Region:Middle East

Author(s):Geetanshi

Product Code:KRAC8145

Pages:89

Published On:November 2025

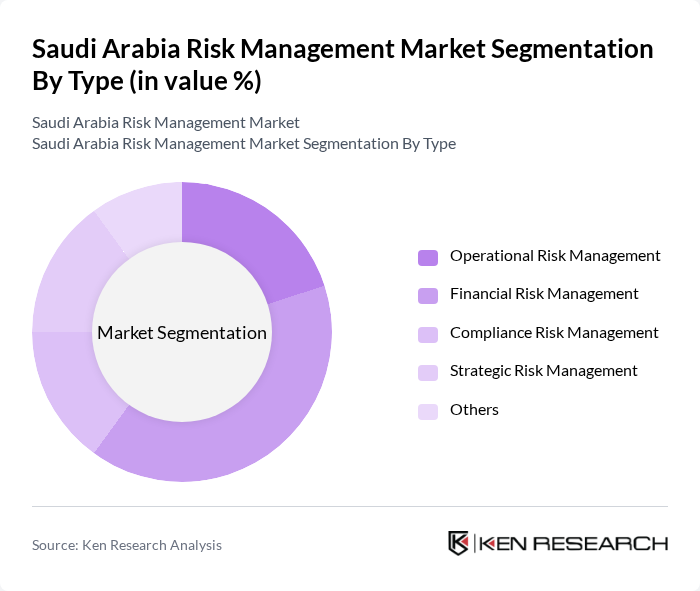

By Type:

The segmentation by type includes Operational Risk Management, Financial Risk Management, Compliance Risk Management, Strategic Risk Management, and Others. Among these, Financial Risk Management is the leading sub-segment, driven by the increasing complexity of financial products and the need for organizations to mitigate risks associated with market fluctuations and credit exposures. The growing emphasis on regulatory compliance and the need for robust financial strategies have further propelled the demand for financial risk management solutions.

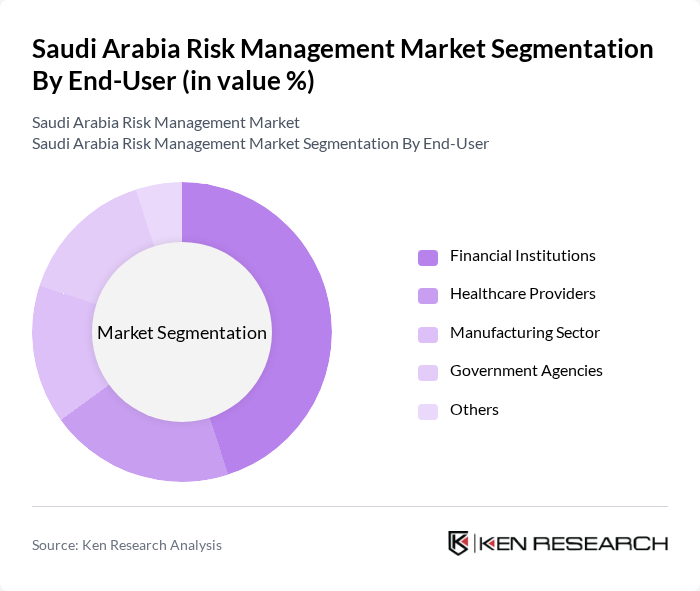

By End-User:

The end-user segmentation includes Financial Institutions, Healthcare Providers, Manufacturing Sector, Government Agencies, and Others. Financial Institutions dominate this segment due to their inherent need for risk management solutions to navigate regulatory requirements and protect against financial losses. The increasing focus on cybersecurity and data protection within financial services has further amplified the demand for specialized risk management services tailored to this sector.

The Saudi Arabia Risk Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Arabian Monetary Authority (SAMA), Al Rajhi Bank, National Commercial Bank (NCB), Riyad Bank, Saudi Investment Bank (SAIB), Arab National Bank (ANB), Banque Saudi Fransi, Gulf International Bank (GIB), Alinma Bank, Saudi British Bank (SABB), Emirates NBD, QNB Alahli, Bank AlJazira, Alawwal Bank, First Abu Dhabi Bank (FAB), Deloitte Saudi Arabia, PwC Saudi Arabia, KPMG Saudi Arabia, EY Saudi Arabia, SGS Saudi Arabia, Bureau Veritas Saudi Arabia, SAP Saudi Arabia, Oracle Saudi Arabia, IBM Saudi Arabia, Accenture Saudi Arabia, Saudi Cybersecurity Authority (NCA), Saudi Data and Artificial Intelligence Authority (SDAIA), Saudi Standards, Metrology and Quality Organization (SASO), Saudi Electricity Company (SEC), and Saudi Aramco contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia risk management market is poised for significant transformation, driven by technological advancements and evolving regulatory landscapes. As organizations increasingly adopt AI and machine learning for risk assessment, the demand for innovative solutions will rise. Furthermore, the focus on environmental, social, and governance (ESG) risks will shape strategic priorities, compelling firms to integrate sustainability into their risk management frameworks. This evolution will create a dynamic environment for growth and collaboration within the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Operational Risk Management Financial Risk Management Compliance Risk Management Strategic Risk Management Others |

| By End-User | Financial Institutions Healthcare Providers Manufacturing Sector Government Agencies Others |

| By Industry Vertical | Banking and Financial Services Insurance Energy and Utilities Telecommunications Others |

| By Risk Type | Credit Risk Market Risk Operational Risk Reputational Risk Others |

| By Service Type | Consulting Services Software Solutions Training and Support Services Others |

| By Technology | Cloud-Based Solutions On-Premises Solutions Hybrid Solutions Others |

| By Policy Support | Government Initiatives Financial Incentives Regulatory Frameworks Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Sector Risk Management | 100 | Risk Managers, Compliance Officers |

| Healthcare Risk Assessment | 60 | Healthcare Administrators, Risk Analysts |

| Energy Sector Risk Mitigation | 50 | Project Managers, Safety Officers |

| Construction Risk Management Practices | 40 | Site Managers, Safety Compliance Officers |

| Consulting Firms' Risk Strategies | 50 | Consultants, Senior Advisors |

The Saudi Arabia Risk Management Market is valued at approximately USD 125 million, reflecting a significant growth driven by regulatory requirements, digital transformation, and increased awareness of risk management practices among organizations across various sectors.