

| Healthcare AI Trust Solutions | 75 | IT Directors, Data Protection Officers |

| Government AI Security Initiatives | 65 | Policy Makers, Cybersecurity Analysts |

| Telecommunications AI Risk Assessment | 55 | Network Security Managers, Operations Heads |

| Retail Sector AI Trust Frameworks | 85 | Supply Chain Managers, IT Security Specialists |

The Kuwait AI Trust Risk Security Management Market is valued at approximately USD 140 million, reflecting a significant investment in AI technologies across various sectors, including banking, oil and gas, and healthcare, driven by increasing cybersecurity threats and regulatory compliance needs.